The token will be integrated into OpenSea, allowing users to stake behind favorite collections or projects, Finzer said.

By Francisco Rodrigues|Edited by Aoyon Ashraf

Oct 18, 2025, 5:24 p.m.

- OpenSea’s CEO, Devin Finzer, announced that the company’s SEA token will launch in Q1 2026, with half of the token’s supply allocated to the community.

- The token will be integrated into OpenSea’s core experience, allowing users to stake on their favorite collections or projects, and 50% of platform revenue will be used to purchase SEA, Finzer said.

- The launch comes after a period of anticipation, marked by speculation about the token’s structure and timing, and marks a new chapter for OpenSea as it expands its offerings and shifts its focus.

OpenSea is set to launch its long-anticipated SEA token in the first quarter of 2026, the company’s CEO Devin Finzer announced.

Half of the token’s total supply will go to the community, with a significant portion distributed through an initial claim. Users with historical activity on the platform and participants in rewards programs will receive separate consideration, Finzer wrote on social media.

STORY CONTINUES BELOW

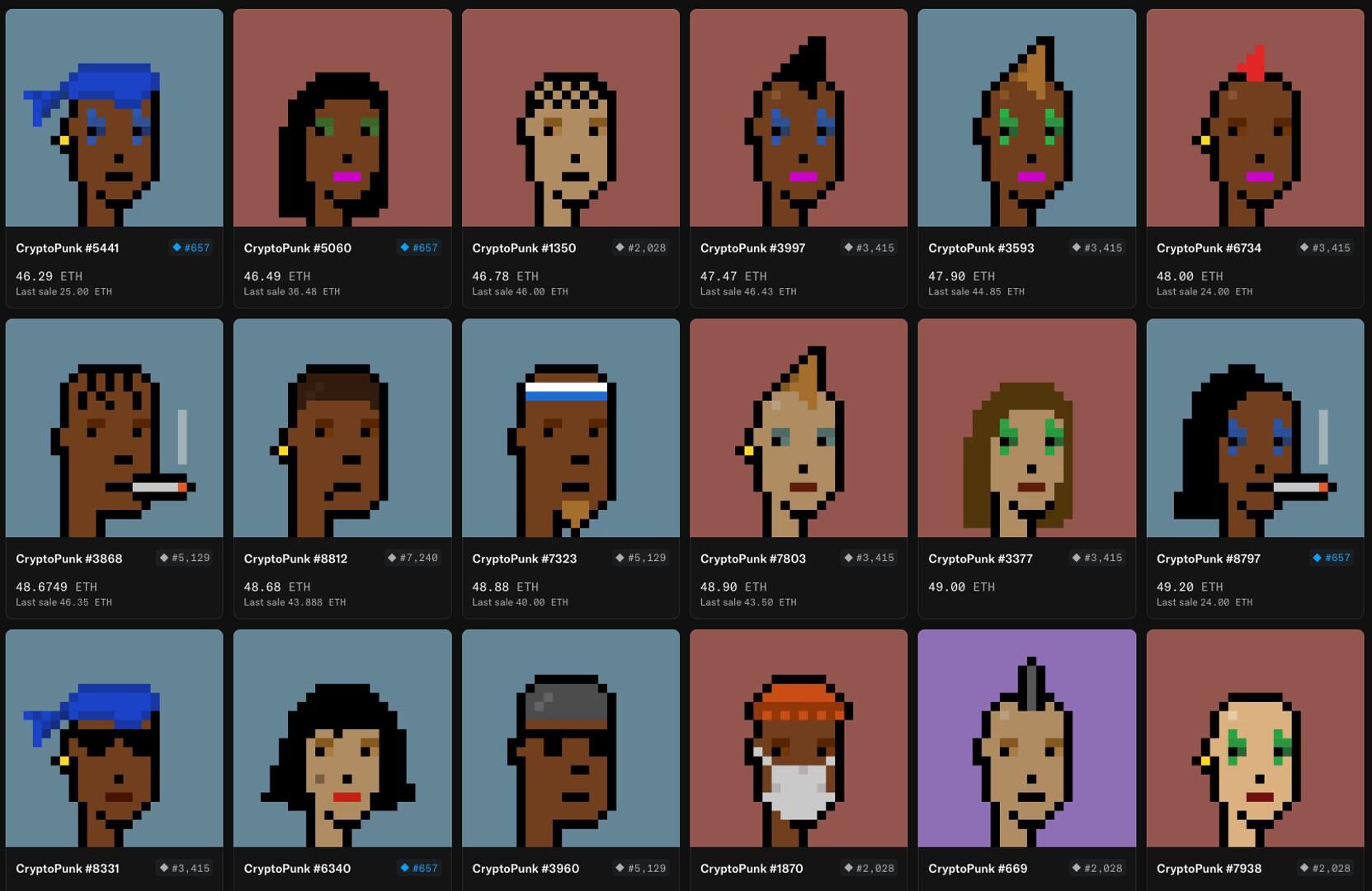

The rollout comes amid a shift in focus for OpenSea, which has long been known as the largest non-fungible token (NFT) marketplace. The platform recorded over $2.6 billion in trading volume this month, with more than 90% of it attributed to token trading.

SEA will be integrated into OpenSea’s core experience, Finzer added. Users will be able to stake the token behind their favorite collections or projects, and at launch, 50% of platform revenue will be used to purchase SEA.

The token’s release comes more than a year after it was first announced. Since then, speculation has grown around its structure and timing, including bets placed on prediction markets like Polymarket.

Finzer’s announcement brought perceived odds of SEA’s token launch this year from nearly 40% to under 1%.

In the meantime, OpenSea has been rolling out new tools, including a mobile app and support for perpetual futures trading, Finzer added.

More For You

By Jamie Crawley, AI Boost|Edited by Stephen Alpher

3 hours ago

Projects such as Rootstock and Babylon may be perking institutional demand for Bitcoin-based yield and restaking

What to know:

- Asset managers and treasuries are exploring Bitcoin-native yield opportunities through platforms like Rootstock and Babylon, moving beyond passive “digital gold” holdings.

- New infrastructure enables staking, restaking, and collateralized stablecoin products secured by Bitcoin, allowing institutions to earn yield without leaving the network.

- While the technology is proven, yield remains thin — often below 2% — meaning institutional uptake will depend on risk appetite and comfort with emerging Bitcoin DeFi models.