-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By CD Analytics, Helene Braun|Edited by Cheyenne Ligon

Oct 2, 2025, 1:50 p.m.

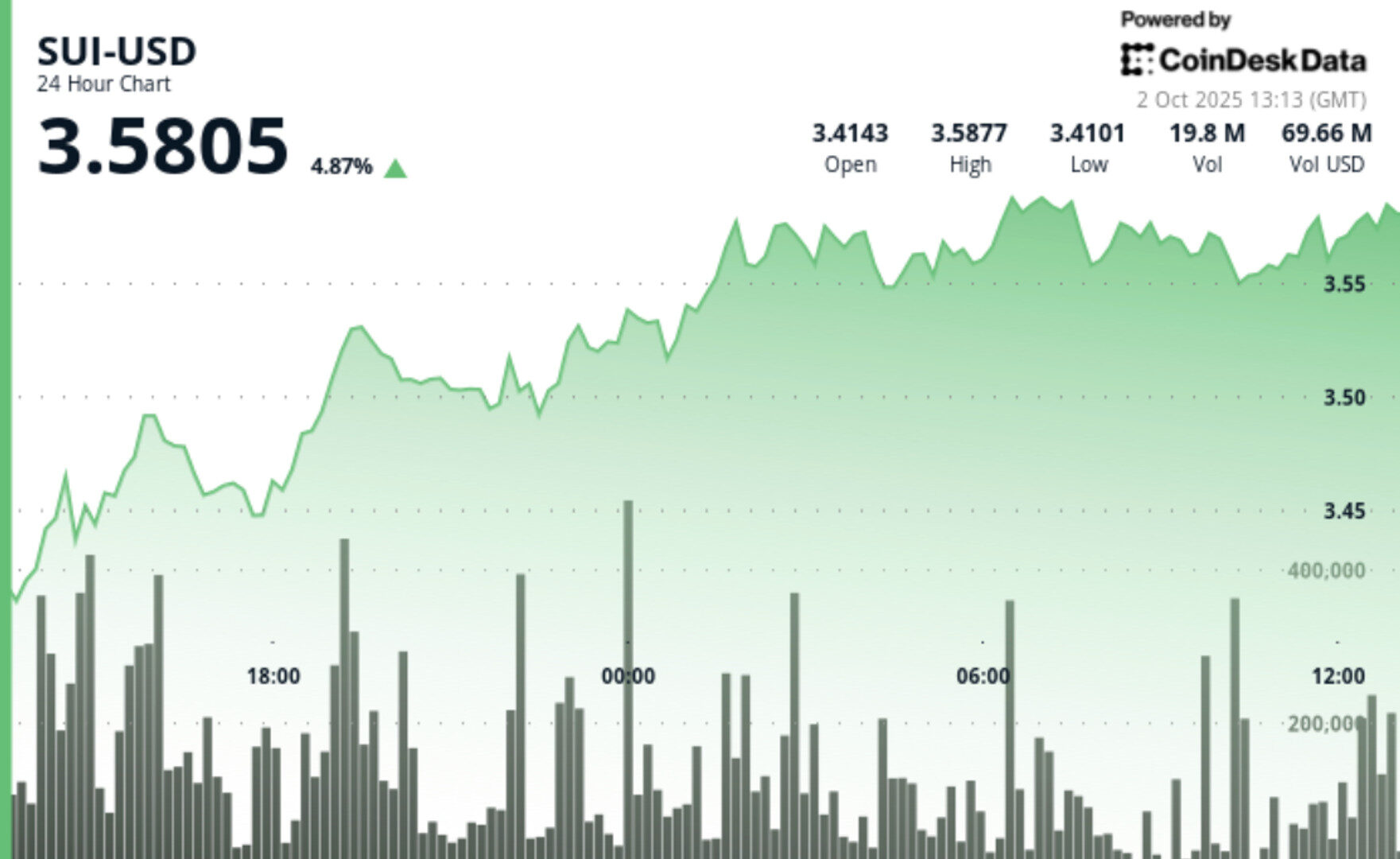

- SUI rose 5% after the Sui blockchain said it will launch its first native stablecoins, USDi and suiUSDe.

- The token is outperforming the broader crypto market, which is up 2.5% over the past 24 hours according to the CoinDesk 20 Index.

- Technical analysis shows strong buying momentum driven by institutional interest and an integration with a South Korean payment platform.

SUI, the native token of the Sui blockchain, rose 5% on Wednesday after the project announced it would introduce its first native stablecoins, USDi and suiUSDe.

STORY CONTINUES BELOW

The announcement comes at a time when investors are showing renewed interest in SUI, which is now outperforming the broader crypto market. The CoinDesk 20 Index — a gauge of top digital assets — is up 2.5% over the same 24-hour period.

SUI climbed from $3.42 to $3.58 in the session, with technical signals showing clear bullish momentum. The token broke through key resistance at $3.56 and established new support at $3.55, backed by rising trading volume.

Driving the rally are signs of growing institutional adoption. Coinbase Derivatives plans to list SUI futures contracts on October 20, opening the door for more professional traders to take positions in the token.

Retail demand is also growing. In South Korea, t’order — a payments platform focused on the restaurant industry — recently integrated SUI to enable transactions using a Korean-won stablecoin. That move appears to have sparked a surge in volume, with activity spiking past daily averages during the early Asian trading hours.

From a technical standpoint, SUI has traded within a $0.19 range between $3.39 and $3.58. An early morning volume spike of 10.87 million tokens exceeded the 10.44 million daily average, suggesting heavy accumulation. The chart shows a series of higher lows — a classic signal of an uptrend.

If buying pressure continues, SUI could soon test the psychological $3.60 mark. For now, it’s one of the best-performing tokens in the market, drawing strength from both product development and deepening institutional ties.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By CD Analytics, Francisco Rodrigues|Edited by Cheyenne Ligon

46 minutes ago

BNB’s price action was also influenced by a reduction in gas fees and Kazakhstan’s state-backed Alem Crypto Fund naming BNB as its first investment asset.

What to know:

- BNB rallied 3.5% in 24 hours to top $1,050, tracking broader crypto market gains as expectations of a Federal Reserve rate cut increased following a weak ADP report.

- The token broke above key resistance levels, driven by volume exceeding the 24-hour average, and outpaced the wider market’s 2.25% gain.

- BNB’s price action was also influenced by token-specific catalysts, including a reduction in gas fees and Kazakhstan’s state-backed Alem Crypto Fund naming BNB as its first investment asset.