The Hedera token trades in a tight but volatile range as the crypto market continues to recover from the weekend’s crash.

By CD Analytics, Oliver Knight

Updated Oct 15, 2025, 3:21 p.m. Published Oct 15, 2025, 3:21 p.m.

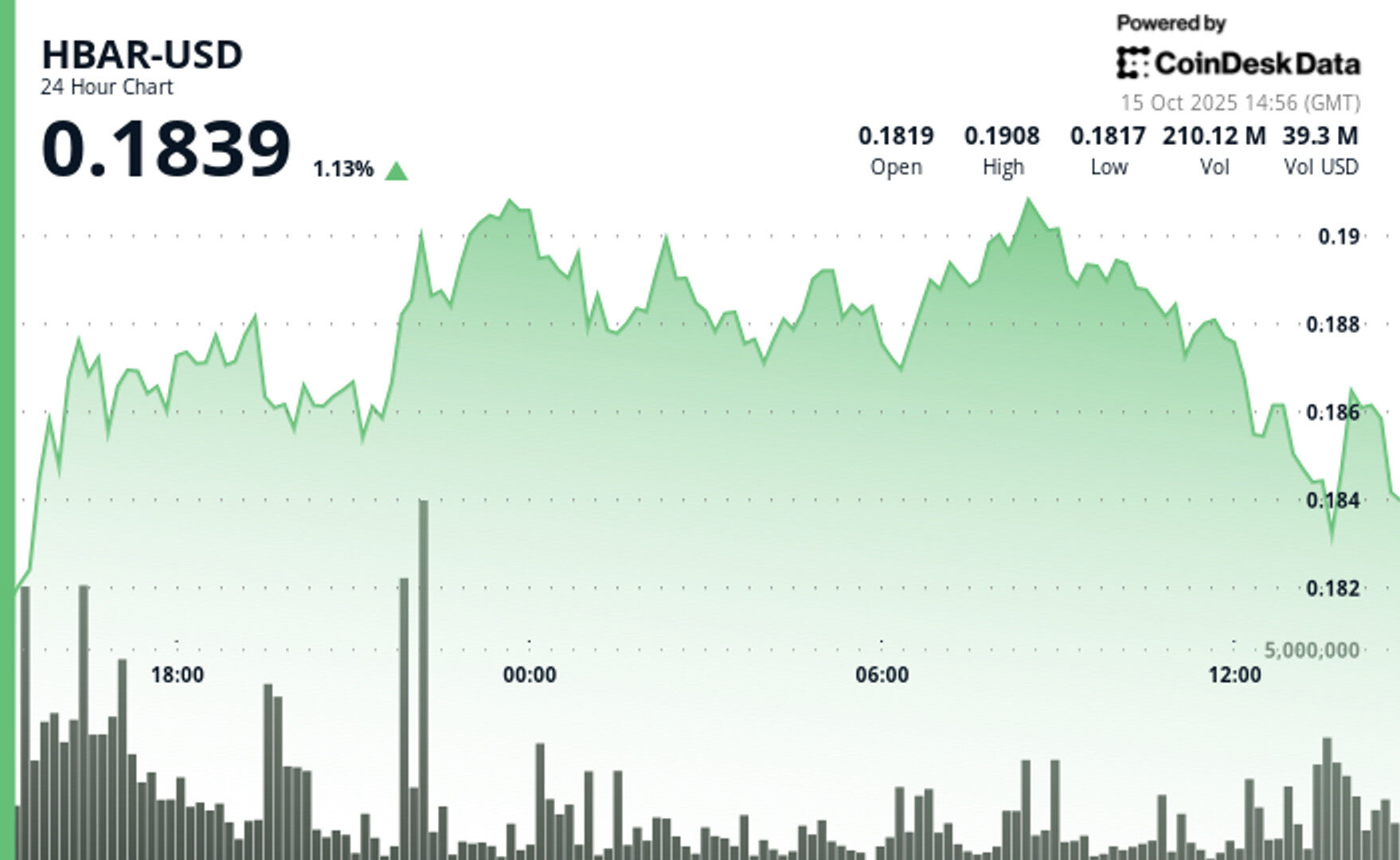

- HBAR swung between $0.181 and $0.192 in a 23-hour window, testing support and resistance around the $0.19 level.

- Volume spiked above 8.9 million during selloffs, signaling strong institutional activity at key technical zones.

- Geopolitical and trade disruptions continue to shape crypto market behavior, keeping risk appetite fragile across digital assets.

Hedera’s HBAR token saw sharp swings between $0.18 and $0.19 over a volatile 23-hour window from Oct. 14 to Oct. 15, with prices moving across a 5% range. The token climbed from $0.18 to a $0.19 peak before hitting resistance, ultimately settling near $0.19 for a modest 2% gain. Support around $0.19 held firm through multiple tests, while selling pressure capped upside momentum.

Technical indicators point to consolidation, with trading volumes showing distribution at intraday highs as traders booked profits. The standoff between buyers and sellers suggests short-term uncertainty, even as support remains intact.

STORY CONTINUES BELOW

Across the broader market, geopolitical tensions and shifting trade policies continued to weigh on investor sentiment. Global capital flow disruptions have raised concerns for blockchain payment networks like Hedera, which rely on cross-border stability.

HBAR’s whipsaw trading underscores crypto’s growing sensitivity to macroeconomic conditions. The token’s late-session rebound highlighted how traders are grappling with external pressures, as risk appetite remains fragile across digital assets.

- Trading band spans $0.009 representing 5% gap between $0.192 high and $0.181 low

- Heavy resistance forms near $0.19 with multiple failed breakout attempts

- Critical support zone anchors around $0.19-$0.19 through repeated successful tests

- Volume explodes past 8.9 million during 13:48 selloff phase

- Final hour shows textbook support-resistance dynamics during recovery move

- Consolidation mode emerges with bearish bias building into session close

- Elevated volume at key levels signals institutional participation during breakouts and retests

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Oct 10, 2025

Combined spot and derivatives volumes fell 17.5% in September, continuing a four-year seasonal trend

What to know:

- Trading activity falls 17.5% in September slowdown: Combined spot and derivatives volumes dropped to $8.12 trillion, marking the first decline after three months of growth. September has now seen reduced trading volume for the fourth consecutive year.

- Open interest reaches record high despite derivatives market share decline: Total open interest surged 3.2% to $204 billion and peaked at an all-time high of $230 billion during the month.

- Altcoins on CME outperform as Bitcoin and Ether futures decline: While CME’s total derivatives volume stayed flat at $287 billion (-0.08%), SOL futures jumped 57.1% to $13.5 billion and XRP futures rose 7.19% to $7.84 billion. BTC and ETH futures fell 4.05% and 17.9% respectively.

More For You

By James Van Straten|Edited by Stephen Alpher

1 hour ago

Roughly $12 billion in futures positions were wiped out on Friday, marking a major shift in market structure and potentially signaling a bottom.

What to know:

- Bitcoin open interest dropped from $70 billion (560,000 BTC) to $58 billion (481,000 BTC) in a single day, the largest ever USD decline.

- Open interest at the CME remained stable while Binance saw significant unwinding, indicating the event was driven by crypto-native liquidity rather than institutional flows.