-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

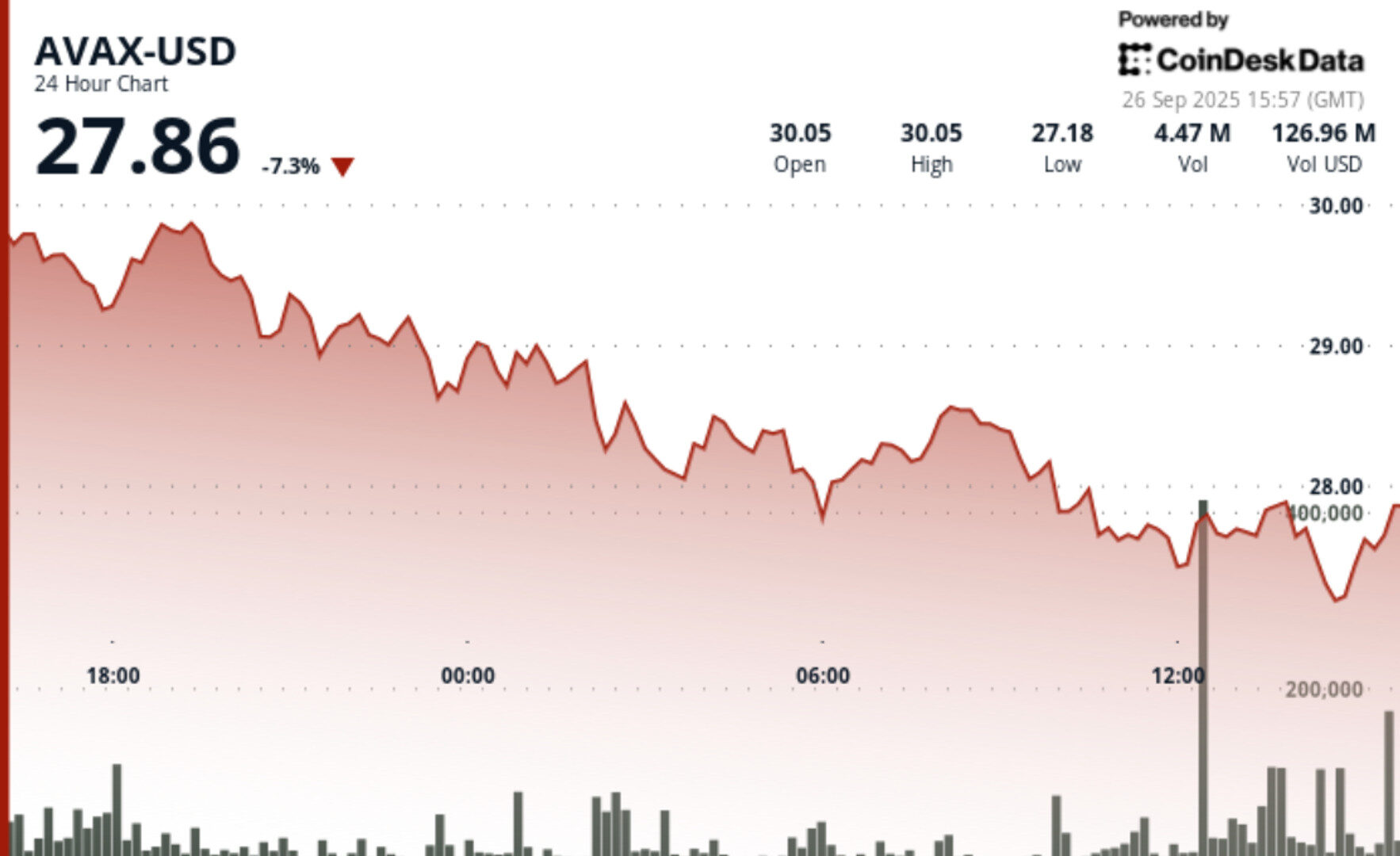

AVAX tumbled alongside the rest of the crypto market, extending a weeklong slide despite Anthony Scaramucci-backed AVAX One’s rebrand.

By CD Analytics, Helene Braun|Edited by Stephen Alpher

Sep 26, 2025, 4:12 p.m.

- Avalanche’s AVAX token fell 8% in 24 hours, extending a weeklong decline to 18%.

- Institutional interest—including a $550 million AVAX acquisition plan from Nasdaq-listed AVAX One—has yet to halt the token’s slide.

- Weak support levels and low trading volumes suggest selling may be slowing, but confidence in Avalanche’s long-term position remains shaky.

Avalanche’s native token AVAX fell 8% over the past 24 hours to $27.72, extending a weeklong slide that erased nearly 18% of its value. The drop occurred alongside a broad plunge in crypto markets that’s seen ETH, SOL, DOGE also post double-digit percentage declines over the past week and BTC fall 6%.

STORY CONTINUES BELOW

AVAX has struggled to break above a resistance level of $30.28 and found only weak support near $27.65. CoinDesk Analytics data shows trading volume sank to 121,896 tokens in early trading Friday, signaling that institutional selling may be slowing but has not yet reversed.

The price slump comes in the wake of Avalanche-aligned corporate initiatives aimed at deepening institutional engagement. Earlier this week, tech company AgriFORCE Growing Systems rebranded as AVAX One and announce plans to raise $550 million to acquire and hold AVAX. The move would make it the first Nasdaq-listed company to focus exclusively on Avalanche’s ecosystem.

The firm assembled a high-profile advisory team led by SkyBridge Capital founder Anthony Scaramucci and Coinbase Institutional’s Brett Tejpaul, positioning itself as a major AVAX custodian. AVAX One aims to hold more than $700 million in the token, a bid to cement its role as a central figure in Avalanche’s growth story.

But for now, the market hasn’t bought in.

The falling price suggests that institutional backers may still be cautious about Avalanche’s long-term positioning. While regulatory approvals for token-related vehicles are pending, they have yet to translate into buying momentum.

Avalanche’s roadmap includes partnerships and enterprise use cases, but these fundamentals have yet to counterbalance the current selling pressure.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By Shaurya Malwa|Edited by Sheldon Reback

2 hours ago

The token, pitched as an official Baby Shark play, was not an authorized product, brand-owner Pinkfong said.

What to know:

- A token associated with Baby Shark plunged over 90% in value after brand-owner Pinkfong denied it was an authorized product.

- The token was launched by a Pinkfong licensee, that, according to issuing platform IP.World, later said it lacked the authority to do so.

- Pinkfong said only two tokens, on Solana and BNB Chain, are officially endorsed, causing the unauthorized token’s market collapse.