-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By CD Analytics, Oliver Knight

Updated Sep 19, 2025, 4:37 p.m. Published Sep 19, 2025, 4:37 p.m.

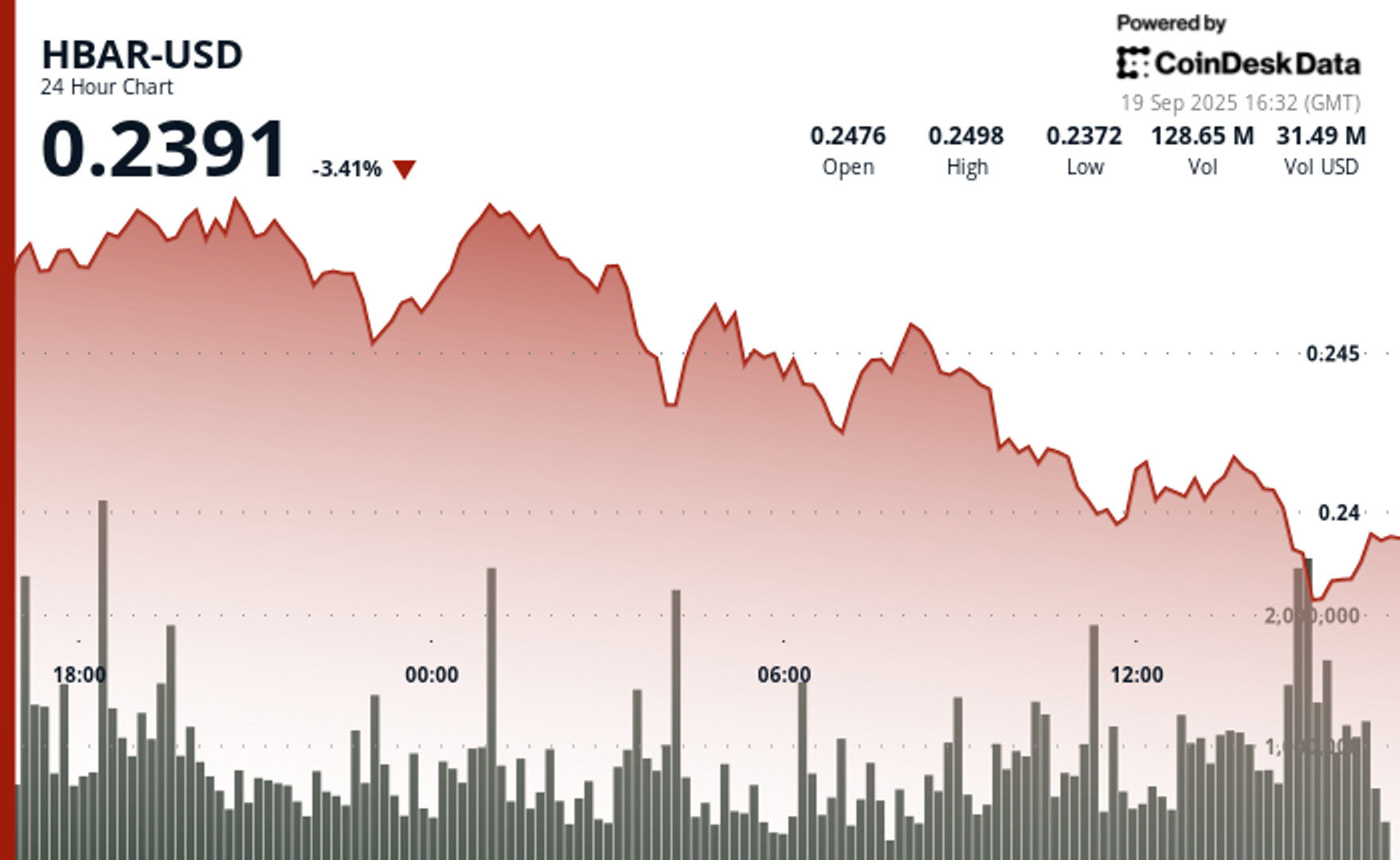

- HBAR fell 3.38% over 23 hours, dropping from $0.25 to $0.24 amid heavy selling and a 55.91 million trading volume spike.

- The token breached multiple support levels but stabilized at $0.24, forming an ascending triangle pattern that signals potential consolidation.

- Despite short-term weakness, institutional backers and Hedera’s energy-efficient technology continue to underpin its long-term market appeal.

HBAR faced steady downward pressure over the past 23 hours, sliding from $0.25 to $0.24—a 3.38% decline. The token initially attempted to build momentum on September 18, reaching $0.25 by 20:00, but sellers quickly overwhelmed demand near that resistance level. Trading activity spiked at 19:00 with volumes topping 55.91 million, underscoring the intensity of selling. By late evening, HBAR broke below key support zones at $0.25 and $0.24, testing the lower boundary before finding temporary stability.

The retracement highlights fragile sentiment in the short term, with bears maintaining control as buyers failed to defend critical thresholds. The inability to reclaim lost ground indicates that market participants remain cautious, though consolidation near $0.24 suggests some stabilization. If the level continues to hold, traders may view it as a base for potential sideways movement before a clearer directional trend emerges.

STORY CONTINUES BELOW

Broader market factors continue to shape HBAR’s outlook. While its energy-efficient Hashgraph technology is often cited as a competitive advantage over traditional blockchains, trading volumes still lag peers like Solana. Still, institutional endorsements from Google, IBM, and Boeing offer a degree of legitimacy that could appeal to investors seeking utility-driven blockchain projects. Its low-cost, high-speed transactions keep HBAR positioned as a contender in the evolving digital asset landscape.

In the final hour of the observed session, HBAR showed signs of stabilization, hovering tightly around $0.24. The token formed a minor ascending triangle pattern, testing support multiple times while nudging slightly upward. Though modest, this recovery on volume of 2.08 million indicates buyers are tentatively stepping back in. Whether that consolidation evolves into sustained upside momentum remains contingent on overcoming immediate resistance near $0.24.

- HBAR breached multiple support levels including $0.25 and $0.24 throughout the bearish phase.

- Volume surge of 55.91 million during the 19:00 hour signalled intensified liquidation pressure.

- Formation of ascending triangular pattern with progressive higher lows established at $0.24, $0.24, and $0.24.

- Resistance remained consistent around $0.24, suggesting potential for breakout above this threshold.

- Recent stabilisation near $0.24 may indicate prospective consolidation preceding subsequent directional movement.

- Technical analysis reveals constructive consolidation pattern featuring successful support examinations.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By CD Analytics, Oliver Knight

1 hour ago

XLM fell 3.58% to $0.39 on heavy institutional selling, but fresh corporate partnerships and stablecoin integrations highlight Stellar’s long-term growth prospects.

What to know:

- XLM dropped below the $0.40 support level as overnight institutional selling volumes spiked above the 24-hour average.

- Despite short-term weakness, Stellar showcased new corporate adoption at its Meridian conference, including PayPal, Centrifuge, and Mercado Bitcoin initiatives.

- Analysts warn of a bearish trend with resistance consolidating at $0.40, even as institutional buyers stabilized prices near $0.39.