-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

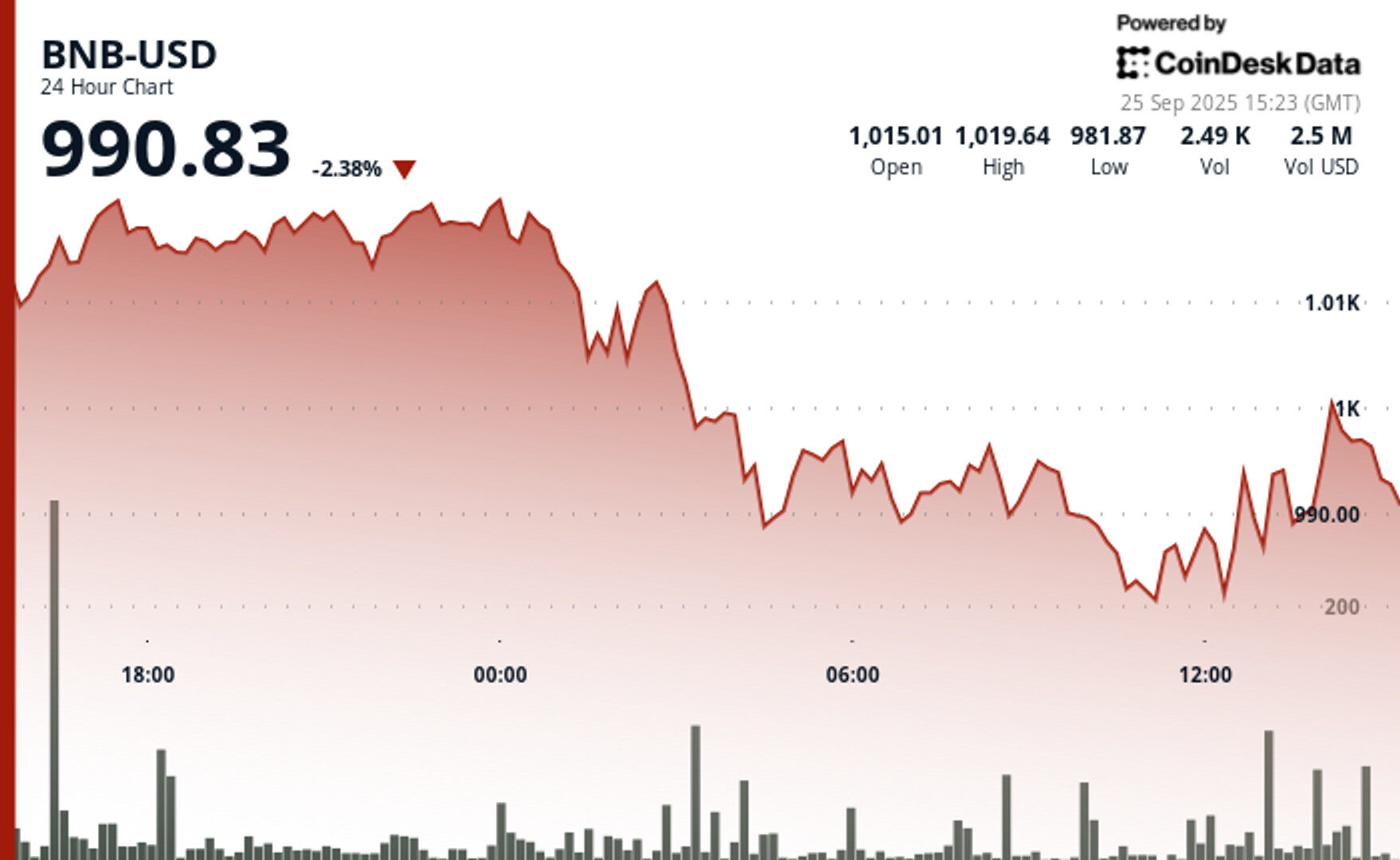

The decline in BNB comes as sentiment remains poor, with the Crypto Fear and Greed Index nearing “fear” and the average RSI indicating oversold conditions.

By CD Analytics, Francisco Rodrigues|Edited by Sheldon Reback

Sep 25, 2025, 3:33 p.m.

- The BNB token, used for fee discounts on Binance and powering the BNB Chain, dropped more than 2% in the last 24 hours to around $1,000, amid a broader cryptocurrency market decline.

- Sentiment in the industry remains poor, with the Crypto Fear and Greed Index nearing “fear” levels and the average crypto relative strength index (RSI) indicating oversold conditions.

- BNB Chain validators have proposed reducing gas fees by 50% to 0.05 gwei, which could lower transaction costs and accelerate block speeds, potentially boosting on-chain trading activity.

BNB, the token that powers the BNB Chain and can be used for fee discounts on leading crypto exchange Binance, dropped more than 2% in the last 24 hours amid a wider cryptocurrency market decline.

Sentiment in the industry remains poor, with the Crypto Fear and Greed Index now at 41, a neutral level close to hitting fear, while the average crypto relative strength index (RSI), a technical indicator, points to oversold levels according to CoinMarketCap.

STORY CONTINUES BELOW

The token slid from $1,025 to just under $1,000 as sellers took control and resistance built near $1,035, according to CoinDesk Research’s technical analysis data model. The broader CoinDesk 20 (CD20) index dropped 3.7%.

BNB Chain validators have put forward a proposal to reduce gas fees from 0.1 to 0.05 gwei. The change would drop average transaction costs to around $0.005 and accelerate block speeds from 750 milliseconds to 450 milliseconds.

The proposal comes at a time in which on-chain trading activity is booming on the BNB Chain after the launch of decentralized trading platform Aster, which recently overtook Hyperliquid in daily perpetual trading volumes.

BNB traded within a $49 range over the past 24-hour period, falling to $993. Strong resistance formed just above $1,030, while support held firm around $987.

The price briefly recovered, ticking up from just below $990 to near $994. The gain came as buying demand appeared and pushed the token to form higher lows.

Trading volume suggested a shift from aggressive selling to slower accumulation, with support consolidating near $989 and resistance emerging just under $996.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By Krisztian Sandor|Edited by Stephen Alpher

1 hour ago

The U.S. economy grew 3.8% in the second quarter, much higher than previously reported, sending yields higher and risk assets lower.

What to know:

- Crypto prices added to losses as strong U.S. economic data impacted market expectations for Federal Reserve rate cuts.

- Bitcoin dropped below $111,000, its lowest since early September, while ETH led far steeper declines in the altcoin sector.

- Crypto-related stocks, including MSTR, COIN, DATs and miners, suffered sharp losses.