Traders are closely watching whether the $2.78 support level holds and how leverage unwinds might affect price volatility.

By Shaurya Malwa, CD Analytics

Updated Oct 10, 2025, 6:17 a.m. Published Oct 10, 2025, 6:17 a.m.

- XRP traded in a narrow range between $2.78 and $2.85, with institutional selling and rising leverage posing risks.

- Exchange reserves reached nine-month highs as 440 million tokens were distributed over 30 days.

- Traders are closely watching whether the $2.78 support level holds and how leverage unwinds might affect price volatility.

XRP chopped in a narrow $2.78–$2.85 band, masking heavy institutional selling and rising leverage risks. Exchange reserves climbed to nine-month highs on 440M tokens distributed over 30 days, while futures open interest swelled near $9B.

Bulls continue to defend the $2.78 floor, but distribution patterns cap upside momentum.

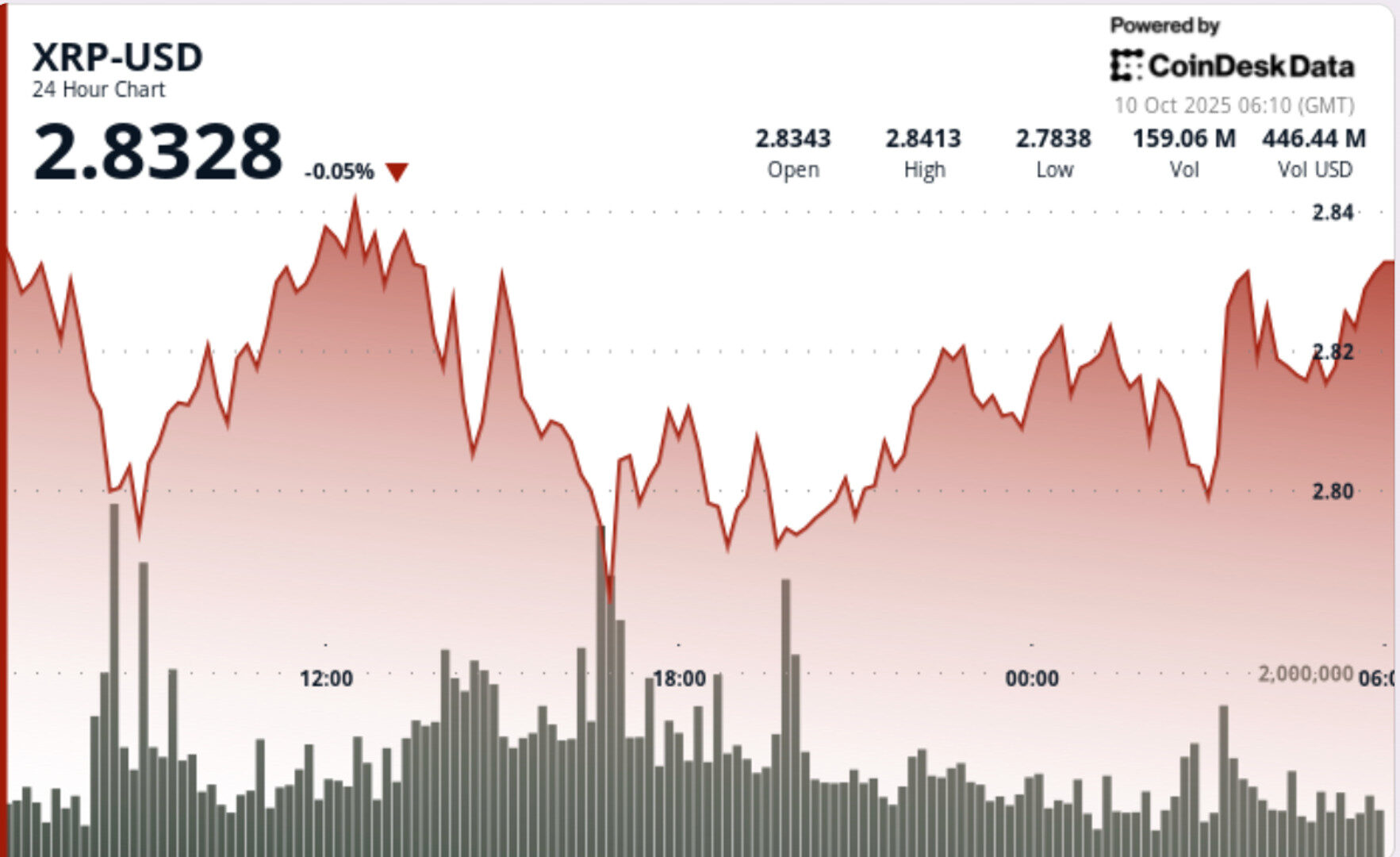

XRP traded flat to lower in the 24 hours to Oct. 10, opening near $2.83 and closing at $2.82. The token briefly rallied to $2.85 before rejection, with volumes spiking above 123M at 08:00 — double the daily average — confirming institutional activity at key levels. The session came as traders positioned ahead of macro catalysts, with Fed policy and regulatory clarity continuing to shape sentiment.

STORY CONTINUES BELOW

- XRP oscillated between $2.79 and $2.85, a 2% corridor.

- Resistance held firm at $2.85, with rejection in the 12:00 hour.

- Support persisted at $2.78, repeatedly defended on high volume.

- Late session saw a drift from $2.83 to $2.82, with 1.6M prints confirming continued distribution.

- Final bars showed waning volume, hinting at selling exhaustion near $2.82.

The $2.85 zone has hardened into supply after multiple rejections, while $2.78 remains the key support pivot. Exchange inflows and distribution from large holders reinforce near-term downside risk, particularly as leverage builds with futures OI approaching $9B.

Still, repeated defenses of $2.78 signal institutional accumulation at the base. A break above $2.85 could reopen $2.90–$3.00, while a slip through $2.78 risks accelerating toward $2.72.

- Whether $2.78 continues to hold as the structural floor.

- If leverage positioning unwinds, adding volatility to the $3.00 retest attempt.

- Ongoing whale distribution versus signs of dip accumulation.

- ETF and Fed catalysts as drivers of the next breakout from the $2.78–$2.85 range.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

9 minutes ago

The OG whale reportedly sold BTC in the spot market earlier this week.

What to know:

- An OG whale has raised a short BTC bet worth millions.

- Early this week, the whale sold BTC in the spot market.

- BTC’s price has bounced from overnight lows under $120,000.