-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

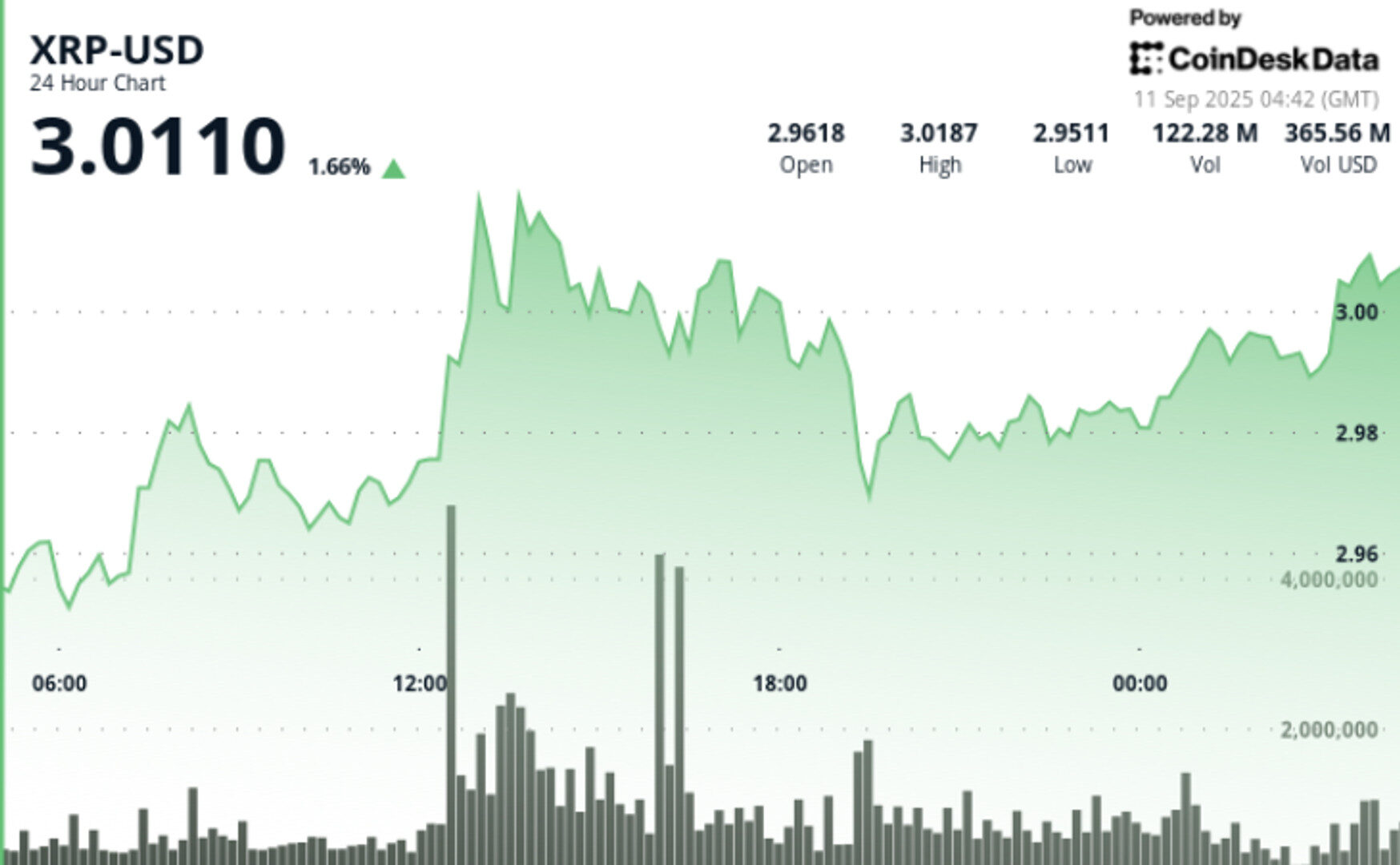

Despite facing resistance near $3.02, the market structure suggests accumulation, with bulls defending support around $2.98 as traders gauge momentum for a push toward higher extension levels.

By Shaurya Malwa, CD Analytics

Updated Sep 11, 2025, 5:18 a.m. Published Sep 11, 2025, 5:18 a.m.

- XRP surpassed the $3.00 mark amid strong institutional interest and high trading volumes.

- The token’s price fluctuated between $2.96 and $2.99, with significant activity during midday trading.

- Analysts suggest a potential breakout to $3.60 if momentum continues, despite current resistance at $3.02.

XRP pierced the $3.00 psychological threshold in a heavy-volume session that signaled strong institutional flows.

The rally carried the token from $2.96 to $2.99 in 24 hours, with midday breakouts on volumes six times the daily average.

Despite facing resistance near $3.02, the market structure suggests accumulation, with bulls defending support around $2.98 as traders gauge momentum for a push toward higher extension levels.

• The September 10 midday rally was fueled by a volume explosion of 116.7M and 119.0M units within the 12:00–13:00 hour, far exceeding the 24-hour average of 48.3M.

• Futures open interest climbed to $7.94B, showing heightened derivatives positioning alongside spot activity.

• Analysts flag a descending triangle breakout scenario with measured targets in the $3.60 area if momentum persists.

• Broader risk assets continue to track Federal Reserve expectations, with rate cut bets supporting flows into large-cap crypto assets.

STORY CONTINUES BELOW

• XRP advanced from $2.96 to $2.99 in the September 9 21:00 to September 10 20:00 trading window, a 1% gain within a $0.09 band.

• The breakout occurred during the 12:00–13:00 window, when XRP spiked from $2.98 to $3.02 on 119M volume, setting a short-term resistance zone.

• The final hour saw selling pressure push the token to $2.98, before buyers re-established support and closed near $2.99.

• Volume spikes of over 1.6M per minute during the late session confirmed institutional bids stepping in at discounted levels.

• Resistance: $3.02 remains the immediate ceiling after multiple rejections during peak trading.

• Support: Buyers repeatedly defended $2.98–$2.99 across multiple retests.

• Volume: Breakout volumes at midday were six times the daily average, validating the move.

• Structure: Higher lows formation suggests sustained accumulation despite resistance caps.

• Indicators: Technicals point to a breakout scenario, with Fibonacci extensions projecting potential upside toward $3.60.

• Whether XRP can sustain closes above the $3.00 mark to flip resistance into support.

• Reaction to $3.02 resistance — a breakout could extend targets to $3.20–$3.60 in coming sessions.

• Futures positioning and open interest at $7.9B, which could amplify volatility around key levels.

• Macro drivers from the Federal Reserve’s September 17 policy meeting and dollar liquidity outlook.

More For You

19 minutes ago

Alphractal called Kospi’s record high an incremental signal that bitcoin’s bull run may be nearing an end.

What to know:

- South Korea’s Kospi index has reached a record high of 4,340 points, driven by shareholder-friendly policies and positive global market sentiment.

- Alphractal called Kospi’s record high an incremental signal that bitcoin’s bull run may be nearing an end.

- The relationship between Kospi and bitcoin highlights their shared sensitivity to global risk sentiment and macroeconomic conditions.