-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

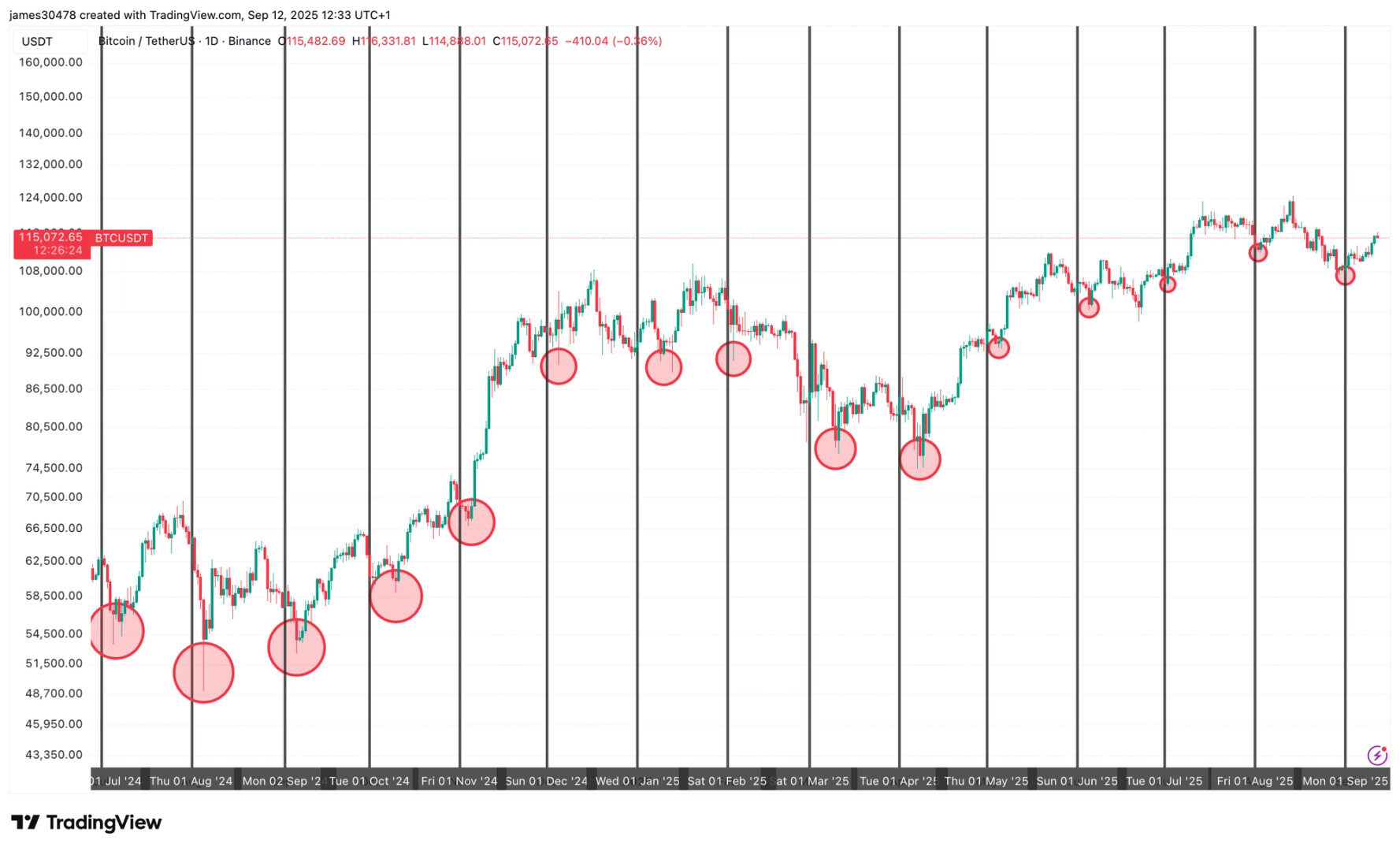

Historical monthly patterns suggest early September could mark the bottom before Q4 momentum builds.

By James Van Straten|Edited by Parikshit Mishra

Sep 12, 2025, 11:37 a.m.

- Since July 2024, bitcoin has typically formed monthly lows within the first 10 days, with only a few brief deviations.

- Q4 has historically been Bitcoin’s strongest quarter, averaging around 85% gains.

Historical data suggests that bitcoin BTC$114,973.88 has likely put in its September 2025 low, around $107,000 on the first of the month.

Looking back to July 2024, a consistent pattern emerges where bitcoin tends to form a bottom for the month within the first 10 days of each month.

STORY CONTINUES BELOW

The notable exceptions were February, June and August 2025, when the lows came later in the month, but even then, the market experienced a correction within those first 10 days before resuming its broader trend.

Speculatively, the reason bitcoin often puts in its low within the first 10 days of the month could be tied to institutional portfolio rebalancing or the timing of key macroeconomic events that tend to cluster early in the month.

“It’s worth noting that several futures and options markets expire on the final day of the month or the first day of the next, this can lead to short term volatility and a subsequent lull in trading activity as traders either rollover trades or reposition entirely,” said Oliver Knight, deputy managing editor, data and tokens, at CoinDesk.

Of course, past performance is not a guarantee of future results, but as Q4 approaches it is worth noting that this quarter has historically been bitcoin’s strongest, delivering an average return of 85%. October in particular has been especially favorable, with only two losing months since 2013.

More For You

By Jamie Crawley|Edited by Sheldon Reback

2 hours ago

Spot ether (ETH) ETFs are currently enjoying a three-day inflow run.

What to know:

- Bitcoin ETFs in the U.S. added $552.78 million on Thursday, their fourth consecutive day of inflows.

- This matches a four-day run ended Aug. 28 and is the joint-longest streak since the seven days ended Aug. 14, which coincided with bitcoin’s ascent to an all-time high of over $123,000.

- Spot ether (ETH) ETFs are currently enjoying a three-day inflow run.