XRP Price Analysis: Ripple in Risk of Deeper Pullback as Fed Cuts Cause Bitcoin Slide

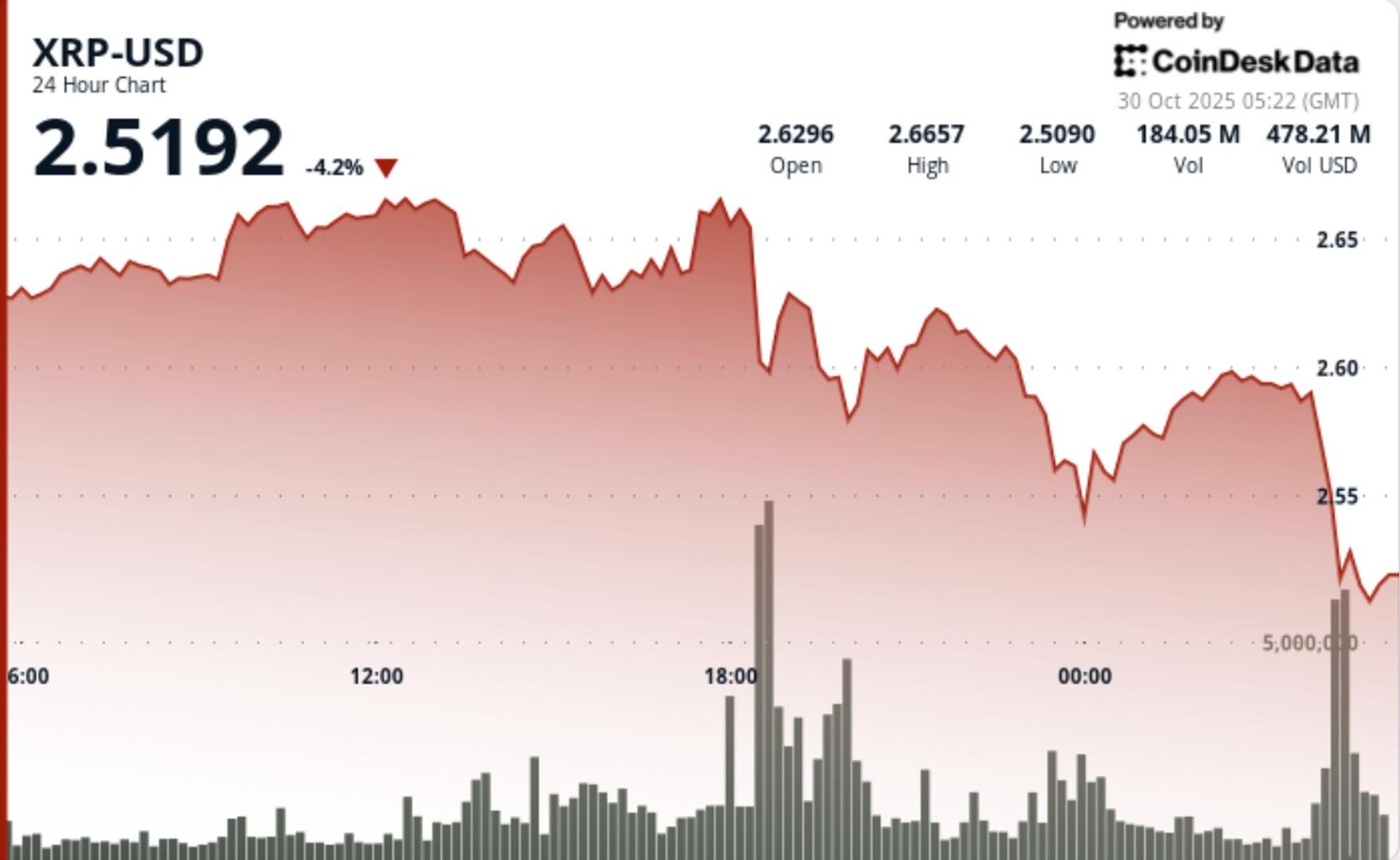

XRP slid from $2.63 to $2.59 after a failed breakout above the $2.67 zone, with trading volume spiking to roughly 392.6 million tokens—about 658% above its recent average—during the rejection.

Updated Oct 30, 2025, 5:53 a.m. Published Oct 30, 2025, 5:53 a.m.

- XRP faced a failed breakout at the $2.67 resistance, leading to a price drop to $2.59 with a significant increase in trading volume.

- On-chain data indicates large XRP holders are selling, raising concerns about profit-taking amid high futures open interest.

- Traders should watch the $2.58 support level, as a break below could signal further downside, while a bounce could target higher resistance levels.

The $2.67-$2.69 zone now stands as critical overhead supply. Meanwhile support in the $2.580 area and the 200-day EMA near ~$2.61 are acting as anchors.

- XRP slid from $2.63 to $2.59 after a failed breakout above the $2.67 zone, with trading volume spiking to roughly 392.6 million tokens—about 658% above its recent average—during the rejection.

- This move coincides with elevated open interest in XRP futures near early-2025 highs (~$2.9 billion).

- Meanwhile, on-chain data suggest major wallets are offloading large amounts of XRP, raising profit-taking concerns even amid broader institutional interest.

- Over the 24-hour window, XRP moved from ~$2.63 to ~$2.59 while carving out a $0.12 trading band. The decisive cap occurred at ~$2.67 resistance, where volume exploded and price faltered.

- A late-session drop from ~$2.590 to ~$2.579 around 04:04-04:05 UTC occurred on ~2.18 million token volume—≈355% above the hourly average—before briefly freezing trading between 04:08-04:10 at near-zero volume.

- The breakdown breached the support cluster near $2.580, establishing fresh lower-lows beneath prior consolidation levels.

- The rejection at resistance affirms the short-term bearish pivot: while long-term structure still shows accumulation, the immediate risk has shifted back to the downside.

- Futures open interest remains elevated, but whale wallet sell-off data suggest distribution—not accumulation—is currently dominant.

- RSI/MACD momentum indicators show divergence (higher highs on price, lower highs on momentum), further warning of potential correction.

- Traders should treat current levels as a high-risk / high-reward pivot zone. A bounce from $2.58–$2.60 on renewed volume could reset momentum and aim toward $2.70–$3.00.

- But a clear break below $2.58 would open downside toward ~$2.53 and perhaps $2.50, especially if whale outflows continue and open interest drops.

- Monitoring large wallet flows, futures OI dynamics and volume spikes will be key to judge whether this is just consolidation or the start of a deeper correction.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By Shaurya Malwa, Omkar Godbole

48 minutes ago

However, bitcoin and other non-yielding assets may benefit in the coming months as liquidity returns and investors rotate out of cash-heavy positions into growth and alternative stores of value.

What to know:

- Bitcoin fell to $108,000 after the Fed’s decision and a silent meeting between Trump and Xi in South Korea.

- Major cryptocurrencies like XRP and Dogecoin saw losses, with futures tied to the S&P 500 also trading lower.

- The Fed’s policy shift towards easier financial conditions may benefit crypto markets, but geopolitical factors remain crucial.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language