Filecoin (FIL) Rises Over 4% as Token Rebounds

By Will Canny, CD Analytics|Edited by Stephen Alpher

Oct 31, 2025, 3:42 p.m.

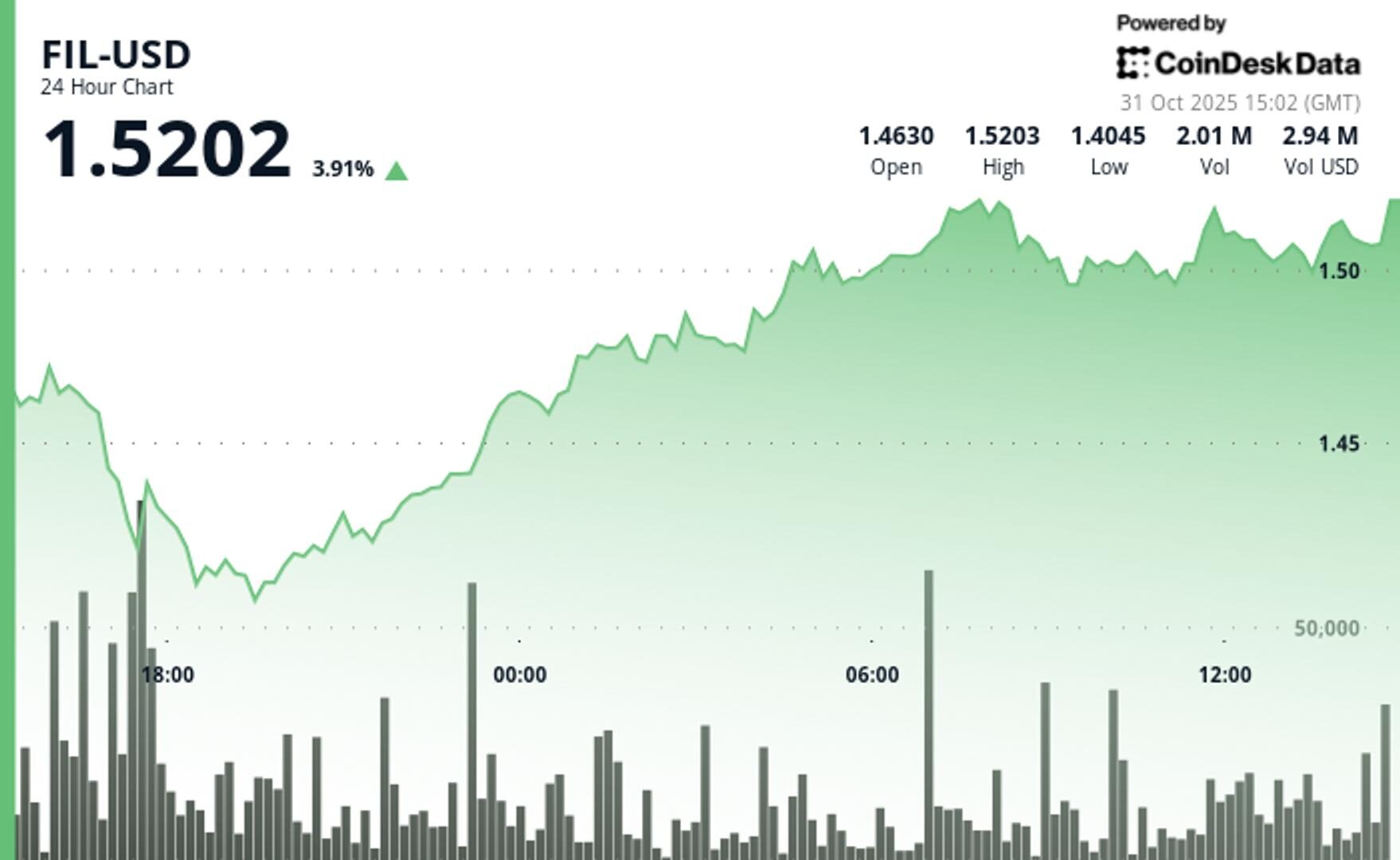

- FIL rose 4.3% amid a wider rally in crypto markets after Thursday’s washout.

- Volume surged to 5.46 million tokens at key support levels, 98% above the 24-hour average

- Technical patterns showed an ascending channel structure with resistance emerging near $1.52.

FIL$1.4957 posted a 4.3% gain over the last 24 hours, amidst a rally in wider crypto markets, bouncing from yesterday’s big declines.

STORY CONTINUES BELOW

The broader market gauge, the CoinDesk 20 index, was 2.5% higher at publication time.

The decentralized storage token traded from a low of $1.40 to highs near $1.52, as traders tested critical support and resistance levels within an ascending channel structure, according to CoinDesk Research’s technical analysis model.

The model showed a key development hit at Oct. 30 17:00 when volume spiked to 5.46 million tokens. This was 98% above the 24-hour moving average.

The surge coincided with a decisive low at $1.41, according to the model. Critical support held firm on subsequent retests. Each recovery wave showed increasing buying interest on declining volume. This suggests institutional accumulation above the $1.41 zone.

Technical Analysis:

- Critical support established at $1.41 with secondary support at $1.48; resistance emerging near $1.52 with potential extension to previous highs

- High-volume accumulation pattern at $1.41 support with 98% surge above average; declining volume on subsequent rallies suggested controlled institutional buying

- Ascending channel structure intact with higher lows pattern; $1.516 ceiling test successful with measured retreat

- Upside target at $1.52 resistance zone; risk management below $1.41 support with stop-loss considerations around $1.38 for aggressive positions

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By Helene Braun, Will Canny, AI Boost|Edited by Sheldon Reback

1 hour ago

Transaction revenue hit $1.05 billion, but price targets range from $266 to $510 as Wall Street debates whether growth can outpace rising costs.

What to know:

- Coinbase beat third-quarter estimates with strong transaction and subscription revenue, but analysts are split on whether that momentum can be sustained.

- Bulls point to growth in B2B crypto payments, key partnerships and regulatory tailwinds, while bears worry about rising costs and margin pressure.

- Analyst price targets range from $266 to $510, reflecting sharp disagreement over Coinbase’s ability to turn short-term gains into long-term profitability.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language