Ark Invest has reportedly taken a 11.5% Solmate (SLMT) stake while the company said it bought $50 million discounted SOL from Solana Foundation.

By Siamak Masnavi, CD Analytics|Edited by Aoyon Ashraf

Oct 14, 2025, 4:26 p.m.

- Solmate (SLMT) says a Schedule 13G filing shows ARK Invest owns approximately 11.5% of the shares as of Sept. 30, 2025.

- The company also says it bought $50 million worth of SOL from the Solana Foundation at a 15% discount.

Solmate Infrastructure (Nasdaq: SLMT) disclosed in a press release issued earlier today that it had purchased $50 million of SOL directly from the Solana Foundation at a 15% discount to market.

The company said the tokens will be used to power bare-metal validators in Abu Dhabi, UAE as part of the Foundation’s “Solana By Design” program, and that the Foundation negotiated the right to nominate up to two directors to Solmate’s board. Solmate described the timing as a purchase “at market lows” during a major liquidation and framed the move as aligning its treasury with its infrastructure build-out.

STORY CONTINUES BELOW

The press release also noted that ARK Invest held roughly 11.5% of Solmate, as of Sept. 30, 2025, citing a Schedule 13G filing.

Solmate said ARK previously bought 6.5 million shares in an oversubscribed PIPE and disclosed subsequent purchases totaling about 780,000 shares, which the company characterized as continued conviction in its strategy.

Solmate is the rebranded, Solana-focused successor to Nasdaq-listed Brera Holdings, which is shifting from a multi-club football strategy to a digital asset treasury and infrastructure business centered on Solana.

Chief Executive Marco Santori said the firm “bought the dip” and called Solmate “brand new Solana infrastructure” for the UAE. He argued digital asset treasuries are “capital accumulation machines” and said the UAE is the “Capital of capital,” positioning Abu Dhabi as a base for validator performance.

Solmate said it will partner with RockawayX on staking infrastructure and plans to stand up bare-metal validators in Abu Dhabi, with more initiatives to follow.

