BTC, ETH Brace for $17B Options Expiry Amid Fed Meeting, Tech Company Earnings

Traders eye potential volatility as bitcoin hovers near max pain around $114,000 and ether nears $4,000.

By James Van Straten|Edited by Sheldon Reback

Oct 29, 2025, 10:25 a.m.

- Options expiry for bitcoin hold a notional value of $14.4 billion, while ether options total about $2.6 billion.

- Heavy clustering of out-of-the-money options shows traders positioning for sharp price moves.

- The combination of the Fed decision and major tech earnings could amplify short-term volatility across crypto markets.

Bitcoin BTC$113,116.35 and ether ETH$4,002.81 options worth roughly $17 billion are set to expire on Friday on Deribit in one of the largest monthly options expiry of the year.

There are 72,716 BTC call option contracts and 54,945 BTC put option contracts due for settlement, representing a combined notional open interest of about $14.4 billion.

STORY CONTINUES BELOW

With the Federal Reserve meeting today to set U.S. interest rates and major tech company earnings scheduled this week, markets are bracing for a potential spike in volatility.

Options are derivative contracts that give investors the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before a specific date. A put option acts as insurance against price declines and a call option provides the right to buy and represents a bullish bet on the underlying asset.

At 82.5% of open interest, out-of-the-money (OTM) options dominate traders’ holdings, showing a clear preference for speculative positioning. This suggests that while some traders may be using OTM options as a hedge against sharp price moves, the overall positioning reflects an expectation of heightened volatility and significant market swings.

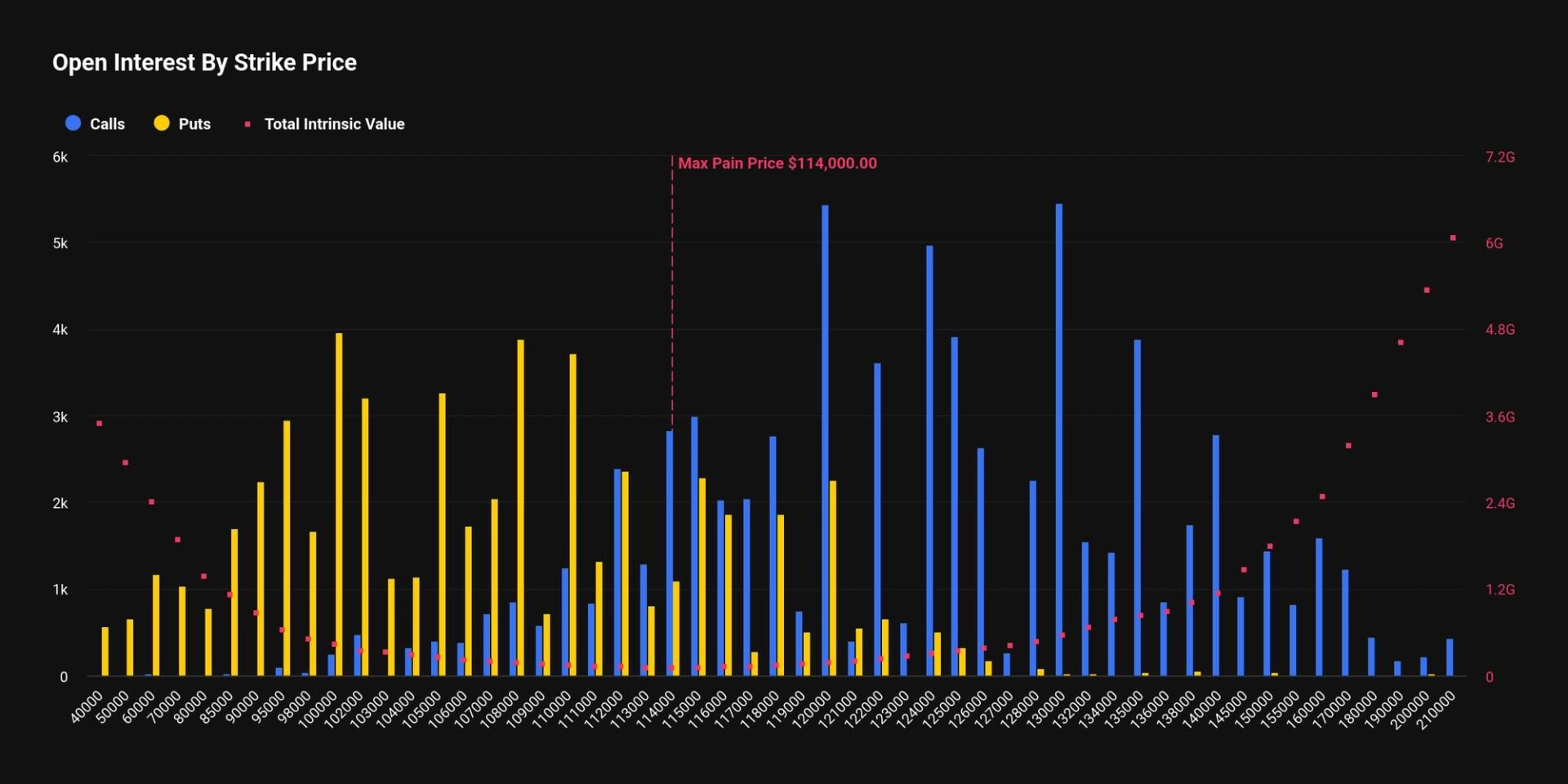

Both calls and puts cluster heavily in the OTM region, with significant call open interest around strike prices of $120,000 and $130,000, while puts dominate at $100,000 and $110,000.

With bitcoin trading near $113,000, the market is gravitating toward the max pain level of $114,000. That represents the price at which the greatest number of options contracts — both calls and puts — expire worthless, causing the least financial loss for option writers and the most for options holders.

As bitcoin trades near the max pain level, price action sometimes gravitates toward it ahead of expiry due to market makers’ hedging activity, however this is just a theory.

Ether options show 375,225 ETH in call open interest and 262,850 ETH in put open interest, representing a notional total of $2.6 billion, with a max pain level at $4,110 compared with a current price of about $4,000.

According to Checkonchain, before IBIT launched options in November 2024, Deribit controlled nearly 80% of the global bitcoin options open interest. That share has since declined to 44%, equal to IBIT’s market share.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By Sam Reynolds, AI Boost|Edited by Sheldon Reback

2 hours ago

DBS said the deal involved trading cash-settled OTC bitcoin and ether options.

What to know:

- DBS and Goldman Sachs said they completed the first-ever over-the-counter cryptocurrency options trade between banks, marking a significant step in institutionalizing digital assets in Asia.

- The trade involved cash-settled bitcoin and ether options, allowing both banks to hedge exposure tied to crypto-linked products.

- The transaction highlights the growing demand for digital asset derivatives and the integration of traditional finance practices into the digital asset ecosystem.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language