By CD Analytics, Will Canny|Edited by Nikhilesh De

Oct 9, 2025, 7:06 p.m.

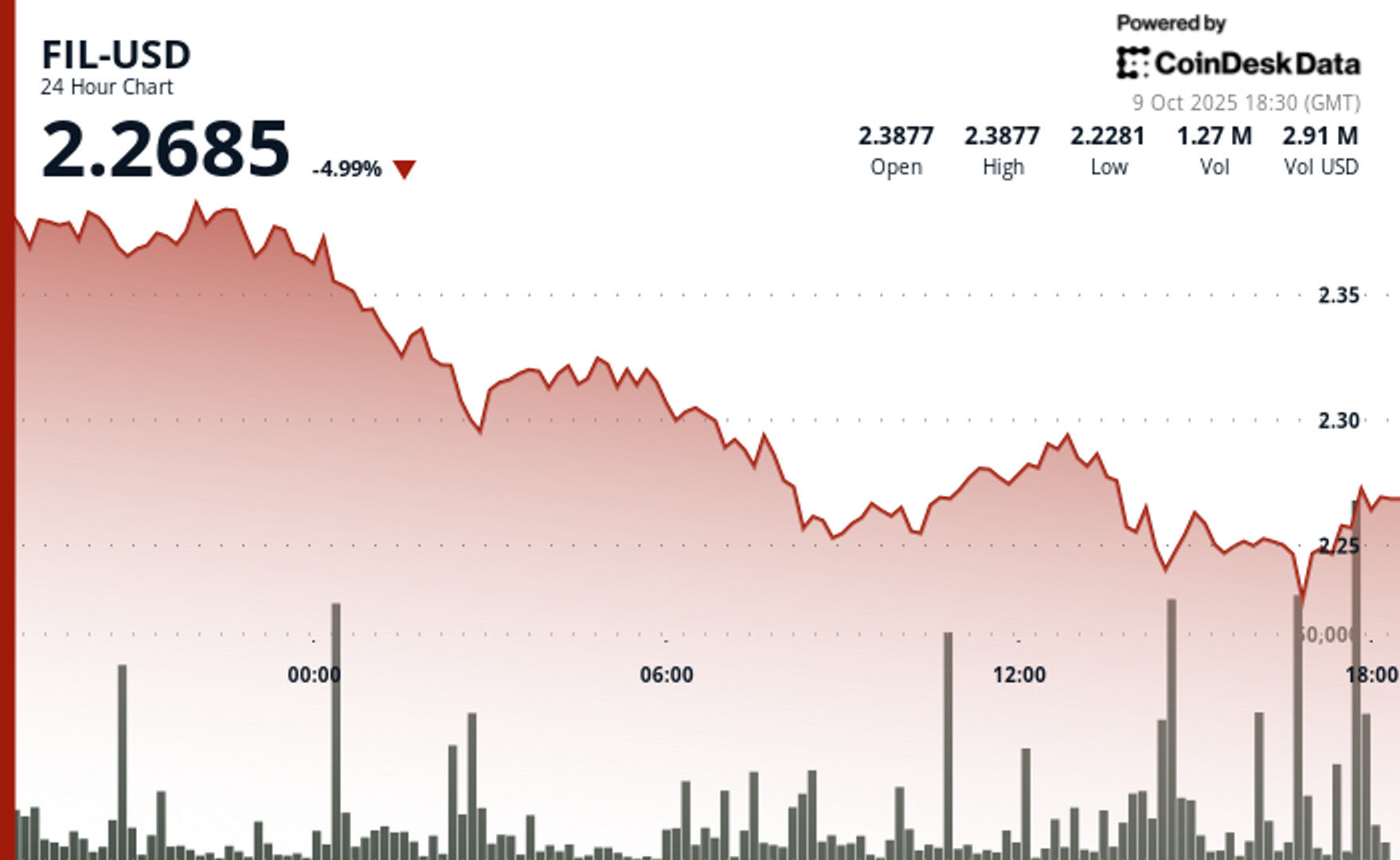

- Filecoin fell as much as 7% amid a wider decline in crypto markets on Thursday.

- The token has support at the $2.23 level and resistance at $2.41.

FIL$2.2679 fell as much as 7% in the last 24 hours, tumbling from $2.39 to $2.23, according to CoinDesk Research’s technical analysis model.

The model showed that the token posted a $0.19 range representing 7.9% volatility.

STORY CONTINUES BELOW

Sellers dominated at the $2.41 resistance level as transaction volume exploded to 5.92 million tokens traded, crushing the 3.42 million daily average. Bulls defended $2.23 support, with volume spiking above 4.8 million, according to the model.

Classic capitulation patterns emerged as selling exhaustion signaled potential base formation above critical $2.23 floor, the model said.

In recent trading, Filecoin was 5.1% lower, around $2.26.

The wider crypto market also declined, with the broad market gauge, the CoinDesk 20, down 3.6%.

- Sellers defended the $2.41 resistance level, triggering a massive volume surge and price rejection.

- Bulls mounted defense at $2.23 support during multiple intraday tests and volume spikes.

- Trading activity exploded past 5.92 million during peak selling, well above the 3.42 million baseline average.

- Textbook capitulation emerges with violent selloff followed by immediate relief bounce pattern.

- Volatility compression and price stabilization suggest seller exhaustion may be approaching critical levels.

- Fresh consolidation zone forms around $2.25 following dramatic recovery from intraday massacre.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By CD Analytics, Krisztian Sandor|Edited by Nikhilesh De

1 hour ago

High-volume selling drove the DeFi bluechip token below critical technical thresholds.

What to know:

- Aave’s governance token, AAVE, dipped below $270 amid significant selling pressure.

- The token fell 5% on Thursday, marking a nearly 10% decline from this week’s high.

- Technical analysis indicates bearish momentum, with failed recovery attempts confirming ongoing selling pressure.