Chainlink’s native token faced heightened volatility as trading volumes surged during a critical technical breakdown.

By CD Analytics, Krisztian Sandor|Edited by Nikhilesh De

Oct 9, 2025, 6:35 p.m.

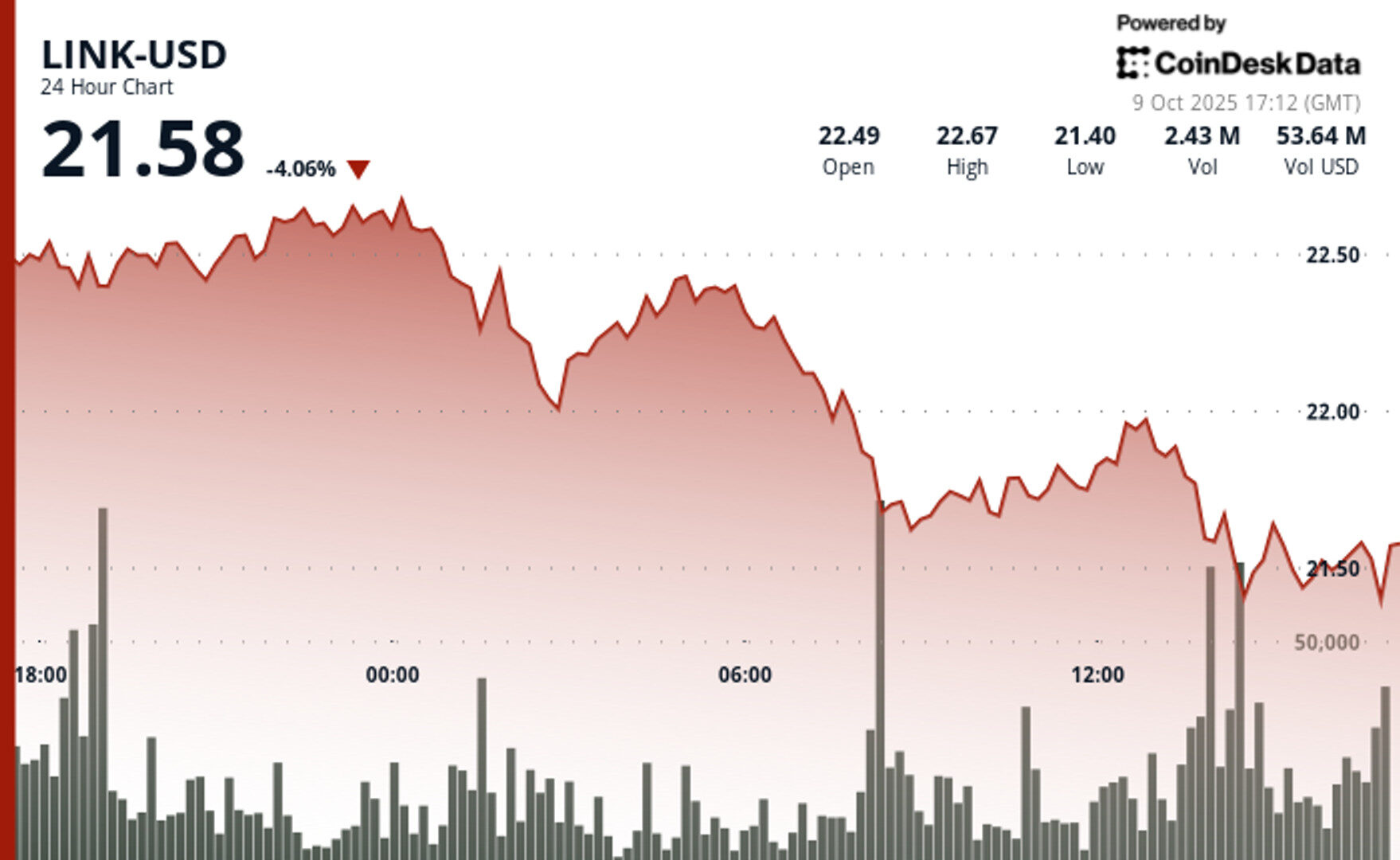

- Chainlink’s native token, LINK, fell 4% to its lowest price in over a week amid significant selling pressure.

- The Chainlink Reserve purchased another 45,729 LINK, but the token’s price drop left the reserve underwater with a cost basis of $22.44.

- Technical indicators show bearish momentum with resistance levels at $22.68 and $21.92, highlighting weakening investor sentiment.

The native token of oracle network Chainlink LINK$20.81 encountered substantial institutional selling pressure over the 24-hour trading session, tumbling to its weakest price in more than a week.

LINK tumbled 4% to a session low of $21.30, reversing over 8% from Monday’s local high, CoinDesk data shows. The decline happened in line with weakness in the broader crypto market. The CoinDesk 20 Index, a benchmark for that broader market market, was also down around the same amount.

STORY CONTINUES BELOW

Meanwhile, the Chainlink Reserve, a facility that purchases tokens on the open market using income from protocol integrations and services, kept its weekly habit, buying another 45,729 LINK worth nearly $1 million on Thursday. The reserve currently holds nearly $10 million worth of tokens.

Thursday’s decline, however, meant that the vehicle is now underwater with LINK trading below the average cost basis of $22.44, the dashboard shows.

CoinDesk Research’s technical model pointed out bearish momentum, underscoring the weakening investor sentiment.

- The token’s trading range expanded to $1.05, representing 5% volatility between the session low of $21.53 and peak of $22.68.

- Technical resistance materialized at the $22.68 level, where the token reversed course on exceptionally heavy volume of 1,981,247 units.

- Additional resistance formed at the $21.92 level.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By CD Analytics, Will Canny|Edited by Nikhilesh De

1 hour ago

The token has established support at $2.23 with resistance at the $2.41 level.

What to know:

- Filecoin fell as much as 7% amid a wider decline in crypto markets on Thursday.

- The token has support at the $2.23 level and resistance at $2.41.