-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Corporate trading desks increased exposure as volume surged 85% to $333.21 million, though regulatory uncertainties persist around stablecoin framework implementation.

By CD Analytics, Oliver Knight

Updated Sep 9, 2025, 12:35 p.m. Published Sep 9, 2025, 12:35 p.m.

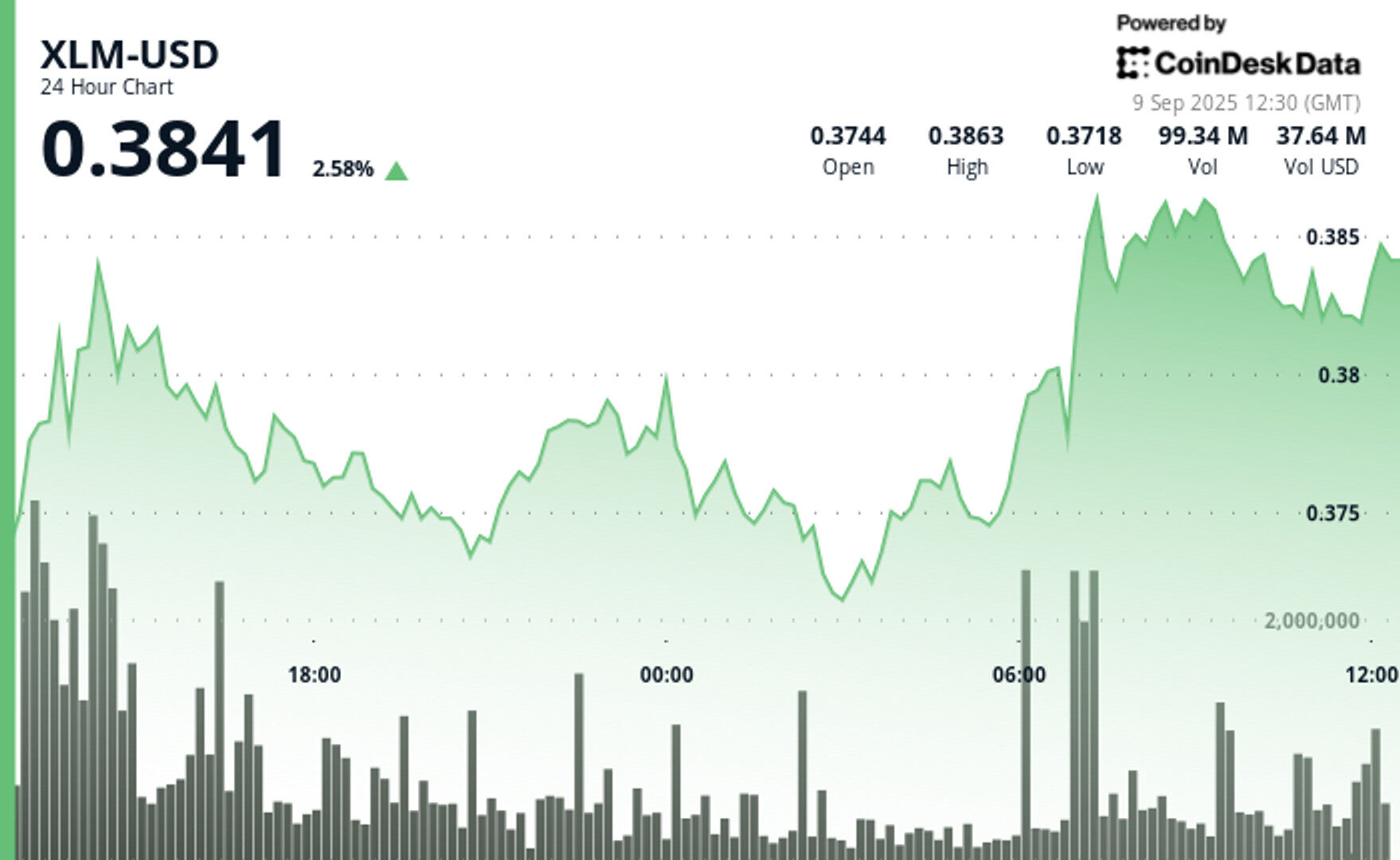

- XLM’s breakout above $0.38, backed by an 85% surge in trading volume to $333.21 million, signals rising institutional flows and treasury interest.

- The tight $0.38–$0.39 consolidation range offers predictable pricing, which corporate treasurers value before allocating to digital assets.

- Paxos’s proposed USDH stablecoin on Stellar and the GENIUS Act framework are shaping Stellar into a regulated payments network, boosting its appeal for corporate adoption.

Stellar’s XLM token saw a sharp rally during a 23-hour period between September 8 and 9, advancing 4% from $0.37 to $0.38 on heavy institutional flows. Trading volume surged to 90.25 million tokens at the September 9 breakout, more than double the 24-hour average, according to market data. A Wall Street proprietary trading desk highlighted the move, noting that resistance formed at $0.39 as corporate accounts began consolidating. Analysts described the $0.38–$0.39 range as a zone of institutional accumulation, underscoring growing corporate treasury interest in blockchain-linked assets.

The breakout also set the stage for a low-volatility consolidation period. Between 10:57 and 11:56 on September 9, XLM maintained a tight trading band, opening and closing at $0.38. Market participants said this stability was crucial for corporate treasurers, who often seek predictable price ranges before approving allocations to digital assets. The technical setup, including emerging golden cross patterns flagged by analysis firms, has bolstered the token’s credibility among institutional investors.

STORY CONTINUES BELOW

Beyond the market action, regulatory developments are shaping how corporate finance teams assess their blockchain strategies. Paxos, fresh off its November 2024 acquisition of Molecular Labs, filed to issue a USDH stablecoin on Stellar’s infrastructure aimed at Hyperliquid’s corporate clients. The move builds on Paxos’s $160 billion track record in stablecoin issuance and highlights the firm’s intent to position Stellar as a regulated payments network for enterprises.

At the policy level, the recently enacted GENIUS Act has drawn criticism from banking associations, who argue its provisions could open doors for exchanges to package stablecoins as investment products. Still, corporate legal departments see the framework as a step toward regulatory clarity. Combined with Stellar’s growing network and Paxos’s proposed USDH stablecoin, the developments could accelerate corporate adoption of blockchain-based cross-border payments.

Technical metrics

- Golden cross technical formation indicates potential long-term institutional accumulation patterns suitable for corporate investment committees.

- Trading volume surge of 85% to $333.21 million demonstrates increased institutional market participation and corporate treasury interest.

- Price breakout above $0.38 resistance with volume confirmation meets institutional risk management criteria for digital asset exposure.

- Support levels established at $0.37-$0.38 provide corporate treasurers with defined risk parameters for position sizing.

- Consolidation phase between $0.38-$0.39 suggests institutional accumulation strategies ahead of potential corporate adoption announcements.

- High-volume resistance at $0.39 requires additional institutional buying pressure, indicating measured corporate adoption pace.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By Krisztian Sandor, AI Boost|Edited by Stephen Alpher

1 hour ago

The repurchase happened as the firm’s stock price fell below the net asset value of its underlying ether holdings.

What to know:

- SharpLink Gaming repurchased $15 million worth of shares, viewing them as undervalued compared to the firm’s underlying ETH holdings.

- The stock was up 3.7% pre-market, but still trades 60% below its July high.

- Waning appetite for digital treasury firms saw their stock prices falling below net asset values, limiting their ability to raise funds for more purchases.