-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

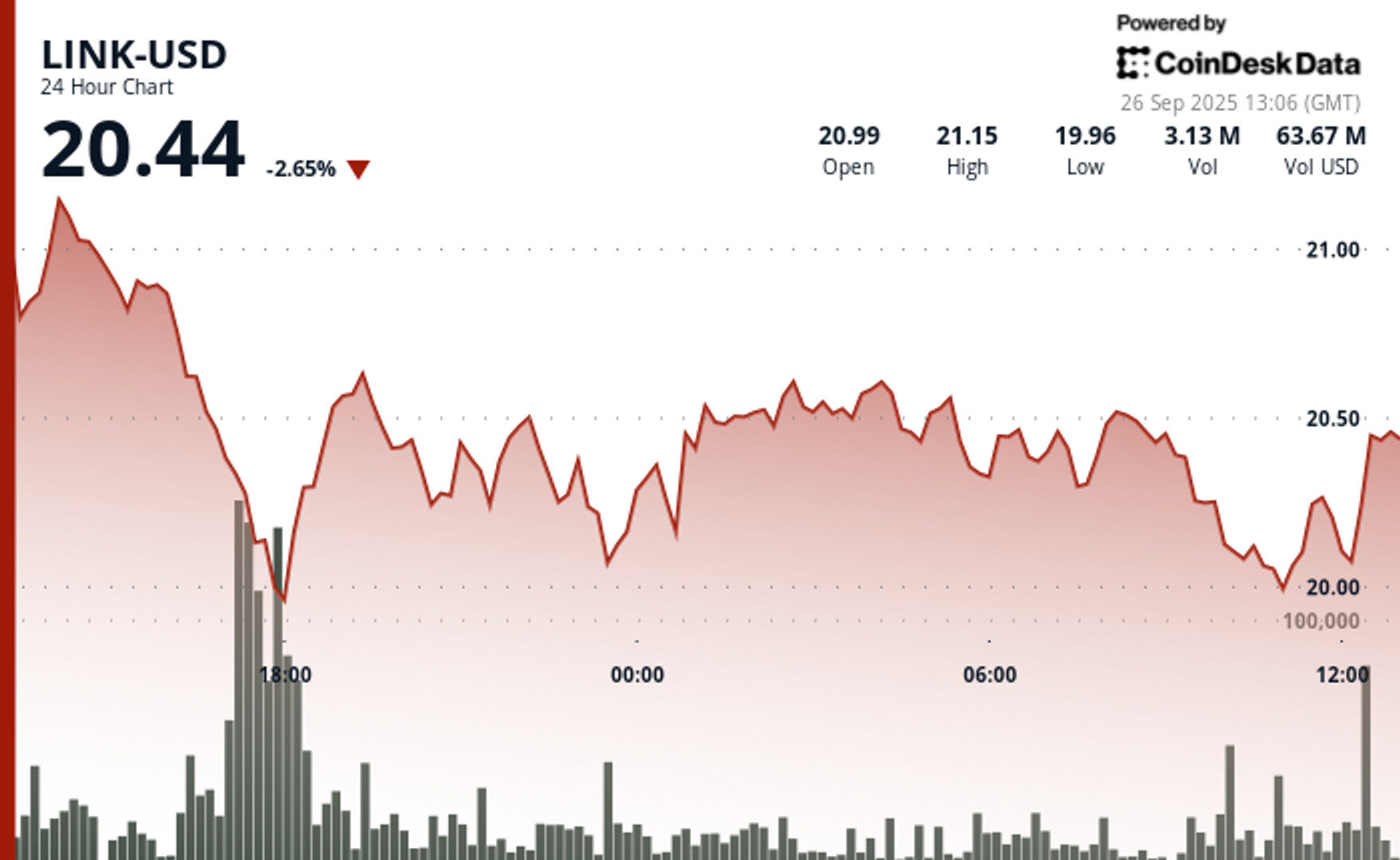

LINK is down nearly 28% since the August highs amid broader crypto weakness, but the $20 support line hints at a potential recovery.

By CD Analytics, Krisztian Sandor|Edited by Stephen Alpher

Sep 26, 2025, 2:19 p.m.

- Chainlink’s native token, LINK, fell to its lowest price in weeks, dropping nearly 28% from its August highs.

- Despite the decline, significant buying activity occurred, including a $4 million purchase by Caliber, bringing its total LINK holdings to $10 million.

- LINK showed signs of recovery with strong support at the $20 level, though resistance remains around $20.57.

Native token of oracle network LINK$20.81 has sunk to its weakest price since early August, giving up past weeks’ gains amid broader crypto market weakness.

LINK dipped briefly below $20 multiple times overnight from Thursday to Friday, declining around 4% over the past 24 hours and down nearly 28% from the August highs.

STORY CONTINUES BELOW

The move happened despite consistent buying activity. On Thursday, wealth management firm Caliber (CWD) bought another $4 million in LINK tokens as part of its digital asset treasury strategy. With the latest purchase, the firm brought total LINK holdings to $10 million, according to the press release.

The Chainlink Reserve, a facility that purchases tokens using revenue from protocol integrations and services, taking supply off from the open market, also bought on Thursday nearly 47,903 LINK, worth just shy of $1 million at current prices. The initiative has purchased over 370,000 tokens ($7.5 million) since its August launch.

Despite the bearish trend, LINK is showing signs of snapping its downtrend with buyers’ defending the $20 price level, CoinDesk Research’s technical analysis model suggested. However, bulls have to push through the subsequent resistance cluster around $20.57 for a more persistent trend shift.

- Price Movement: LINK retreated 5% from $21.16 to $19.95 before rebounding to $20.26, showcasing substantial intraday fluctuation with firm support at the $20.00 psychological barrier.

- Macroeconomic Influences: Broad-based cryptocurrency volatility mirrored wider risk-aversion sentiment as bitcoin fell below $109,000 and major altcoins tumbled.

- Microeconomic Components: Outstanding trading volume exceeding 5 million units during the selloff suggested institutional participation, while the following recovery on continuous buying interest indicates robust underlying appetite for LINK tokens.

- Volume Assessment: Outstanding volume of 5,031,849 units during decline created firm support at $19.95 threshold.

- Support Zones: Essential support region identified between $19.95-$20.00 with multiple successful validations.

- Resistance Objectives: Subsequent resistance cluster positioned near $20.57 with intermediate resistance at $20.30-$20.35.

- Momentum Signals: Bullish measured move formation indicates sustained upward momentum capacity.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By Will Canny, Helene Braun, AI Boost|Edited by Stephen Alpher

21 minutes ago

Alongside, JPMorgan downgraded IREN and CleanSpark

What to know:

- JPMorgan upgraded Riot Platforms to overweight, while downgrading IREN and CleanSpark.

- Citigroup also upgraded RIOT.

- HPC and AI cloud were seen as key upside drivers, with JPMorgan assigning a 50% probability of new co-location deals.