By James Van Straten|Edited by Sheldon Reback

Oct 3, 2025, 9:46 a.m.

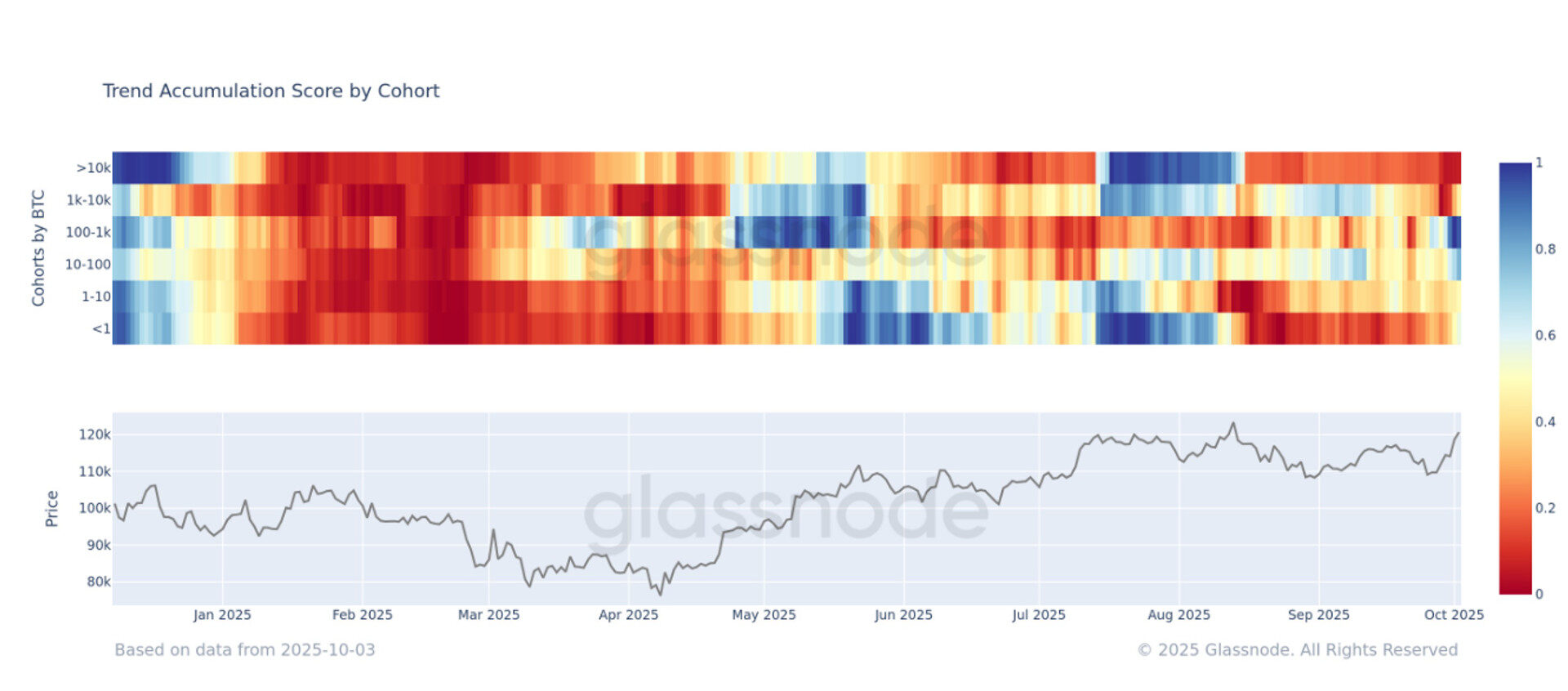

- The aggregate Accumulation Trend Score climbed to 0.62, its first sustained reading above 0.5 since August, reinforcing that demand is again outweighing supply.

- Mid-sized wallets (10–1,000 BTC) are firmly in accumulation mode and retail traders are gradually joining in while whales remain the main source of selling pressure.

- Bitcoin gained roughly 8% during U.S. market hours this week, underscoring renewed bullish sentiment from American participants.

Bitcoin BTC$120,358.66 has risen 10% this week as several groups of wallet holders switch from distribution to accumulation for the first time since August. The largest cryptocurrency rose above $121,000 on Thursday, the highest since it hit a record on Aug. 14, CoinDesk data shows.

The Accumulation Trend Score, which measures the relative strength of accumulation or distribution over a 15-day period, has increased to 0.62, according to Glassnode data.

STORY CONTINUES BELOW

This value is above the neutral threshold of 0.5, signaling that on aggregate, market participants are looking to buy rather than sell. A reading closer to 1 indicates stronger accumulation, while a reading closer to 0 suggests distribution.

Broken down by cohort, wallets holding between 100 and 1,000 BTC have swung sharply into accumulation after distributing coins just last week. Those holding between 10 and 100 BTC are also beginning to accumulate again. Retail participants, who hold less than 10 BTC, have considerably slowed their selling and are beginning to show signs of buying activity.

On the other hand, large whales with balances above 10,000 BTC remain heavily into distribution, extending a trend that has persisted since August.

Alongside these shifts in wallet behavior, a notable bullish trading pattern has emerged in U.S. markets. From Monday through Thursday, bitcoin has consistently gained during U.S. trading hours, rising about 8% during these sessions alone, according to Velo data.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By Oliver Knight, Jacob Joseph|Edited by Sheldon Reback

23 minutes ago

Bitcoin’s battle with $120,000 could set the stage for fresh record highs, as derivatives data shows signs of both bullish conviction and concentrated risk, while altcoins outperform.

What to know:

- Futures open interest remains above $32 billion, with basis rates near 8%, but funding divergences across exchanges suggest pockets of aggressive long exposure.

- Put-call volumes and delta skews signal a moderation of bullish sentiment, pointing to a more balanced and cautious positioning among options traders.

- With BTC holding its ground, tokens like ETH, SOL, and smaller caps such as ETHFI and CAKE rallied strongly, though select names like MYX took steep losses.