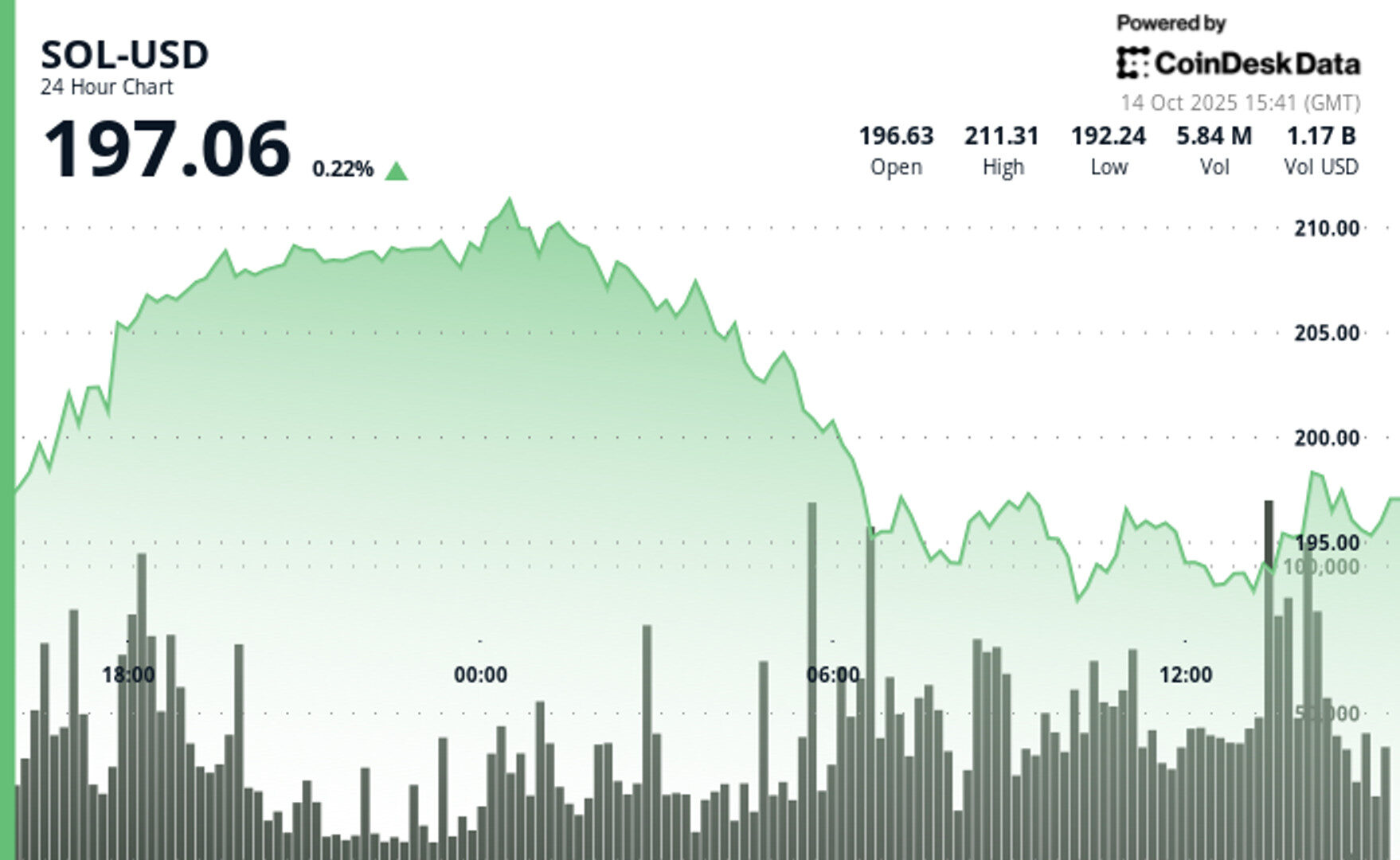

The analysis window runs from Oct. 13, 2025, 11:00 UTC to Oct. 14, 2025, 10:00 UTC. Below are the highlights:

- According to CoinDesk Research’s technical analysis data model, over that span, SOL traded between $191.42 and $209.45, roughly a 9% swing.

- Price advanced from about $192.79 and sliced through the $200.62 and $205.64 areas on heavier-than-usual trading, then momentum faded after 00:00 UTC on Oct. 14, with a slide from roughly $206.34 into the $193–$194 area where buyers reappeared.

- In the final hour, 09:41–10:40 UTC on Oct. 14, SOL bounced from $196.20 but couldn’t sustain the move, dipping to $191.46 at 10:35 UTC before settling around $192.43 by 10:40 UTC.

- Taken together, the tape shows support forming near $193–$194 with a deeper cushion around $191, and supply showing up near $205–$206 and again closer to $209–$211.

- Holding above the mid-$190s keeps the door open for a retest of $200 and then $205–$206; losing $193 would put $191 back in play.

As of Oct. 14, 2025, 15:31 UTC, SOL was $197.06, up 0.22% over 24 hours.

Today’s session printed a high at $211.31 and a low at $192.24. The early rejection near $211.00 was followed by a drift lower and stabilization around $196–$198.

In practical terms, $195.00 is the near-term pivot for buyers; holding above that level leaves room to probe $200.00 and, if reclaimed on UTC closes, $205.00–$206.00 where sellers were active in the research window.

A decisive push through $206.00 on UTC closes would put $209.00–$211.00 back in view. On the downside, a break below $195.00 would likely invite a check of $193.00–$194.00; if that area gives way, the late-window cushion around $191.00 becomes the next reference.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By CD Analytics, Francisco Rodrigues|Edited by Stephen Alpher

3 hours ago

Trading volume has surged, reflecting increased volatility, and technical analysis suggests bearish signals that could extend the recent downturn

What to know:

- PEPE has nearly 5% in the past 24 hours and nearly a quarter of its value in the past week.

- Trading volume has surged, reflecting increased volatility, and technical analysis suggests bearish signals that could extend the recent downturn, with PEPE already down 31% this year.

- Despite the bearish trend, some long-term holders are accumulating, and one proponent Pepe Whale, has called for a new all-time high this month, while PEPE whales have reduced their holdings by over 0.5% in the past week.