By CD Analytics, Krisztian Sandor|Edited by Nikhilesh De

Oct 9, 2025, 6:43 p.m.

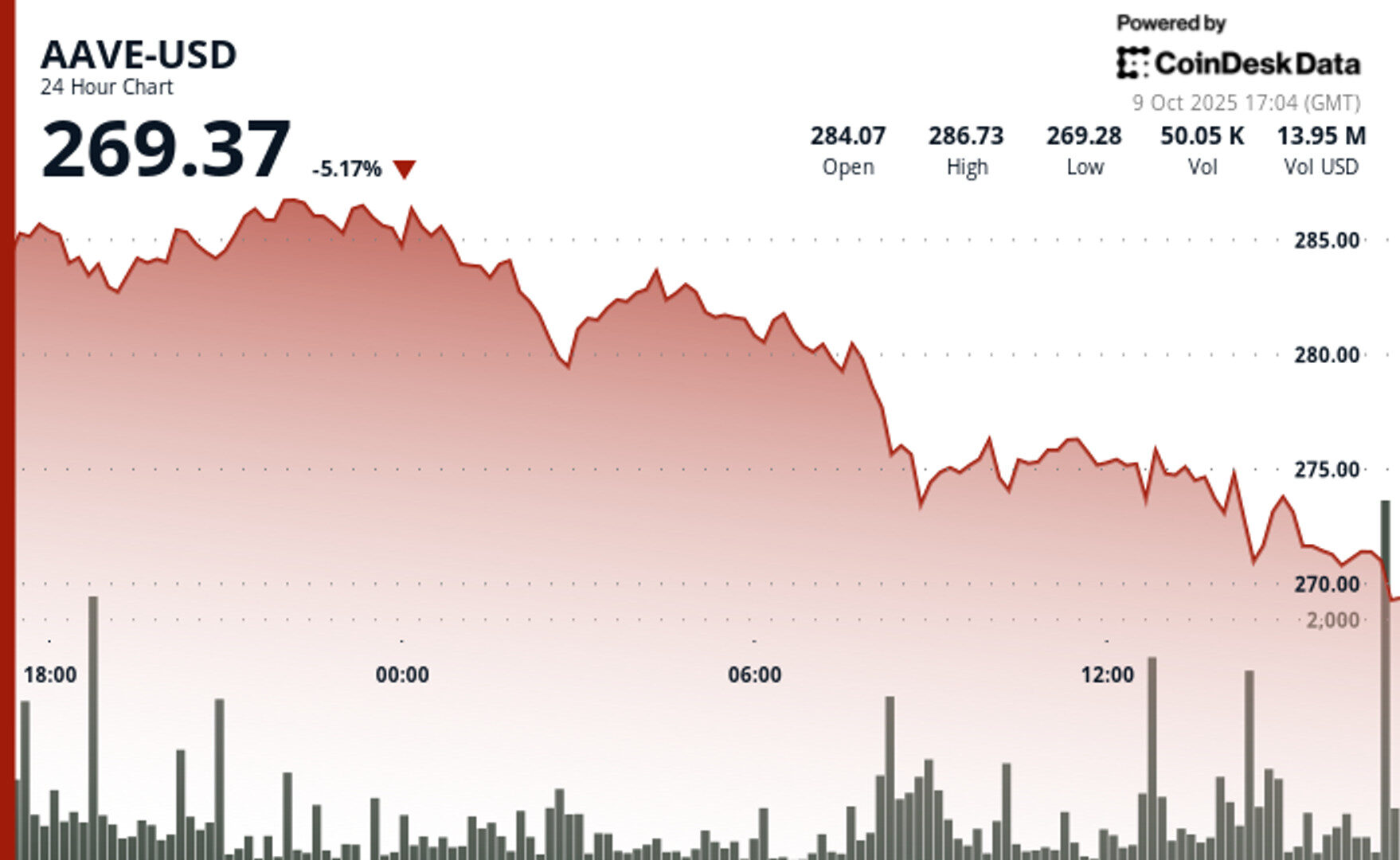

- Aave’s governance token, AAVE, dipped below $270 amid significant selling pressure.

- The token fell 5% on Thursday, marking a nearly 10% decline from this week’s high.

- Technical analysis indicates bearish momentum, with failed recovery attempts confirming ongoing selling pressure.

The governance token of the prominent decentralized lending protocol Aave AAVE$272.83 has faced substantial selling pressure through the past 24 hours, dipping briefly below the $270 level.

The DeFi bluechip plunged 5% in the early Thursday session, sliding nearly 10% lower since this week’s high. It has modestly recovered later in the day U.S. hours, changing hands at around $272.

STORY CONTINUES BELOW

The price action occurred amid a weak session for cryptocurrencies with bitcoin on the verge of breaking below $120,000. The broad market CoinDesk 20 Index was down more than 4% during the day.

The technical picture shows bearish momentum for the DeFi major, CoinDesk Research’s analysis model suggested.

Losing key support at $273 triggered a cascade of selling, accelerating the decline. Subsequent recovery attempts proved unsuccessful, with the failed rallies confirming sustained selling pressure, the model suggested.

- Trading volume spiked to 63,651 units, substantially exceeding 24-hour average of 31,013 units.

- Technical resistance established at $280.00 level.

- Breakdown below critical support at $273.00 triggered additional algorithmic liquidation.

- Multiple recovery attempts failed, indicating sustained selling pressure.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By CD Analytics, Will Canny|Edited by Nikhilesh De

22 minutes ago

The token has established support at $2.23 with resistance at the $2.41 level.

What to know:

- Filecoin fell as much as 7% amid a wider decline in crypto markets on Thursday.

- The token has support at the $2.23 level and resistance at $2.41.