Stellar Edges 1.5% Higher Breaking $0.32 Amid Institutional Accumulation

XLM demonstrates resilience with modest gains and exceptional volume surge, signaling potential momentum building beneath current consolidation patterns.

By CD Analytics, Oliver Knight

Updated Oct 29, 2025, 5:10 p.m. Published Oct 29, 2025, 5:10 p.m.

- XLM advanced 1.53% to $0.319 on volume exceeding 30-day average by 134%.

- Technical analysis reveals controlled institutional buying without speculative excess.

- Protocol 24 upgrade expectations and RWA tokenization growth support sentiment.

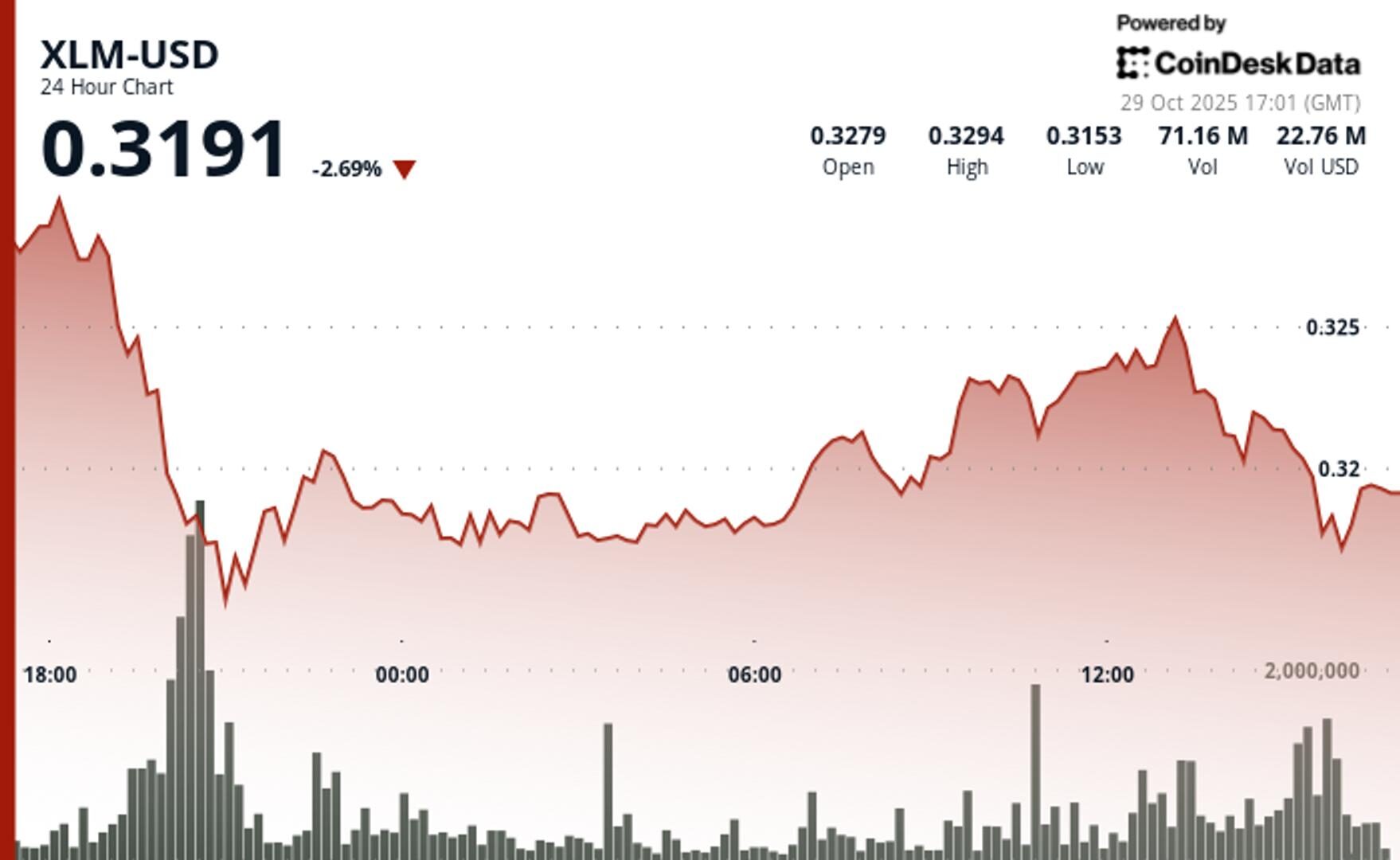

Stellar Lumens (XLM) gained 1.53% in the past 24 hours, rising from $0.3168 to $0.3177 as trading volume jumped 134% above its 30-day average. The controlled price action amid high volume points to institutional accumulation rather than retail-driven momentum.

XLM slightly outperformed the broader crypto market by 1.23%, consolidating between $0.315 and $0.325 after rebounding from a $0.3162 low. Diminishing short-term volume suggests distribution has eased, with strong support forming above $0.32 ahead of the upcoming Protocol 24 upgrade.

STORY CONTINUES BELOW

The surge in volume without sharp price swings indicates steady institutional buying, often a precursor to sustainable breakouts. Meanwhile, Stellar’s ecosystem continues to expand, reaching $639 million in tokenized assets—a 26% monthly increase—led by Franklin Templeton’s $446 million tokenized treasury fund.

- Support / Resistance

- Primary support: $0.316

- Immediate resistance: $0.325

- Broader range: $0.31 – $0.33

- Volume Analysis

- 134% increase above 30-day average volume

- Occurred alongside modest price gains

- Indicates institutional accumulation rather than retail speculation

- Chart Patterns

- Volume-price divergence evident

- Suggests controlled buying activity

- Points to potential volatility expansion ahead

- Targets & Risk/Reward

- Breakout above $0.325 could target $0.35 – $0.40 range

- Downside risk limited to $0.31 support zone

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By Stephen Alpher, Krisztian Sandor

18 minutes ago

Though acknowledging growing weakness in the labor market, Powell said a December rate cut is not a “foregone conclusion.”

What to know:

- Fed Chair Jerome Powell was unexpectedly hawkish in his press conference Wednesday, suggesting markets are way ahead of themselves in pricing in a December rate cut.

- The news sent markets lower, bitcoin among them, now down 5% over the past 24 hours and below $110,000.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language