Solana (SOL) Price News: Declines Despite Spot ETF Launch

One onchain observer noted a large transaction by Jump Crypto, speculating that the crypto firm might be rotating SOL into BTC, perhaps weighing on sentiment.

By Krisztian Sandor|Edited by Stephen Alpher

Oct 30, 2025, 8:59 p.m.

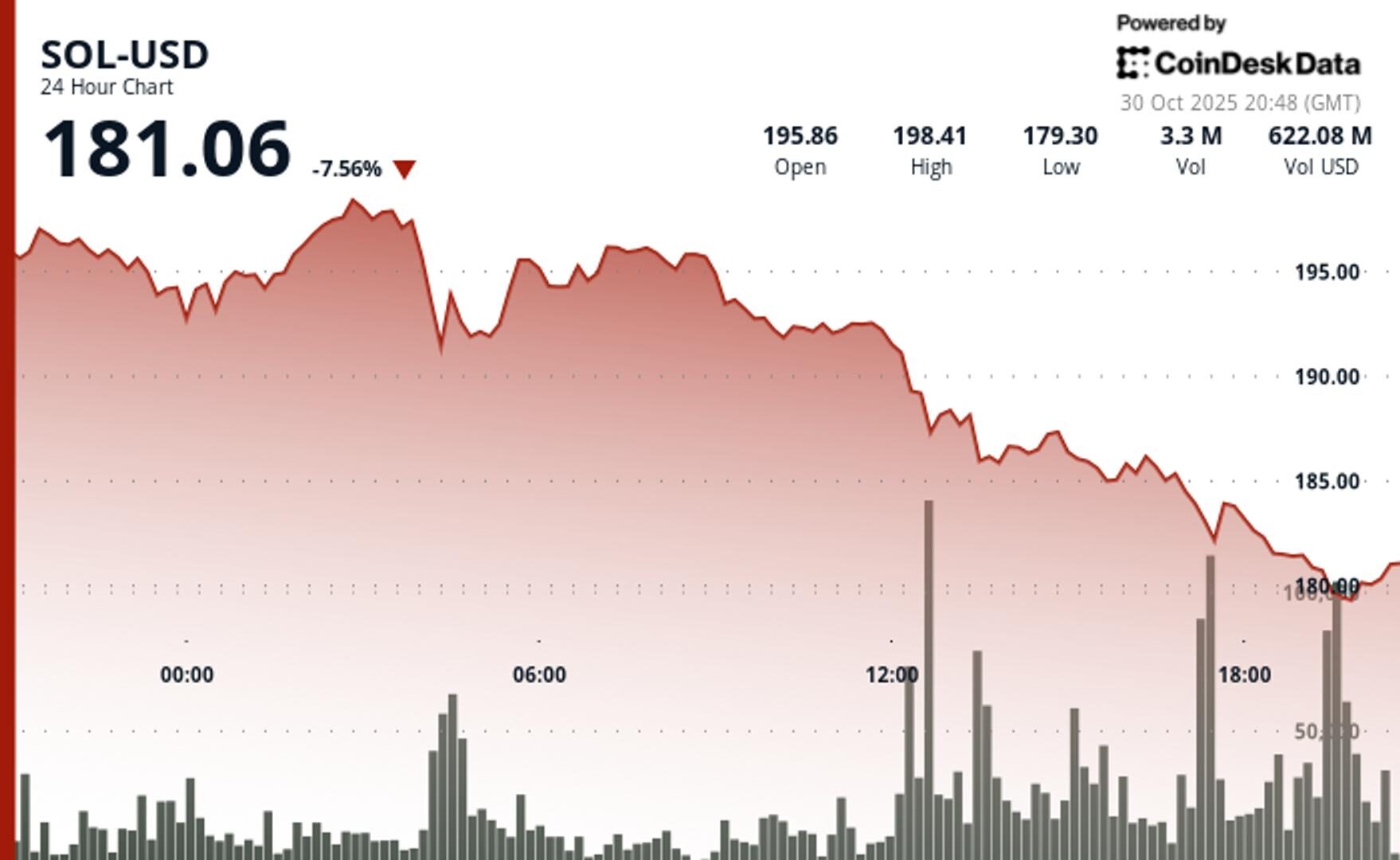

- Solana (SOL) fell 8% on Thursday, continuing its decline despite a solid launch of the first spot-based Solana ETFs in the U.S.

- The Bitwise Solana Staking ETF (BSOL) saw $116 million in net inflows, while the Grayscale Solana Trust (GSOL) attracted $1.4 million.

- A significant on-chain transfer by Jump Crypto may have impacted sentiment, as that firm moved 1.1 million SOL to Galaxy Digital, sparking speculation of rotating from SOL to BTC.

Solana SOL$182.33 tumbled 8% on Thursday, extending this week’s slide despite the long-anticipated debut of the first spot-based Solana ETFs in the U.S.

The drop below $180 has erased all year-over-year gains for the token and also leaves it down 4% for 2025. Making those numbers feel worse for SOL bulls, both BTC and ETH — despite their own recent price weakness — continue sporting year-over-year gains of more than 40%.

STORY CONTINUES BELOW

The Bitwise Solana Staking ETF (BSOL), launched on Tuesday, pulled in $116 million in net inflows across the first two sessions, adding to $223 million in seed investment, per data by Farside Investors. The Grayscale Solana Trust (GSOL), which was converted from a closed-end fund into an ETF on Wednesday, attracted modest $1.4 million inflow.

Bitwise’s decent capital influx wasn’t enough to buoy SOL, which posted a 12% decline from Monday’s highs.

What perhaps weighed on sentiment was a large onchain transfer noted by blockchain sleuth Lookonchain. Blockchain data showed that Jump Crypto — one of the most prominent crypto trading firms — appeared to have moved 1.1 million SOL (worth $205 million) to Galaxy Digital, receiving roughly 2,455 BTC ($265 million) around the same time, speculating that Jump may be rotating out of SOL to BTC.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By CD Analytics, Krisztian Sandor|Edited by Nikhilesh De

1 hour ago

The lending protocol’s token showed weakness as technical support crumbled, plunging below $210.

What to know:

- AAVE tumbled below $210 from $248 earlier this week as crypto markets crumbled.

- Key support level at $211 broke down with consecutive lower highs, confirming the bearish shift.

- The protocol’s institutional real-world asset lending arm, Horizon, grew to $450 million in two months since launch.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language