-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Without significant expansion, the new wave of stablecoin launches may simply redistribute market share rather than grow the pie, said the bank.

By Will Canny, AI Boost|Edited by Stephen Alpher

Sep 19, 2025, 2:24 p.m.

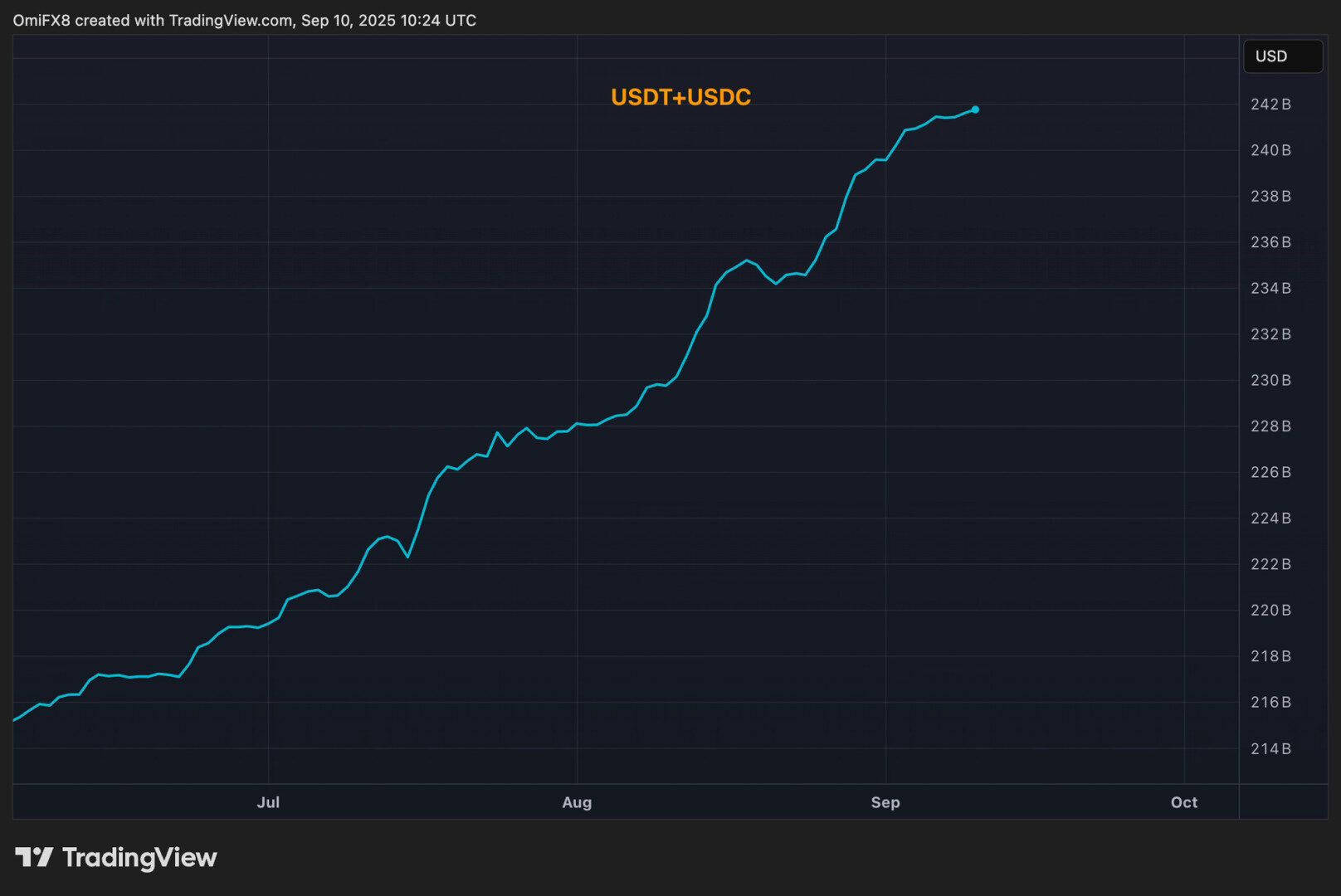

- JPMorgan says the $270 billion stablecoin market continues to track crypto’s overall market cap, meaning new launches may just shuffle market share.

- Tether plans a fully U.S.-compliant stablecoin, to compete with Circle’s USDC and appeal to institutional clients.

- Hyperliquid, PayPal, Robinhood, and Revolut are launching stablecoins, while Circle is building its own blockchain to keep USDC at the center of the crypto ecosystem, the report noted.

The $270 billion stablecoin sector has grown significantly but still accounts for less than 8% of crypto’s total market cap, a level it has held since 2020, according to a JPMorgan research note.

That dynamic could turn the coming wave of U.S. stablecoin launches into a zero-sum contest, unless the crypto market itself expands significantly, analysts led by Nikolaos Panigirtzoglou wrote.

STORY CONTINUES BELOW

Tether, whose USDT is primarily used overseas, plans to debut a U.S.-compliant token, USAT. Unlike USDT, whose reserves are about 80% compliant with U.S. requirements, USAT’s backing would fully meet the new regulatory standards, the bank said.

Stablecoins are cryptocurrencies whose value is tied to another asset, such as the U.S. dollar or gold. They play a major role in cryptocurrency markets, providing a payment infrastructure, and are also used to transfer money internationally. Tether’s USDT is the largest stablecoin, followed by Circle’s (CRCL) USDC.

The passage of U.S. stablecoin legislation in July has already spurred a fresh round of launches aimed at Circle’s USDC, which dominates the U.S. market, the report noted.

While new players are jockeying for position ahead of regulatory implementation, the stablecoin market’s growth remains tied to crypto’s overall market cap, the analysts wrote.

Circle is also losing ground to competitors like Hyperliquid, whose exchange alone accounts for nearly 7.5% of USDC usage, as well as fintech giants PayPal (PYPL), Robinhood (HOOD), and Revolut, which are rolling out their own tokens, JPMorgan said.

In response, Circle is developing Arc, a blockchain tailored to USDC transactions, to improve speed, security, and interoperability and keep USDC central to crypto infrastructure.

Without significant expansion, the new wave of stablecoin competition may simply redistribute market share rather than grow the pie, the report added.

USDC supply has surged to $72.5 billion, 25% ahead of Wall Street firm Bernstein’s 2025 estimates, the broker said in a report earlier this month.

Read more: Circle’s USDC Market Share ‘On a Tear,’ Says Wall Street Broker Bernstein

AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By James Van Straten, AI Boost|Edited by Stephen Alpher

23 minutes ago

Threatening the $118,000 level hours earlier, bitcoin slipped back to the $116,000 area.

What to know:

- The Bank of Japan plans to sell $2.2 billion worth of ETFs annually, a process Governor Ueda said could take more than 100 years.

- Japan’s Nikkei dropped over 1% on the news, with the yield on the country’s 10-year JGB rising to 1.64%.

- Crypto dipped lower, with bitcoin sliding back to just above $116,000.