-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

New challenger Remittix raises $25.2M with aggressive referral program while technical forecasts project XLM’s potential surge toward $1.96.

By CD Analytics, Oliver Knight

Updated Sep 12, 2025, 2:36 p.m. Published Sep 12, 2025, 2:36 p.m.

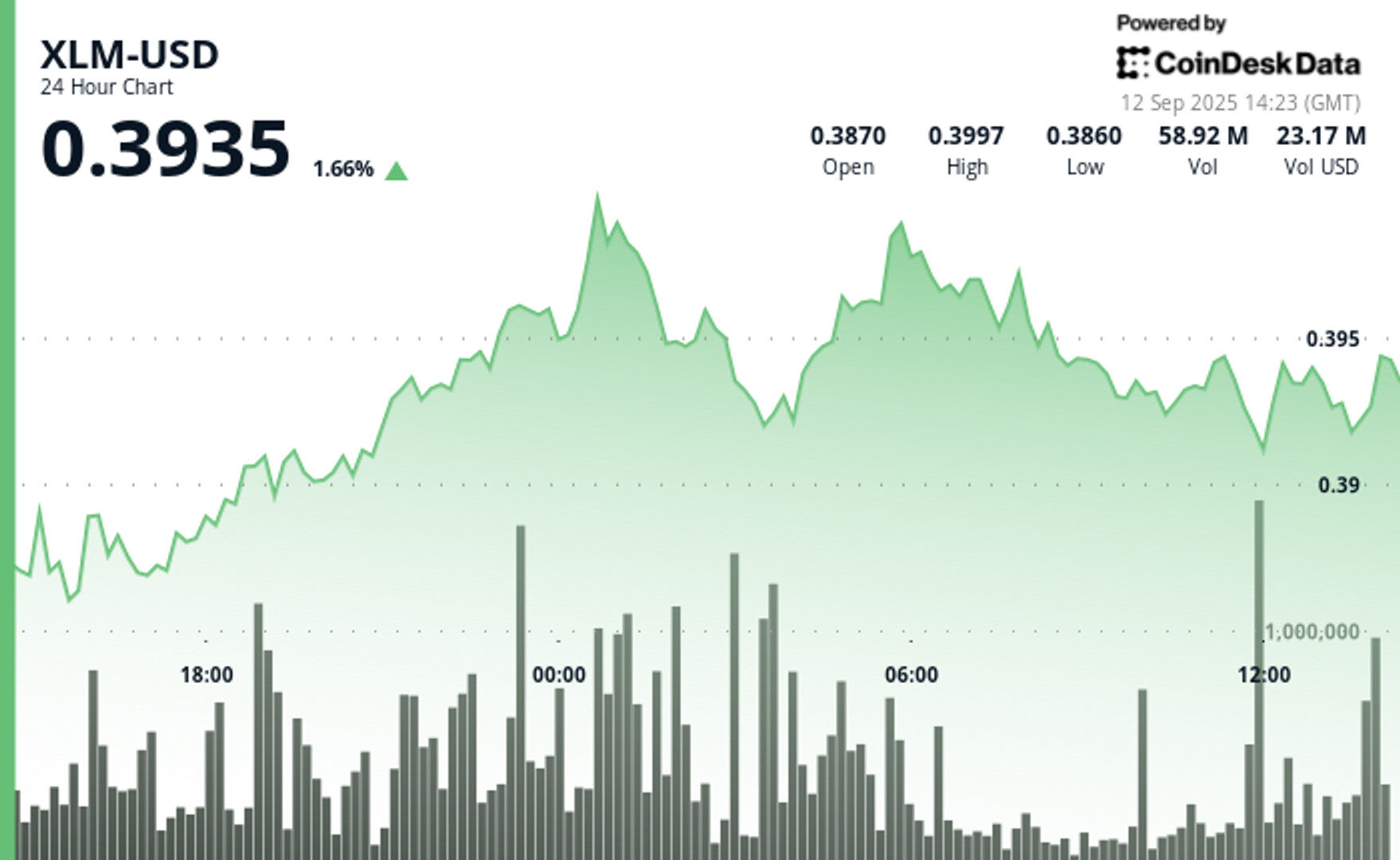

- Price action: XLM swung between $0.384 and $0.400 over 24 hours before closing at $0.393, with selling pressure emerging late in the session.

- Sector competition: Payments challenger Remittix raised $25.2M and launched a 15% USDT referral incentive, targeting XRP and XLM’s market dominance.

- Technical outlook: Elliott Wave analysis points to a possible 400% rally for XLM, while speculation grows over Ripple-Stellar collaboration on cryptographic infrastructure.

Stellar’s XLM navigated a volatile 24-hour trading session from Sept. 11 to Sept. 12, oscillating between $0.384 and $0.400 before closing near $0.393. The token saw early strength, advancing to session highs around $0.400, but selling pressure in the final hours pushed prices back toward support levels at $0.392. Market analysts note this late-session distribution activity underscores the corrective movement that has weighed on XLM despite its otherwise resilient performance.

The pullback coincided with rising competition in the payments sector. New entrant Remittix has launched with a 15% USDT referral incentive and secured $25.2 million in funding, sharpening challenges to incumbents like Ripple’s XRP and Stellar’s XLM. The aggressive go-to-market strategy highlights intensifying rivalry in the cross-border payments arena, a sector long dominated by these two tokens.

STORY CONTINUES BELOW

At the same time, some technical strategists see long-term upside for XLM. Elliott Wave projections suggest the token could stage a 400% rally toward $1.96, a move that would place Stellar’s market capitalization in the $60–$71 billion range. That outlook hinges on broader adoption trends and the resilience of Stellar’s ecosystem as competition ramps up.

Adding to market intrigue, a digital asset researcher has suggested Ripple and Stellar may be collaborating on a unified global financial infrastructure that leverages Zero-Knowledge cryptographic protocols. While unconfirmed, such a move would represent a significant step in aligning blockchain networks to enhance security, privacy and interoperability across global finance.

- XLM established a comprehensive trading range of $0.02 representing 4% volatility spanning $0.38 to $0.40.

- Sustained bullish momentum maintained throughout opening 17 hours with 3% advancement supported by increased volume participation.

- Session peak of $0.40 achieved at midnight on 12 September before encountering technical resistance.

- Support foundation established around $0.39 threshold containing the pullback during closing seven hours.

- Final 60 minutes demonstrated bearish pressure with decline from $0.39 to $0.39 confirming broader corrective trend.

- Intraday summit of $0.39 at 11:24 before sharp reversal at $0.39 resistance threshold.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By CD Analytics, Oliver Knight

30 minutes ago

Hedera’s token sees heightened Wall Street activity as trust and ETF filings surface, though regulatory hurdles remain.

What to know:

- HBAR ETF buzz: Grayscale flagged plans for a Hedera trust while the DTCC listed a Canary HBAR ETF under ticker HBR.

- Institutional flows: Resistance at $0.245 capped gains, with $0.240 holding as a critical support amid heavy trading volumes.

- Regulatory roadblocks: Analysts warn DTCC listings are preliminary, with SEC approval still required before any ETF launch.