-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By James Van Straten, AI Boost|Edited by Parikshit Mishra

Updated Sep 24, 2025, 9:07 a.m. Published Sep 24, 2025, 9:04 a.m.

- Every wallet cohort, from under 1 BTC holders to over 10,000 BTC whales, is in distribution, with the largest whales selling most aggressively.

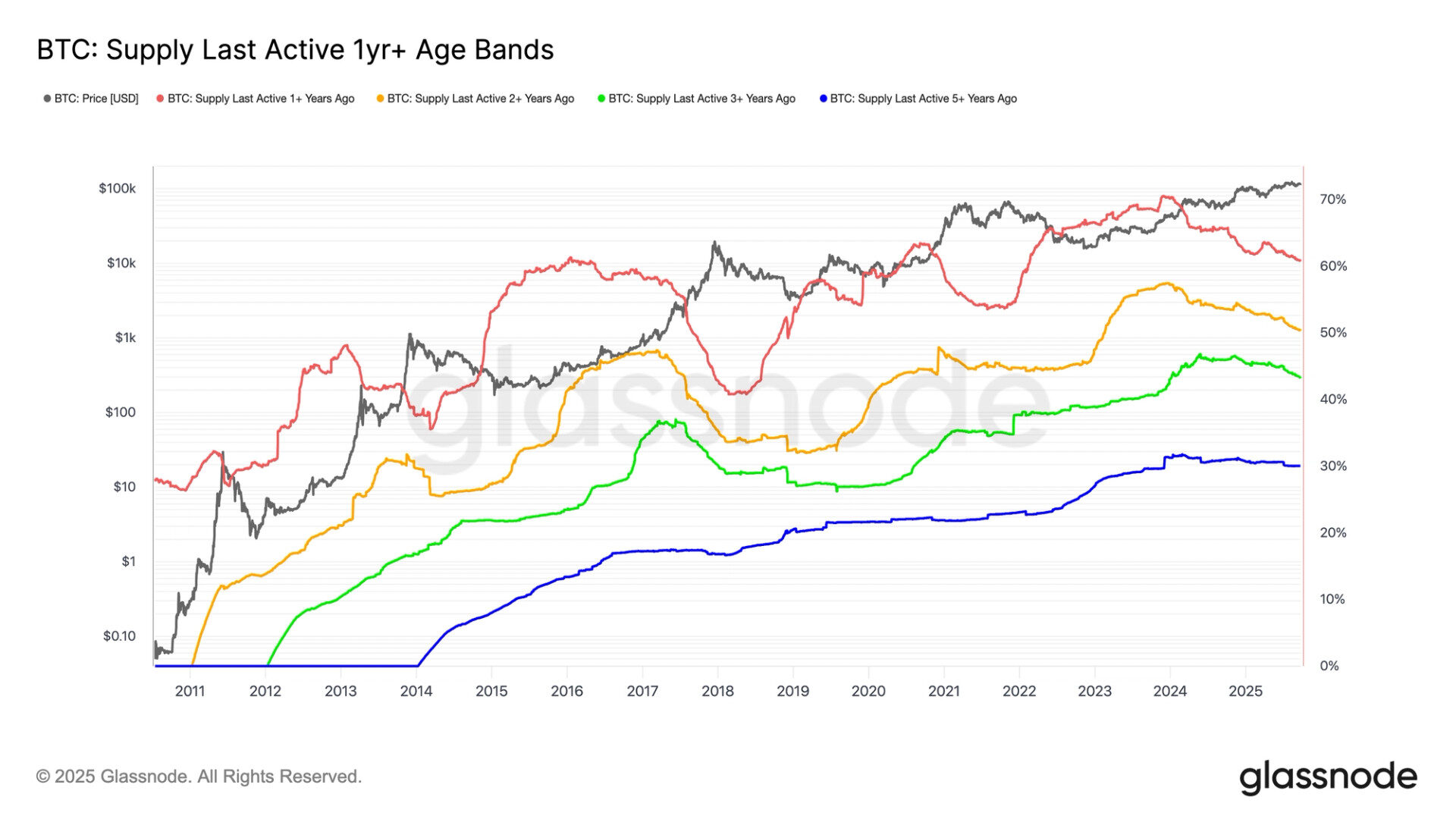

- Long-term holder supply is declining, as one year plus supply has dropped from 70% to 60% and two year plus supply from 57% to 52%, while five year plus holders remain steady.

BTC$112,790.07 remains stagnant in the $110,000 to $120,000 range, while gold and U.S. equities hover near all-time highs.

According to Glassnode’s Accumulation Trend Score by cohort, selling pressure is evident across all wallet groups. This metric measures the relative strength of accumulation based on the size of entities and the volume of coins acquired over the past 15 days. A value closer to 1 signals accumulation, while a value closer to 0 signals distribution. Exchanges and miners are excluded from this calculation.

STORY CONTINUES BELOW

Currently, every cohort, from wallets holding less than 1 BTC to whales holding over 10,000 BTC, is in distribution. The largest whales, with holdings above 10,000 BTC, are showing some of the most aggressive levels of selling over the past year.

Looking at long-term holder supply, the percent of circulating supply unmoved for at least 1 year has dropped sharply from 70% to 60%. The peak was in November 2023, when bitcoin traded near $40,000. At the same time, 2+ year holders also began to sell, with their share declining from 57% to 52%.

The three year plus cohort now sits just above 43% and has been steadily falling since November 2024. These wallets largely represent buyers from the previous cycle top in November 2021 at around $69,000, many of whom accumulated more during the 2022 bear market when prices hit lows of $15,500. With bitcoin’s recovery, these investors are realizing gains.

By contrast, five year plus holders remain steady, reflecting that the longest-term investors are not participating in the sell-off.

This trend shows that investors sitting on unrealized profits from this cycle are continuing to realize profits, adding to the ongoing selling pressure.

Read more: BlackRock’s Bitcoin ETF: Bearish Sentiment in IBIT Stays Strong for Two Straight Months

AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By Omkar Godbole|Edited by Parikshit Mishra

1 hour ago

IBIT’s price uptrend has stalled since July.

What to know:

- BlackRock’s IBIT has shown a bearish put bias for two consecutive months, indicating market caution.

- Traders have favored protective puts over bullish calls since July, suggesting a risk-averse sentiment.

- IBIT’s price uptrend has stalled since July.