On-chain flows show large holders adding 30M tokens (approximately $8M), suggesting accumulation remains intact even as resistance caps upside momentum.

By Shaurya Malwa, CD Analytics

Updated Oct 9, 2025, 5:18 a.m. Published Oct 9, 2025, 5:18 a.m.

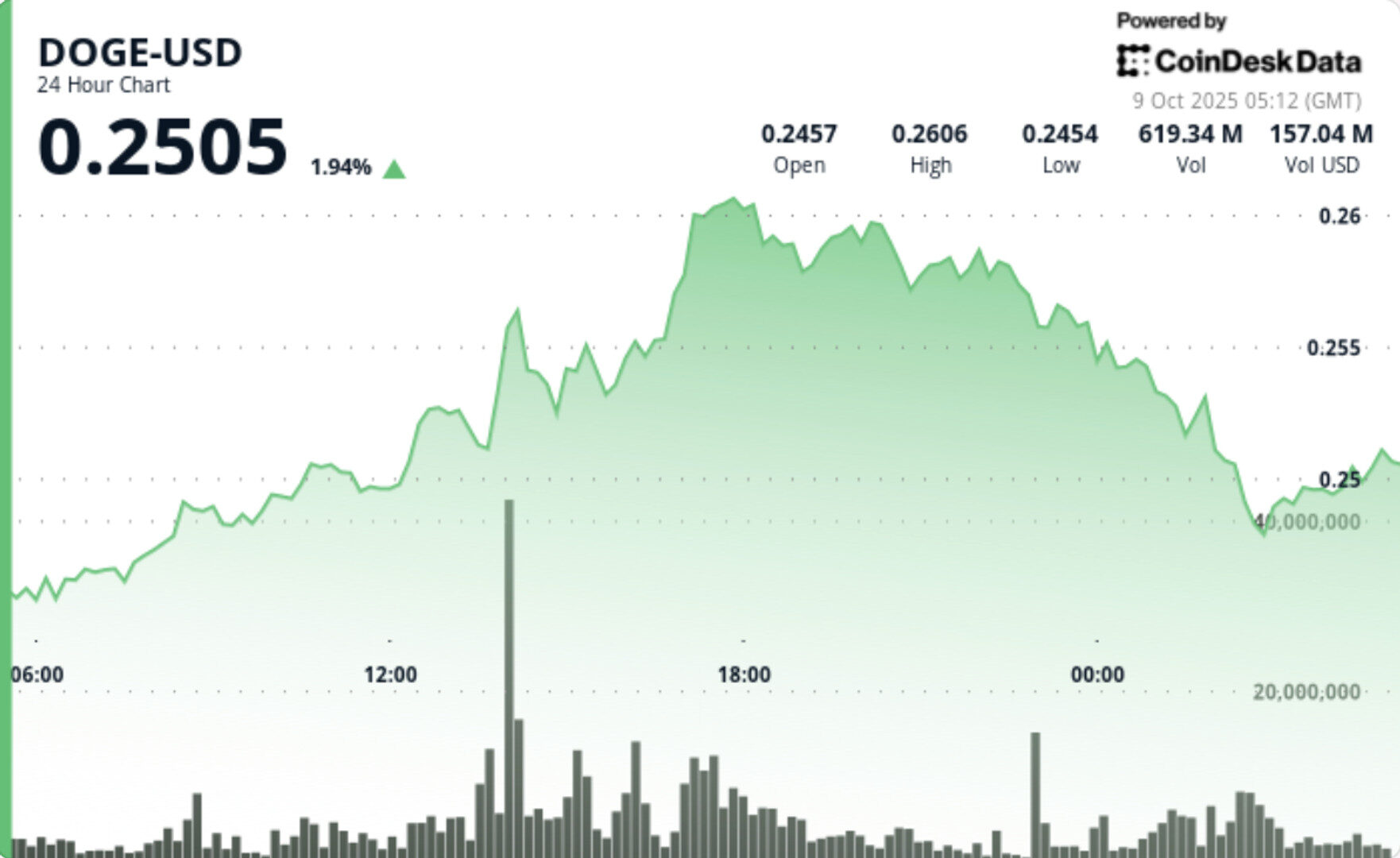

- Dogecoin failed to maintain above $0.26, leading to significant institutional profit-taking.

- Large holders added 30 million DOGE, indicating ongoing accumulation despite resistance.

- Traders are watching for a recovery above $0.25 and a potential break through $0.26.

Dogecoin failed to sustain above $0.26, triggering heavy institutional profit-taking that dragged price back toward $0.25.

Despite the short-term retreat, on-chain flows show large holders adding 30M tokens (approximately $8M), suggesting accumulation remains intact even as resistance caps upside momentum.

DOGE traded a 6% range between $0.24 and $0.26 in the 24 hours to Oct. 9. The token rallied into $0.26 during the afternoon session but met strong institutional selling pressure. Whale addresses added more than 30M DOGE, reinforcing longer-term positioning despite near-term weakness. Analysts highlighted parallels to prior historical cycles where key resistance breaks have unlocked exponential upside, with $0.41 flagged as a critical longer-term trigger.

STORY CONTINUES BELOW

- DOGE spiked from $0.25 to $0.26 around 17:00 on 750M turnover — double the daily average.

- Heavy profit-taking at $0.26 reversed gains, pulling price back to $0.25 by session close.

- Late trading saw a breakdown below $0.25 as liquidation flows hit, with a 14.6M surge at 02:01 confirming distribution.

- DOGE closed at $0.25, down ~2% from intraday highs.

Resistance is reinforced at $0.26 after repeated rejections on elevated volume. Support at $0.25 failed late in the session under liquidation flows, raising near-term downside risk. Still, accumulation patterns — with 30M DOGE added by large wallets — point to institutional confidence in the broader structure. A sustained reclaim of $0.26 would open the path toward $0.27–$0.30, while $0.24 is now the near-term floor to watch.

- Whether DOGE can quickly regain $0.25 support after the liquidation flush.

- If whale accumulation continues to offset distribution at resistance.

- A clean break through $0.26 to reestablish upside momentum.

- Longer-term watch: $0.41 resistance, tied to historic breakout cycles.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By Omkar Godbole, AI Boost|Edited by Sam Reynolds

18 minutes ago

Arthur Hayes argues that Bitcoin’s traditional four-year market cycle has ended, as current shifts in global monetary policy indicate expanding fiat liquidity.

What to know:

- Arthur Hayes argues that bitcoin’s traditional four-year market cycle is no longer valid.

- Current shifts in global monetary policy indicate expanding fiat liquidity, he said.

- Previous bear markets were catalyzed by monetary tightening across the advanced world.