-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

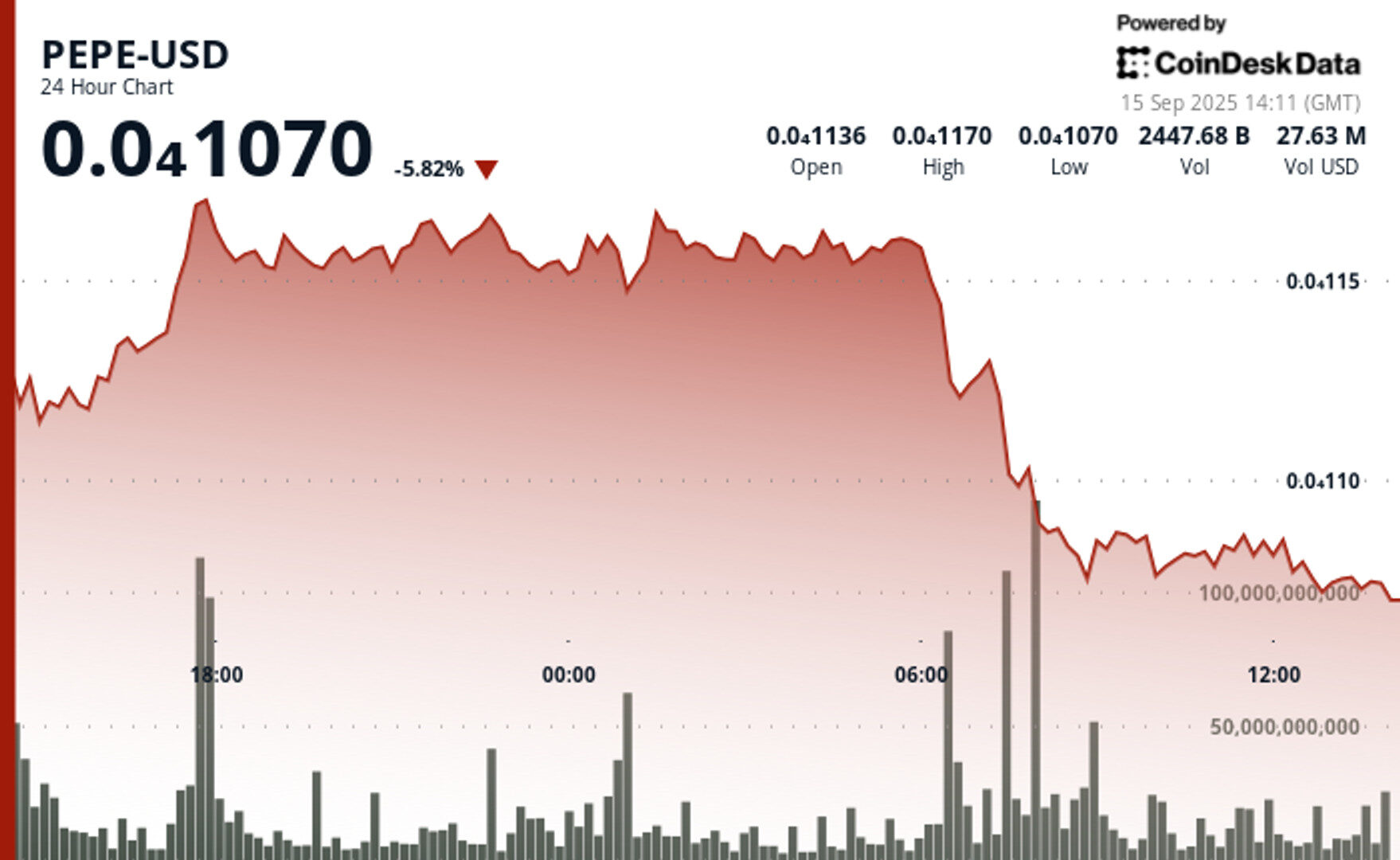

The drop in PEPE’s value was part of a wider crypto market drawdown, with the CoinDesk 20 index losing 1.8% of its value, and memecoins being especially hard hit.

By CD Analytics, Francisco Rodrigues|Edited by Stephen Alpher

Updated Sep 15, 2025, 3:08 p.m. Published Sep 15, 2025, 2:29 p.m.

- PEPE, a meme-inspired cryptocurrency, has lost nearly 6% of its value in the last 24 hours, dropping to a low of $0.0000107.

- The drop in PEPE’s value was part of a wider crypto market drawdown, with the CoinDesk 20 index losing 1.8% of its value, and memecoins being especially hard hit.

- Despite the short-term price drop, data from Nansen shows that large investors are still accumulating PEPE, with the top 100 non-exchange addresses holding PEPE on the Ethereum network increasing their holdings by 1.38% over the past week.

Meme-inspired cryptocurrency PEPE has lost nearly 6% of its value in the last 24-hour period, sliding to a $0.0000107 low even as large investors accumulate.

Trading volumes for the cryptocurrency surged into the trillions of tokens amid the drop, as the token kept failing to find support amid the intense selling pressure. The drop came amid a wider crypto market drawdown, where the broader CoinDesk 20 (CD20) index lost 1.8% of its value.

STORY CONTINUES BELOW

Memecoins were especially hard hit in the sell-off. The CoinDesk Memecoin Index dropped nearly 5% over the last 24 hours, while bitcoin saw a drop of 0.8%.

The drop comes just days after altcoin season speculation grew among cryptocurrency circles over the Federal Reserve’s expected interest rate cut later this week, which is expected to be a boon for risk assets.

Data from Nansen shows that over the past week, the top 100 non-exchange addresses holding PEPE on the Ethereum network have seen their holdings grow by 1.38% to 307.33 trillion tokens, while exchange wallets had a 1.45% drop in holdings to 254.4 trillion tokens.

PEPE’s price action pointed to a market in retreat, according to CoinDesk Research’s technical analysis data model. The token dropped from $0.000011484 to $0.000010782, with sellers dominating the chart.

Price peaked at $0.000011732 during a resistance test, but volume swelled to 5.5 trillion tokens at that level, before the market ultimately turned lower.

Support showed signs of buckling during the next phase, with the token brushing against $0.000010746. Trading activity intensified again, hitting 7.7 trillion tokens and reinforcing bearish sentiment.

The cryptocurrency’s price whipsawed within a 9% intraday range, a sign that traders remain unsure whether support levels are going to hold.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By CD Analytics, Oliver Knight

6 minutes ago

Corporate treasury departments and institutional funds drive unprecedented trading volumes amid regulatory uncertainty.

What to know:

- HBAR slid 5% between Sept. 14–15, dropping from $0.24 to $0.23 amid concentrated corporate selling.

- Institutional volumes spiked to 126.38 million tokens on Sept. 15, nearly triple typical activity, signaling large-scale portfolio rebalancing.

- Recovery attempts faltered, with buyers testing $0.24 resistance before retreating, leaving $0.23 as the key support level.