The rebound printed one of the year’s heaviest sessions, confirming aggressive dip-buying as traders reposition ahead of fresh macro headlines.

By Shaurya Malwa, CD Analytics

Updated Oct 13, 2025, 5:29 a.m. Published Oct 13, 2025, 5:29 a.m.

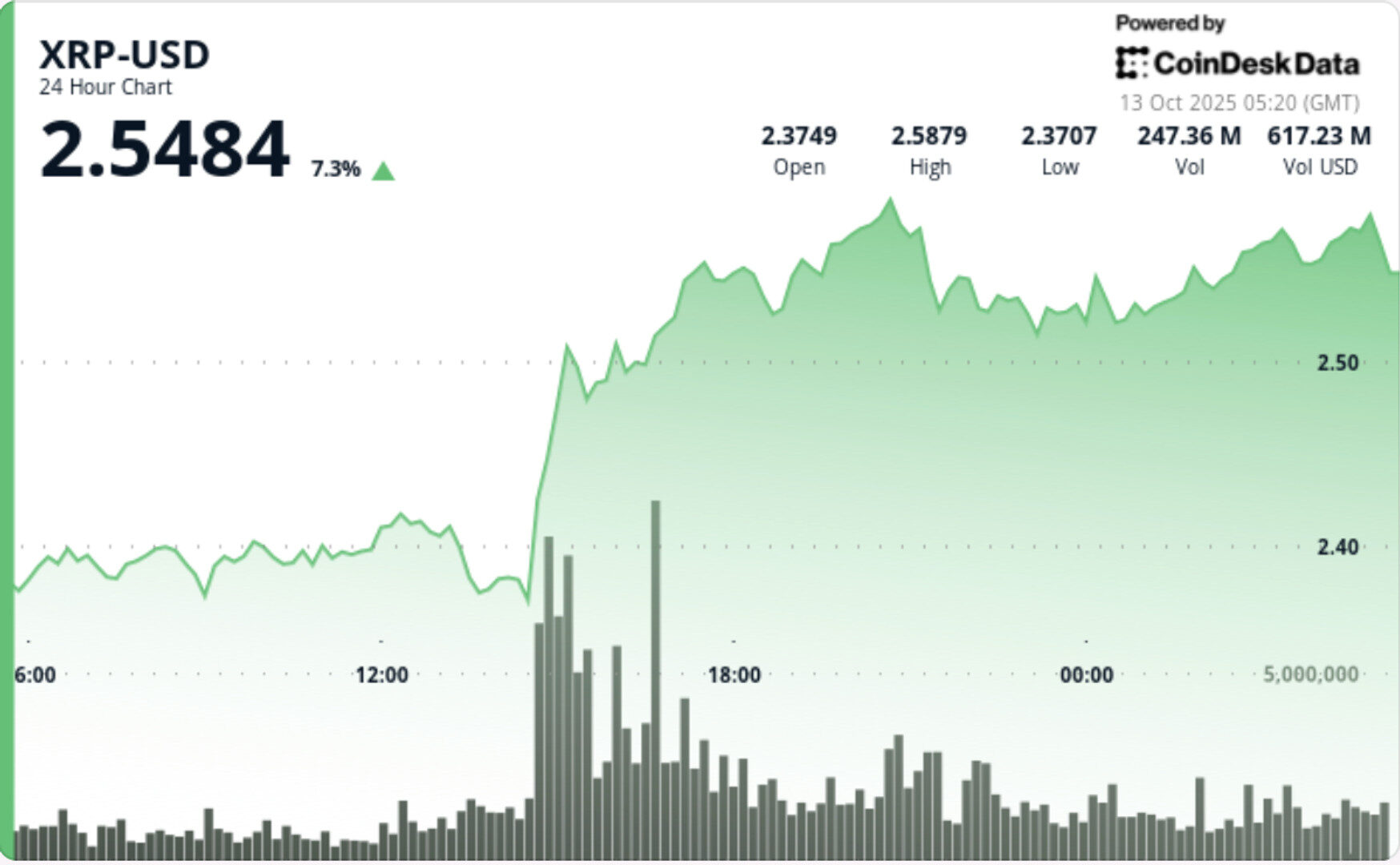

- XRP rebounded significantly, recovering $30 billion in market value after a tariff-driven collapse, with prices rising from $2.37 to $2.58.

- The recovery was fueled by explosive institutional volume, signaling aggressive dip-buying as traders anticipate new macroeconomic developments.

- Analysts are optimistic about XRP’s potential to close above $3.12, which would mark its strongest performance since inception.

XRP clawed back $30 billion in market value after last week’s tariff-driven collapse, ripping from $2.37 to $2.58 on explosive institutional volume. The rebound printed one of the year’s heaviest sessions, confirming aggressive dip-buying as traders reposition ahead of fresh macro headlines.

The recovery follows a 50 % wipe-out triggered by President Trump’s 100 % China-tariff declaration, which wiped $19 billion in crypto liquidations in minutes. Renewed buying has since restored confidence, with analysts eyeing a potential record weekly close above $3.12 that would mark XRP’s strongest candle since inception. Broader markets remain risk-off—Dow –900, Nasdaq –820—but crypto desks flagged selective institutional inflows into XRP.

STORY CONTINUES BELOW

- XRP jumped 8.5 % between Oct 12 05:00 and Oct 13 04:00, trading a $0.22 (9 %) range $2.37–$2.59.

- Breakout bursts hit during 14:00–17:00 as volumes spiked to 276.8 M—over 2× daily average (118 M).

- Support confirmed at $2.37 with high-volume reversals; resistance formed near $2.59.

- Late-session push through $2.57 closed at $2.58 on 2.3 M turnover, validating continuation.

Structure now shows a clean ascending channel: $2.37 base, $2.59 lid. Sustained closes above $2.59 could open $2.70–$2.75, while failure to defend $2.50 risks retrace toward $2.42. Momentum remains bullish with institutional prints leading each breakout leg. Analysts highlight the breakout above $2.57 as confirmation of a near-term trend reversal; continued volume support keeps upside bias intact.

- Whether $2.57 holds as the new support pivot.

- Break above $2.59 to target $2.70–$2.75; stretch goal $3.00+.

- Trade-war headlines and Fed rhetoric driving cross-asset risk appetite.

- ETF speculation and institutional flows sustaining post-crash recovery.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By Sam Reynolds|Edited by Omkar Godbole

1 hour ago

Arkham data shows bitcoin miner Marathon bought 400 BTC through its custodian Anchorage Digital as prices plunged, with fresh FalconX inflows hinting at continued institutional accumulation.

What to know:

- Marathon Digital Holdings increased its bitcoin holdings by purchasing an additional 400 BTC valued at approximately $45.9 million.

- Bitcoin experienced a significant drop of nearly 13% due to U.S.–China tariff tensions, but has since recovered slightly.

- Analysts warn that bitcoin’s inability to maintain gains above key resistance levels may lead to a retest of $100,000.