-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Seven XRP spot ETF applications remain pending before the U.S. Securities and Exchange Commission. Grayscale’s submission is scheduled for October 18, with others queued through November 14, creating a concentrated window of regulatory catalysts that could reshape near-term flows.

By Shaurya Malwa, CD Analytics

Updated Sep 30, 2025, 5:46 a.m. Published Sep 30, 2025, 5:46 a.m.

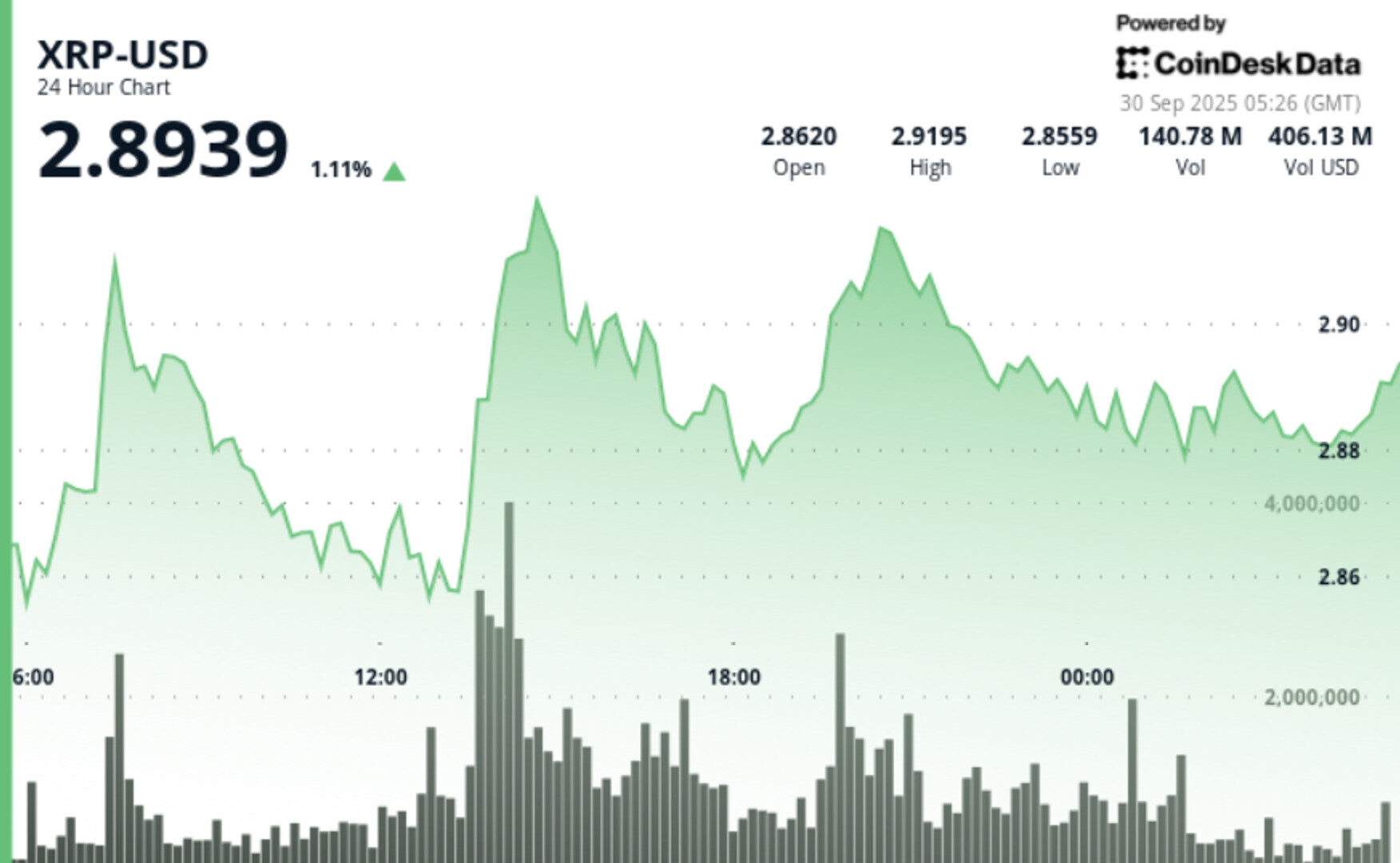

- XRP rose 2.1% over a 24-hour period, driven by significant institutional accumulation of over 120 million tokens.

- Seven XRP spot ETF applications are pending with the SEC, with decisions expected between October 18 and November 14.

- Traders are closely watching if XRP can maintain support above $2.90, a key level for potential further gains.

XRP gained 2.1% during the 24-hour trading session from September 28 at 21:00 to September 29 at 20:00, climbing from $2.84 to $2.90 while moving within a $0.10 range that represented 3.47% of the opening price.

• Large institutional addresses holding between 10–100 million XRP tokens accumulated over 120 million coins across the last 72 hours.

STORY CONTINUES BELOW

• Seven XRP spot ETF applications remain pending before the U.S. Securities and Exchange Commission. Grayscale’s submission is scheduled for October 18, with others queued through November 14, creating a concentrated window of regulatory catalysts that could reshape near-term flows.

• Market sentiment has been buoyed by anticipation of increased corporate portfolio exposure. Analysts frame ETF approvals as a structural driver that could accelerate XRP’s adoption within institutional allocation strategies.

• XRP traded within a $0.10 corridor, fluctuating between a low of $2.84 and a high of $2.93, reflecting 3.5% volatility during the period. Price capped out near $2.93 where selling pressure intensified, particularly during the September 29 14:00 session.

• The most significant upward moves came at 02:00 and 07:00 GMT on September 29, where volume spiked to over 97 million units. These surges significantly outpaced the daily average of 57.4 million, confirming institutional participation during rally phases.

• The final hour of trading extended the advance, as price moved from $2.88 to $2.90 for a 0.7% late gain. The breach of the $2.90 psychological barrier was confirmed by a 4.8 million unit volume burst, taking the session to its highs before settling around $2.9045.

• Resistance is clustered between $2.92 and $2.93, where price repeatedly stalled on higher volume. This zone marks the next hurdle for continuation, with breakout confirmation likely requiring a close above $2.93 on expanding participation.

• Support has consolidated between $2.85 and $2.86, where buyers consistently defended bids during retracements. Multiple successful retests of this band throughout the session highlight its importance as an accumulation zone.

• The $2.90 psychological level has shifted into a near-term pivot. Price reclaimed it in the late session, and traders will monitor whether this can hold as support heading into the weekend.

• Volatility over the 24-hour window reached 3.47%, consistent with elevated institutional repositioning around key regulatory catalysts.

• Whether XRP can sustain closes above $2.90 and flip this into support, which would validate continuation attempts toward $3.00 and beyond.

• The SEC’s October–November ETF review window, with Grayscale’s October 18 date seen as the first major structural catalyst for institutional inflows.

• Whale wallet activity, with 120 million tokens accumulated over three days suggesting further upside if this pace continues.

• Broader macro conditions, with Treasury yield volatility and Fed policy signals influencing risk appetite across both equities and digital assets.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By Shaurya Malwa, CD Analytics

37 minutes ago

Trend bias remains constructive, and a potential golden-cross setup is being monitored if shorter moving averages curl higher.

What to know:

DOGE attempted to break above $0.24 but faced resistance, settling back to $0.23 by session end.

Whale net outflows of approximately 40M DOGE contributed to the resistance at $0.24, despite heavy trading volume.

DOGE remains above its 200-day moving average, with traders watching for a potential golden-cross setup if shorter moving averages rise.