-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Jamie Crawley|Edited by Sheldon Reback

Sep 18, 2025, 1:51 p.m.

- Nvidia, the world’s largest public company by market cap, said it will invest $5 billion in Intel.

- The two companies plan to develop custom data center and PC products, combining Nvidia’s artificial intelligence capabilities and Intel’s CPU technologies.

- Having dominated the CPU market for decades, Intel has not enjoyed comparable success as the computing market becomes more focused on AI.

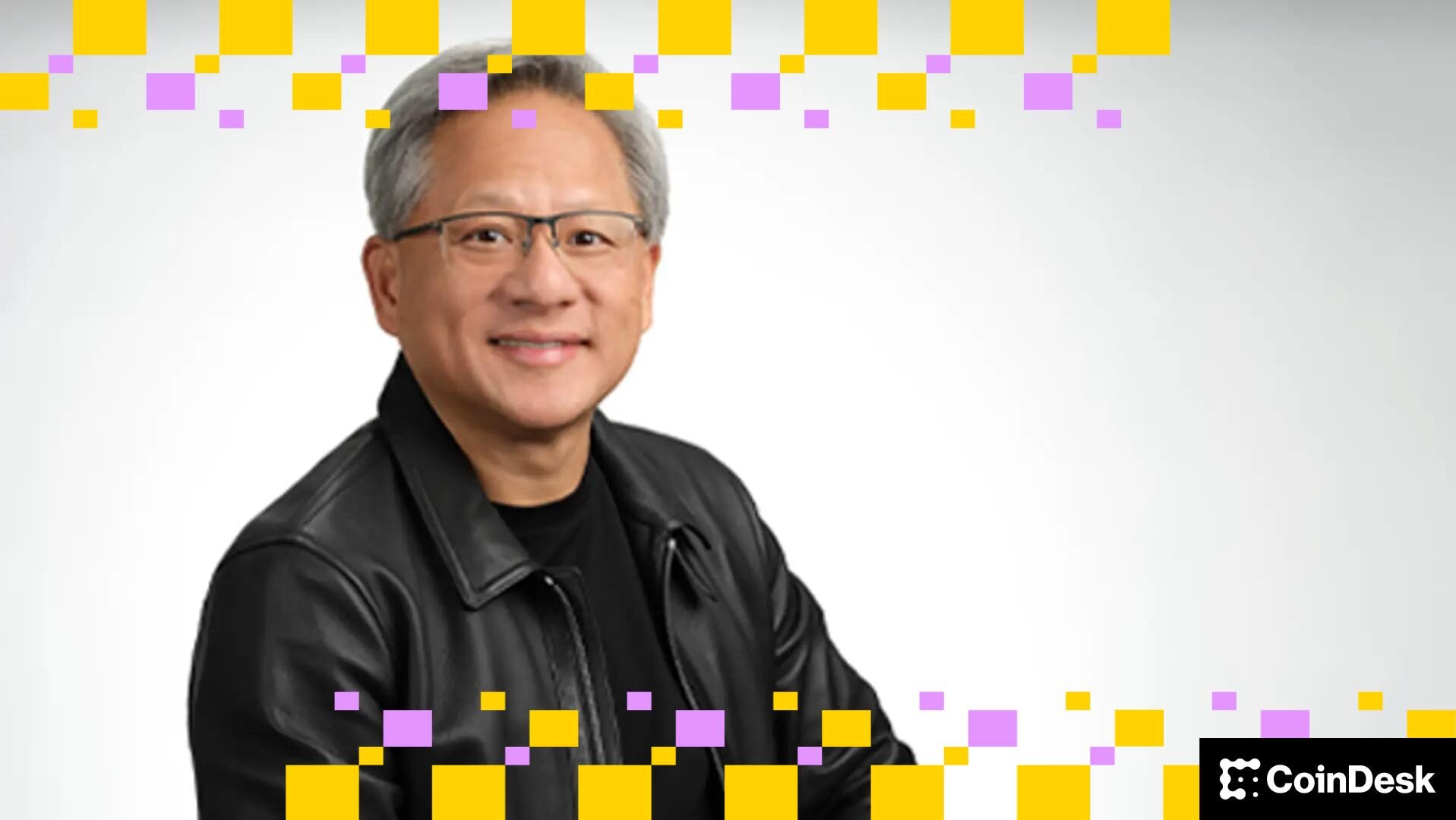

Nvidia (NVDA), the world’s largest public company by market cap, said it will invest $5 billion in Intel (INTC) and work with the chipmaker on developing custom data-center and PC products as artificial intelligence becomes more pervasive.

The Santa Clara, California-based maker of the graphic processing units (GPUs) that underpin AI computing will buy shares of its neighbor at $23.28 each, 6.5% lower than Wednesday’s closing price of $24.90, according to an announcement on Thursday.

STORY CONTINUES BELOW

While Nvidia is known for its GPU production, Intel was a leader in developing microprocessors and entered public consciousness as the provider of central processing units (CPUs) that drove IBM-compatible microcomputers. Its fortunes have declined as AI, with its intensive computing requirements, has taken root.

Intel stock surged 24% on Thursday, taking its market cap to $143 billion. That’s just a fraction of the $500 billion it boasted in 2000, according to companiesmarketcap.com. Nvidia, with a value of $4.23 trillion, rose 1.85%.

The U.S. government bought a 10% stake in Intel last month for $8.9 billion in an attempt to shore up the future of American chip manufacturing.

The crypto industry watches Nvidia’s performance with a keen eye as a proxy for market sentiment, which may reflect in AI tokens and the broader crypto market.

More For You

By Ian Allison|Edited by Sheldon Reback

3 hours ago

STBL transforms tokenized securities such as money market funds into freely usable stablecoins, and allow-listed, interest-accruing NFTs.

What to know:

- STBL’s novel structure mirrors traditional finance bond-stripping mechanics.

- The issued stablecoin design is intended to remain a non-security in spirit and align with the GENIUS Act.