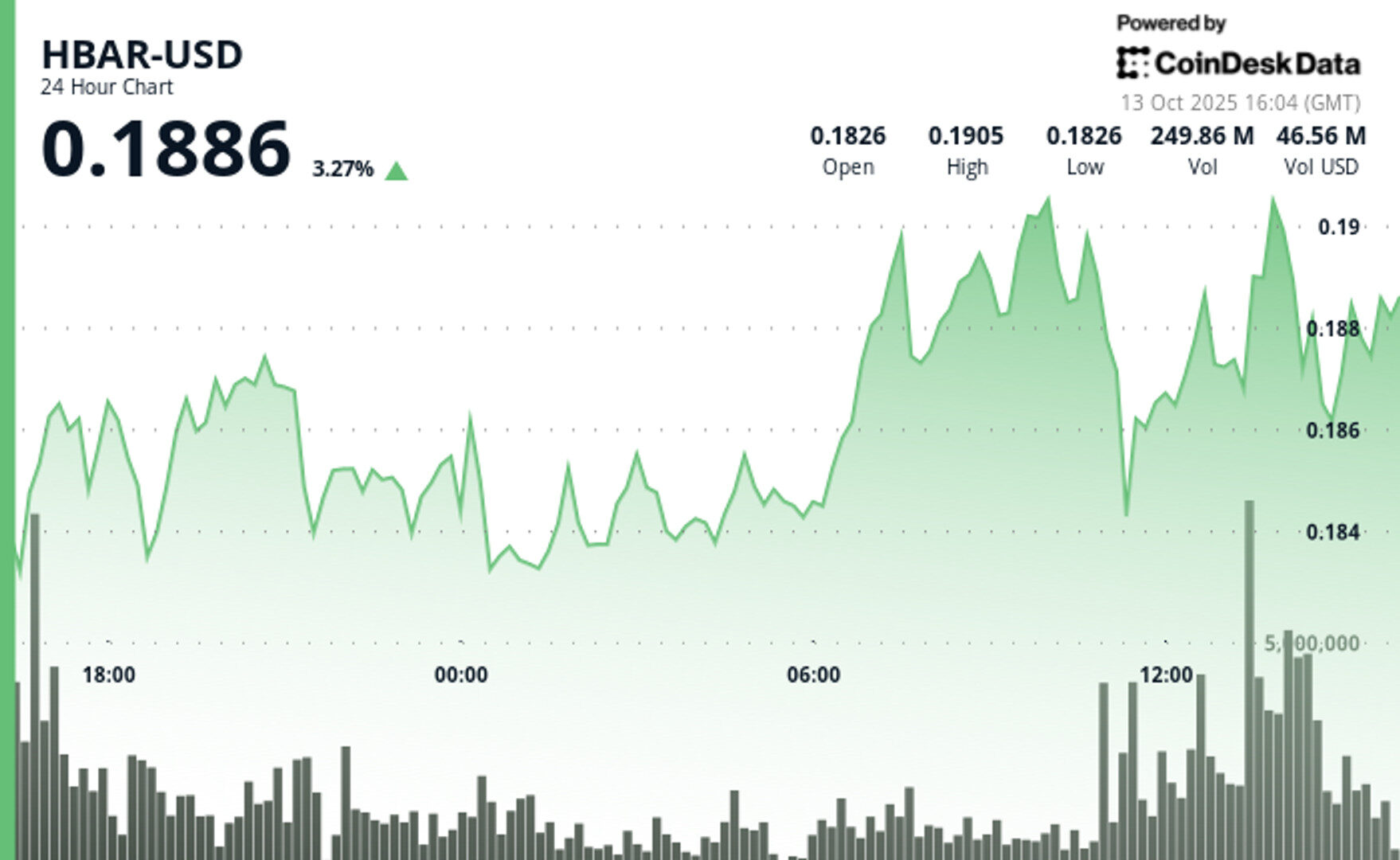

HBAR surged past key resistance at $0.19 amid a dramatic volume spike, signaling renewed institutional interest and reinforcing bullish momentum after a 9% recovery stretch.

By CD Analytics, Oliver Knight

Updated Oct 13, 2025, 4:11 p.m. Published Oct 13, 2025, 4:11 p.m.

- Trading activity spiked to 15.65 million units at 13:31 on Oct. 13, driving a breakout above the $0.19 resistance zone.

- Consecutive high-volume intervals suggest strong institutional engagement and sustained accumulation.

- HBAR maintained support above $0.189, capping a 23-hour, 9% rally between $0.17 and $0.19, setting the stage for potential continued upside.

HBAR (Hedera Hashgraph) experienced pronounced volatility in the final hour of trading on Oct. 13, soaring from $0.187 to a peak of $0.191—a 2.14% intraday gain—before consolidating around $0.190.

The move was driven by a dramatic surge in trading activity, with a standout 15.65 million tokens exchanged at 13:31, signaling strong institutional participation. This decisive volume breakout propelled the asset beyond its prior resistance range of $0.190–$0.191, establishing a new technical footing amid bullish momentum.

STORY CONTINUES BELOW

The surge capped a broader 23-hour rally from Oct. 12 to 13, during which HBAR advanced roughly 9% within a $0.17–$0.19 bandwidth. This sustained upward trajectory was characterized by consistent volume inflows and a firm recovery from earlier lows near $0.17, underscoring robust market conviction. The asset’s ability to preserve support above $0.18 throughout the period reinforced confidence among traders eyeing continued bullish action.

Strong institutional engagement was evident as consecutive high-volume intervals extended through the breakout window, suggesting renewed accumulation and positioning for potential continuation. HBAR’s price structure now shows resilient support around $0.189–$0.190, signaling the possibility of further upside if momentum persists and broader market conditions remain favorable.

- HBAR operated within a $0.017 bandwidth (9%) spanning $0.174 and $0.191 throughout the previous 23-hour period from 12 October 15:00 to 13 October 14:00.

- Substantial volume surges reaching 179.54 million and 182.77 million during 11:00 and 13:00 sessions on 13 October validated positive market sentiment.

- Critical resistance materialized at $0.190-$0.191 thresholds where price movements encountered persistent selling activity.

- The $0.183-$0.184 territory established dependable support through volume-supported bounces.

- Extraordinary volume explosion at 13:31 registering 15.65 million units signaled decisive breakout event.

- High-volume intervals surpassing 10 million units through 13:35 substantiated significant institutional engagement.

- Asset preserved support above $0.189 despite moderate profit-taking activity.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By CD Analytics, Oliver Knight

19 minutes ago

Stellar posts dramatic intraday recovery from $0.33 support to $0.35 resistance as institutional money flows in.

What to know:

- XLM posts 6% daily gains — Stellar’s token closed at $0.35 after trading between $0.33 and $0.35, showing renewed bullish momentum.

- Institutional accumulation spotted — A three-minute rally from $0.34 to $0.35 on heavy volume signals major buyer interest.

- Macro sentiment improving — Analysts and veteran traders, including Peter Brandt, view the October selloff as temporary, with crypto markets showing signs of resilience.