-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

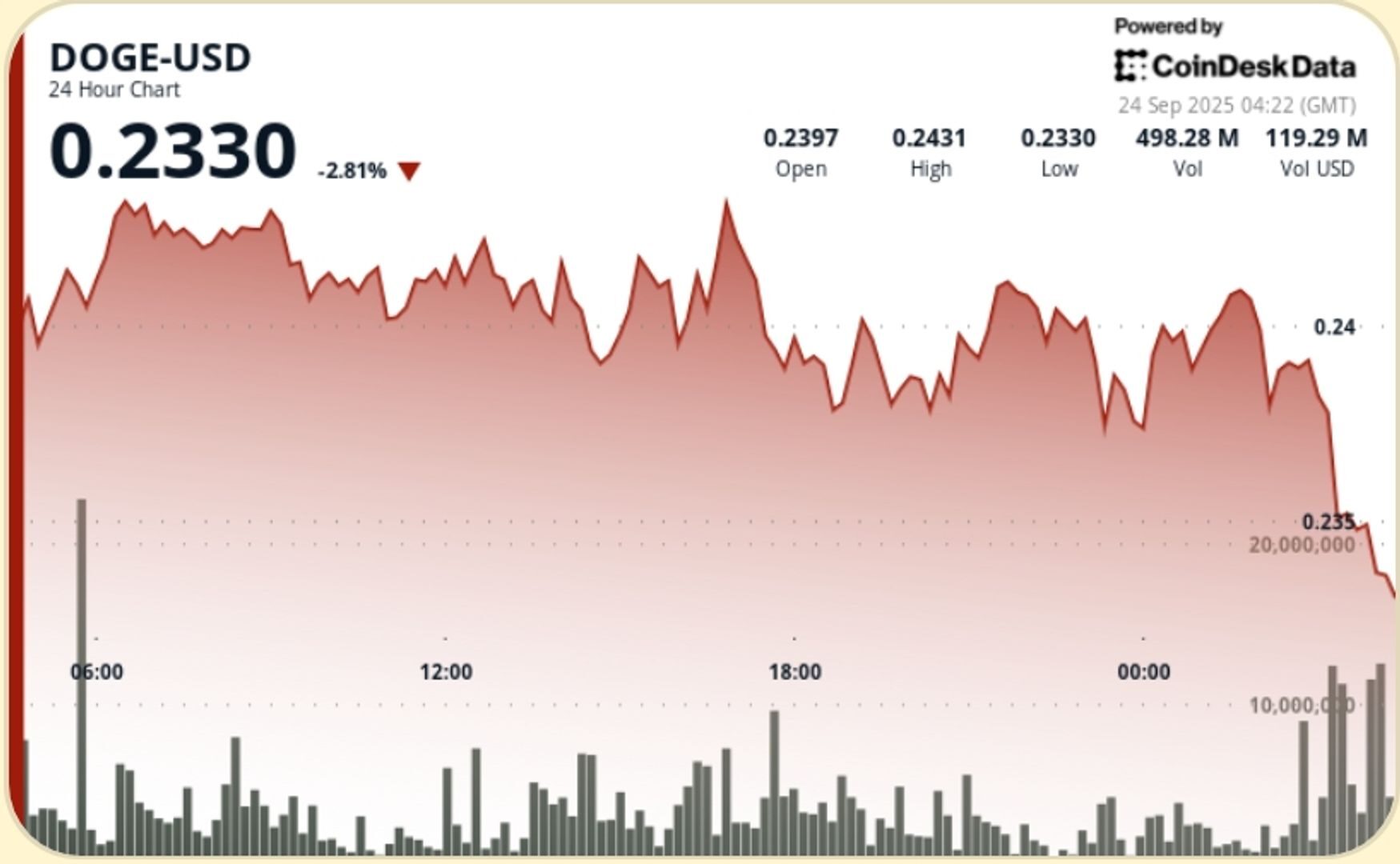

Meme token holds above $0.24 support as volume spikes past 500M while resistance consolidates near $0.2.

By Shaurya Malwa, CD Analytics

Updated Sep 24, 2025, 4:26 a.m. Published Sep 24, 2025, 4:26 a.m.

- Dogecoin traded in a narrow range between $0.236 and $0.244, showing resilience despite broader crypto market fragility.

- Early rallies tested resistance at $0.244, but profit-taking limited upward momentum.

- Traders are monitoring the $0.244 resistance level for a potential breakout and the $0.236–$0.240 support band for signs of accumulation.

Broader crypto sentiment remained fragile amid risk-off flows, though DOGE showed resilience with consistent liquidity inflows.

STORY CONTINUES BELOW

DOGE$0.2370 consolidated in a tight band during the 24-hour window from September 23 at 03:00 to September 24 at 02:00, trading between $0.236 and $0.244. Early rallies at 06:00 and 16:00 tested the $0.244 mark, but repeated profit-taking capped upside momentum.

• DOGE fluctuated in a $0.008 range, equal to 3.28% of its trading spectrum.

• Early session highs tested $0.244 but met with sustained selling pressure.

• Final session hour (01:11–02:10) saw DOGE advance from $0.239 to $0.241 before consolidating at $0.240.

• Net session gain of 1.37% from $0.237 open to $0.240 close underscores defensive bid despite volatility.

• Support: Strong base formed at $0.236–$0.240 zone with buyers stepping in on dips.

• Resistance: $0.241–$0.244 remains firm ceiling after multiple rejections.

• Volume: Over 500M DOGE transacted during early rallies; closing hour spike above 7M highlighted bullish defense.

• Pattern: Narrow consolidation suggests potential coiling for breakout, though resistance at $0.244 must clear for continuation.

• Break above $0.244 resistance to validate bullish continuation.

• Retest of $0.236–$0.240 support band for signs of accumulation versus exhaustion.

• Volume sustainability — whether closing-hour spikes repeat in upcoming sessions.

• Broader memecoin sentiment as regulatory developments weigh on speculative assets.

More For You

By Aoyon Ashraf|Edited by Nikhilesh De

7 hours ago

The talks of the deals are in early stages and prospective investors have been given access to a data room over the past few weeks, Bloomberg reported.

What to know:

- Tether is seeking to raise $15 billion to $20 billion for a 3% stake in the company through a private placement.

- The raise would value Tether at approximately $500 billion, comparable to companies like OpenAI and SpaceX.

- Tether reported a $4.9 billion net profit in the second quarter, with $162.5 billion in reserves against $157.1 billion in liabilities.