Share this article

The breakdown was accompanied by outsized volume, with a peak around 392.6 million tokens — nearly 400% of its daily average.

By Shaurya Malwa, CD Analytics

Updated Oct 30, 2025, 6:57 p.m. Published Oct 30, 2025, 6:51 p.m.

- XRP plunged nearly 8% as institutional selling intensified, breaching the critical $2.46 support level.

- The broader crypto market reacted negatively to hawkish signals from the Federal Reserve.

- Traders should monitor resistance near $2.46–$2.50 and downside targets of $2.30–$2.40 if current support breaks.

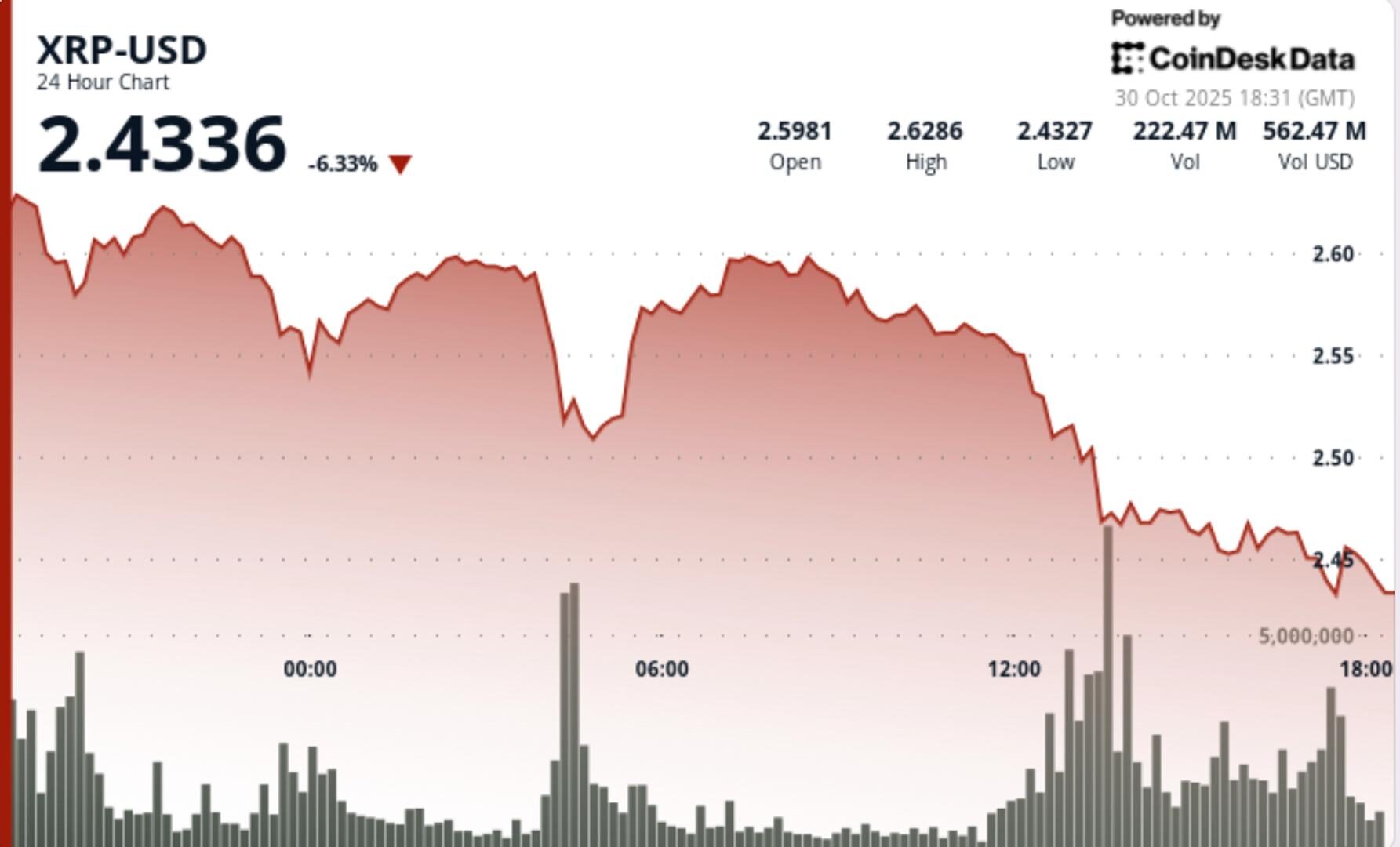

XRP plunged nearly 8% in Thursday’s session as institutional selling accelerated through multiple high-volume breakdowns, breaching the critical $2.46 support level that had anchored the month-long consolidation range.

- XRP fell sharply from $2.65 to $2.48 amid aggressive selling pressure as macro and technical factors aligned against it.

- The broader crypto market reacted negatively to hawkish signals from the Federal Reserve, even as trade prospects between the United States and China showed signs of improvement.

- At the same time, technical analysts flagged a confirmed bear setup after a key support level failed to hold.

- XRP collapsed approximately 6.4% during the 24-hour period, sliding from ~$2.65 down to ~$2.48.

- The breakdown was accompanied by outsized volume, with a peak around 392.6 million tokens — nearly 400% of its daily average.

- The decisive breakdown occurred after multiple support zones failed to hold, with the critical $2.46 level breached and the $2.48 floor tested.

- The drop included two intense selling waves, and the final leg of the decline came on minimal volume, indicating exhaustion and institutional exit.

- The chart structure shows a clear bearish breakdown from an ascending or neutral consolidation pattern.

- Support at ~$2.46 gave way, turning into resistance. Momentum indicators (e.g., RSI and MACD) point to weakening conditions and a confirmed sell-signal scenario.

- The volume profile — with the extremely high spike during the fall and muted recovery volume afterward — suggests distribution (selling) rather than healthy accumulation.

- Key levels now to monitor are resistance near ~$2.46–$2.50, and downside targets in the range of ~$2.30–$2.40 if the current support breaks.

- Traders should treat current levels with caution. A sustained bounce above ~$2.50 may offer relief, but the confirmation of the breakdown means the bears currently hold the edge.

- If XRP fails to reclaim the ~$2.50–$2.46 zone, the path toward ~$2.30 or lower becomes higher probability.

- On-chain whale flows and futures open interest (which may show further weakening) should be monitored closely as additional confirmation of structural risk.

- Macro-tailwinds (trade news, regulatory developments) can still trigger relief rallies, but the technical framework currently favours a continuation of weakness until meaningful support is rebuilt.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By Shaurya Malwa, CD Analytics

1 hour ago

Despite expectations for Q4 rallies, Dogecoin’s market structure remains fragile, with traders watching if it can defend the $0.18 base.

What to know:

- Dogecoin fell 6.8% on Tuesday, breaking below the $0.18 support level amid heavy whale outflows and increased trading activity.

- On-chain data showed over $29 million in large transactions, including a significant transfer to Binance, contributing to the price decline.

- Despite expectations for Q4 rallies, Dogecoin’s market structure remains fragile, with traders watching if it can defend the $0.18 base.