Chainlink (LINK) Price News: Drops 8% Despite 64K Token Buyback

The oracle network’s token succumbed to the broader crypto market weakness, even though adoption continues growing with a recent Ondo partnership.

By CD Analytics, Krisztian Sandor|Edited by Cheyenne Ligon

Oct 30, 2025, 6:29 p.m.

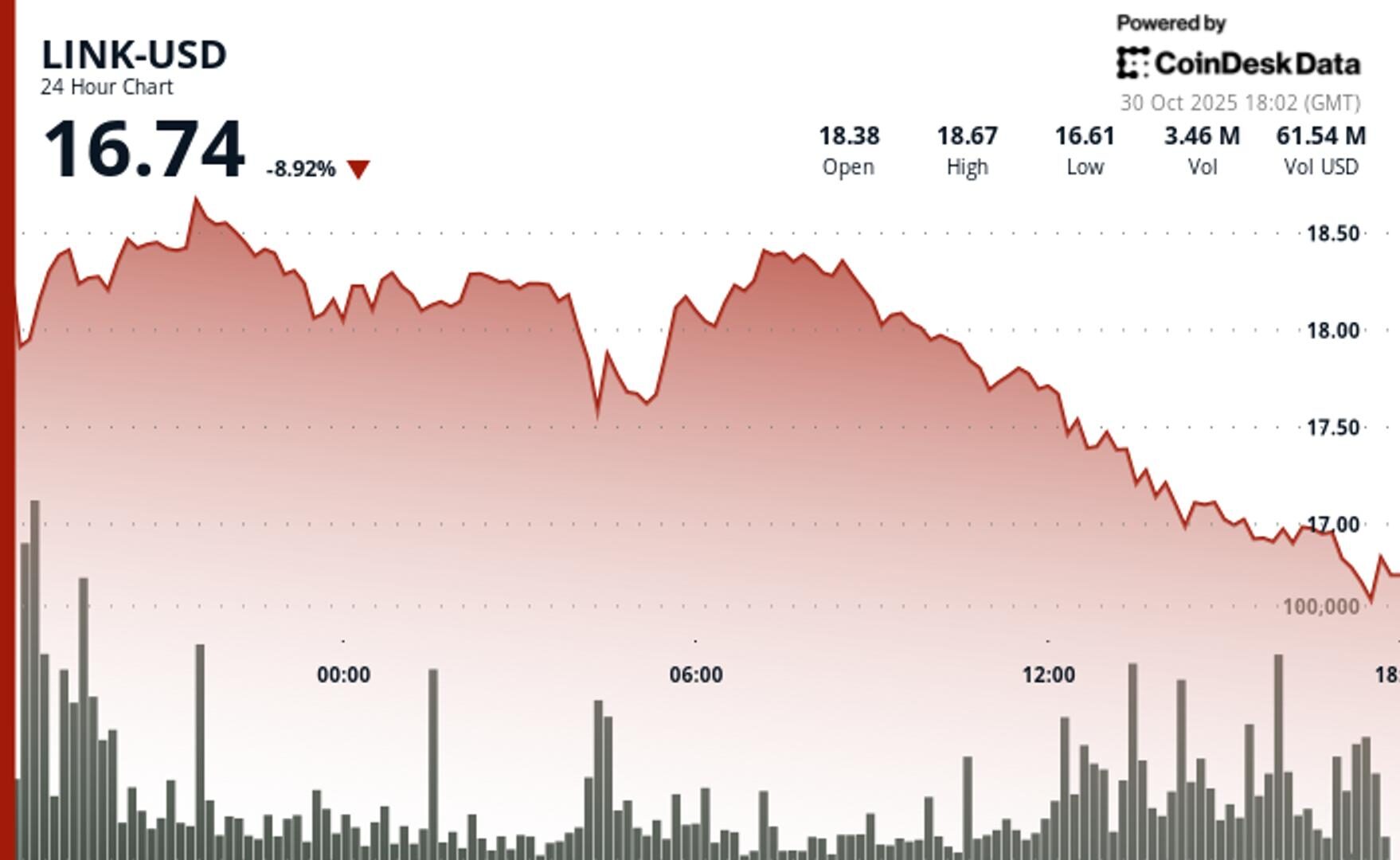

- LINK dropped 8% below $17 on Thursday to its weakest price in nearly two weeks as trading volume soared during support breakdown.

- The Chainlink Reserve continued to buy back tokens, making its largest nominal purchase since August.

- Real-world asset protocol Ondo Finance tapped Chainlink for data feeds for tokenized equities.

Native token of oracle network Chainlink LINK$16.61 plunged through critical support levels on Thursday as institutional selling dominated the session.

The token declined 8% from $18.39 to $16.92 over the past 24 hours, falling below a descending trendline that contained recent price action, CoinDesk research’s market insight tool showed. Trading volume surged to 3.94 million units during the initial breakdown, nearly double the average.

STORY CONTINUES BELOW

Recent hourly data shows LINK trapped below $17 in a narrow consolidation range. Multiple attempts to reclaim the $17 psychological level failed as trading activity dropped 58% below session peaks. The compression suggests institutional buyers remain absent despite oversold technical conditions developing.

On the news front, real-world asset protocol Ondo Finance named Chainlink the provider of price feeds for over 100 tokenized stocks and ETFs. The service includes streaming data about corporate actions like dividend payments to ensure accurate valuations across multiple blockchains. The partnership also involves Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and collaborations through the Ondo Global Market Alliance.

The Chainlink Reserve, which uses protocol revenue from partnerships and services to purchase tokens on the open market, added another 64,445 LINK to its stash on Thursday. That’s the largest nominal acquisition since early August, when the reserve started. It now holds $11 million worth of LINK.

- Support/Resistance: Immediate resistance at $17.00 psychological level, stronger resistance at $18.20 from failed recovery attempt.

- Volume Analysis: Exceptional 3.94 million unit volume during breakdown confirmed institutional selling.

- Chart Patterns: Descending trendline break triggered accelerated selling through multiple support zones.

- Targets & Risk: Next support target $16.50 zone, potential deeper correction toward $16.00 if consolidation fails.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By Siamak Masnavi, CD Analytics|Edited by Aoyon Ashraf

11 minutes ago

Volume rose 60.5% above the weekly average as long-term holders sold 325,600 BTC and trading compressed into a $107,000 to $108,000 band near support.

What to know:

- Trading ran 60.5% above the seven-day average while long-term holders distributed about 325,600 BTC, the largest monthly sell since July.

- Action compressed into a $107,000 to $108,000 band with resistance cited near $111,650 and $113,600, per our model.

- Analysts flagged context: Altcoin Daily noted the 50-week moving average near $103,000, Santiment said retail fear spiked and Omkar Godbole marked first support around $97,000.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language