The token found strong demand near $0.20 as institutional flows persisted, even as broader markets reacted to shifting trade rhetoric and renewed regulatory scrutiny following House of Doge’s Nasdaq debut.

By Shaurya Malwa, CD Analytics

Updated Oct 14, 2025, 4:56 a.m. Published Oct 14, 2025, 4:56 a.m.

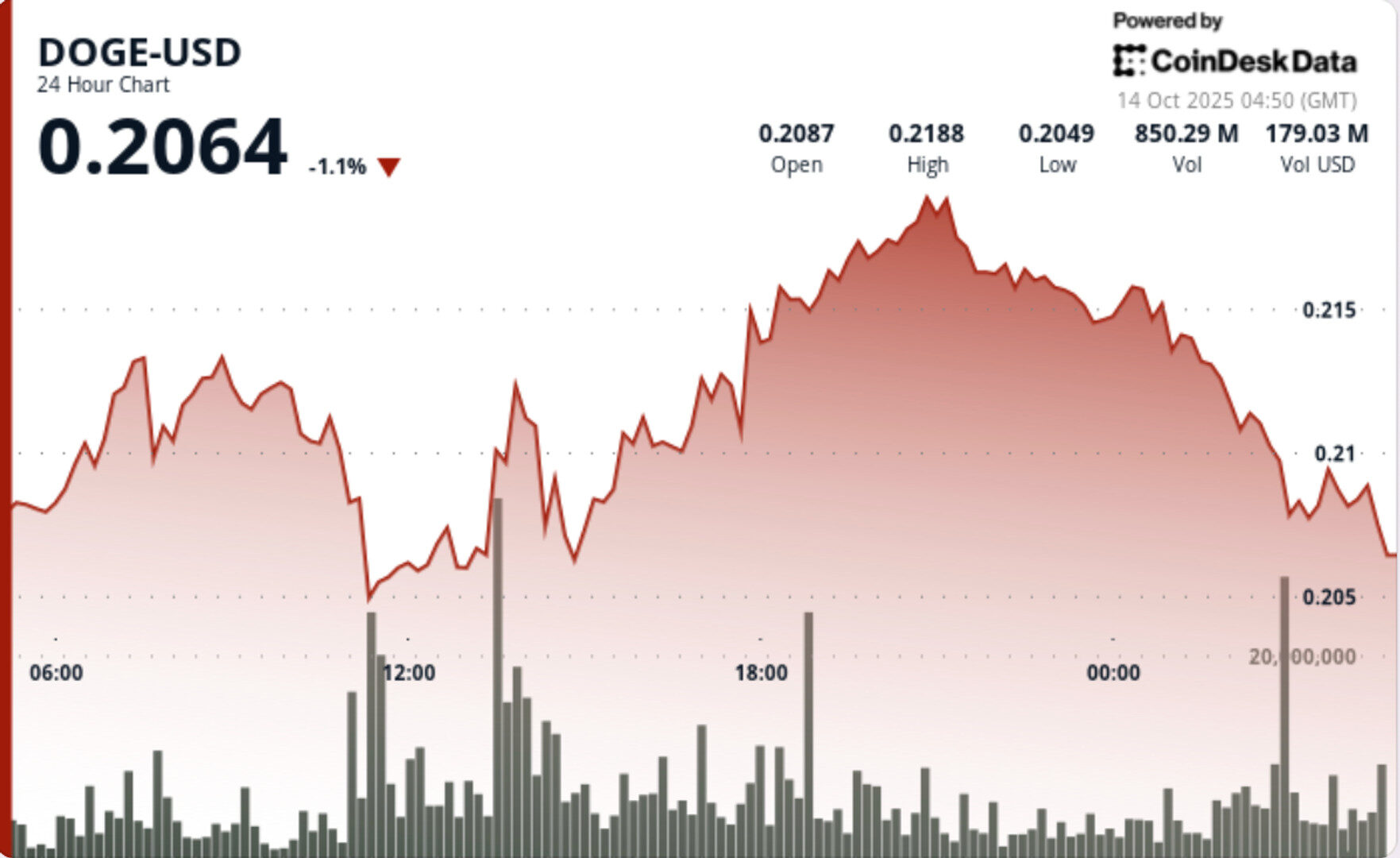

- Dogecoin fluctuated between $0.20 and $0.22, closing at $0.21 after failing to sustain a breakout above $0.22.

- Institutional buying near $0.20 suggests strong demand despite regulatory scrutiny following House of Doge’s Nasdaq debut.

- Traders are watching if DOGE can hold above $0.21 to target $0.23–$0.24 or risk falling back to $0.18.

Dogecoin traded volatile through the October 13–14 session, slipping 1% after failing to sustain a breakout above $0.22. The token found strong demand near $0.20 as institutional flows persisted, even as broader markets reacted to shifting trade rhetoric and renewed regulatory scrutiny following House of Doge’s Nasdaq debut.

Markets steadied after the Trump administration softened its tone on China tariffs, triggering a partial rebound in risk assets. DOGE bounced from $0.18 lows earlier in the week to test $0.22 resistance before profit-taking emerged. The listing of House of Doge — the meme coin’s affiliated entity — via reverse merger on Nasdaq has amplified corporate exposure to digital assets, but also raised regulatory compliance challenges for institutional investors.

STORY CONTINUES BELOW

“The participation patterns we’re seeing — strong morning sell volume and disciplined evening accumulation — are hallmarks of active institutional management,” said a senior strategist at a digital asset trading desk. “Treasury teams are hedging volatility but not exiting positions.”

- DOGE fluctuated between $0.20–$0.22 from Oct. 13 03:00 to Oct. 14 02:00, closing at $0.21.

- Resistance capped at $0.22 after a 21:00 rejection on above-average volume.

- Heavy institutional buying appeared near $0.20 during 11:00 session with 1.52 B tokens traded.

- A liquidation burst at 01:54 drove $0.21 breach on 39.6 M volume as algo selling triggered stops.

- Session stabilized around $0.21 with consistent accumulation into close.

DOGE continues to oscillate within a $0.20–$0.22 band, consolidating recent 11% gains. Support remains well-defined at $0.20 with multiple high-volume rebounds. The $0.22 ceiling has now been tested three times without sustained follow-through, forming a near-term pivot for momentum traders.

Volume concentration at $0.21 indicates institutional inventory building rather than panic distribution. Should price hold above $0.21 through the next session, upside targets re-emerge toward $0.23–$0.24; failure to defend $0.20 risks a retrace toward $0.18.

- Whether DOGE can reclaim and hold $0.22 to confirm continuation toward $0.24.

- Signs of renewed whale inflows after 1.5 B tokens accumulated near $0.20 support.

- Corporate and regulatory headlines tied to House of Doge’s listing.

- Broader meme-coin sentiment as XRP and SHIB trade flat on declining volume.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By Shaurya Malwa, CD Analytics

6 minutes ago

raders are monitoring the $2.55 support and $2.65–$2.66 resistance zones for potential market shifts.

What to know:

- XRP faced selling pressure near $2.66 as a large transfer to Binance signaled short-term distribution.

- Institutional buying defended the $2.55 support level amid increased trading volume.

- Traders are monitoring the $2.55 support and $2.65–$2.66 resistance zones for potential market shifts.