ASTER Zooms 20% as Binance’s CZ Purchases 2M Tokens

ASTER is a rebranded derivative platform token with a max supply of 8 billion, focusing on community incentives and decentralized exchange features.

By Shaurya Malwa|Edited by Sam Reynolds

Updated Nov 2, 2025, 3:19 p.m. Published Nov 2, 2025, 3:15 p.m.

- DEX token ASTER surged nearly 20% after Binance founder Changpeng Zhao purchased 2 million tokens, sparking speculative demand.

- ASTER is a rebranded derivative platform token with a max supply of 8 billion, focusing on community incentives and decentralized exchange features.

- Despite the rally, traders should be cautious due to high token supply, competition, and a narrative-driven price increase.

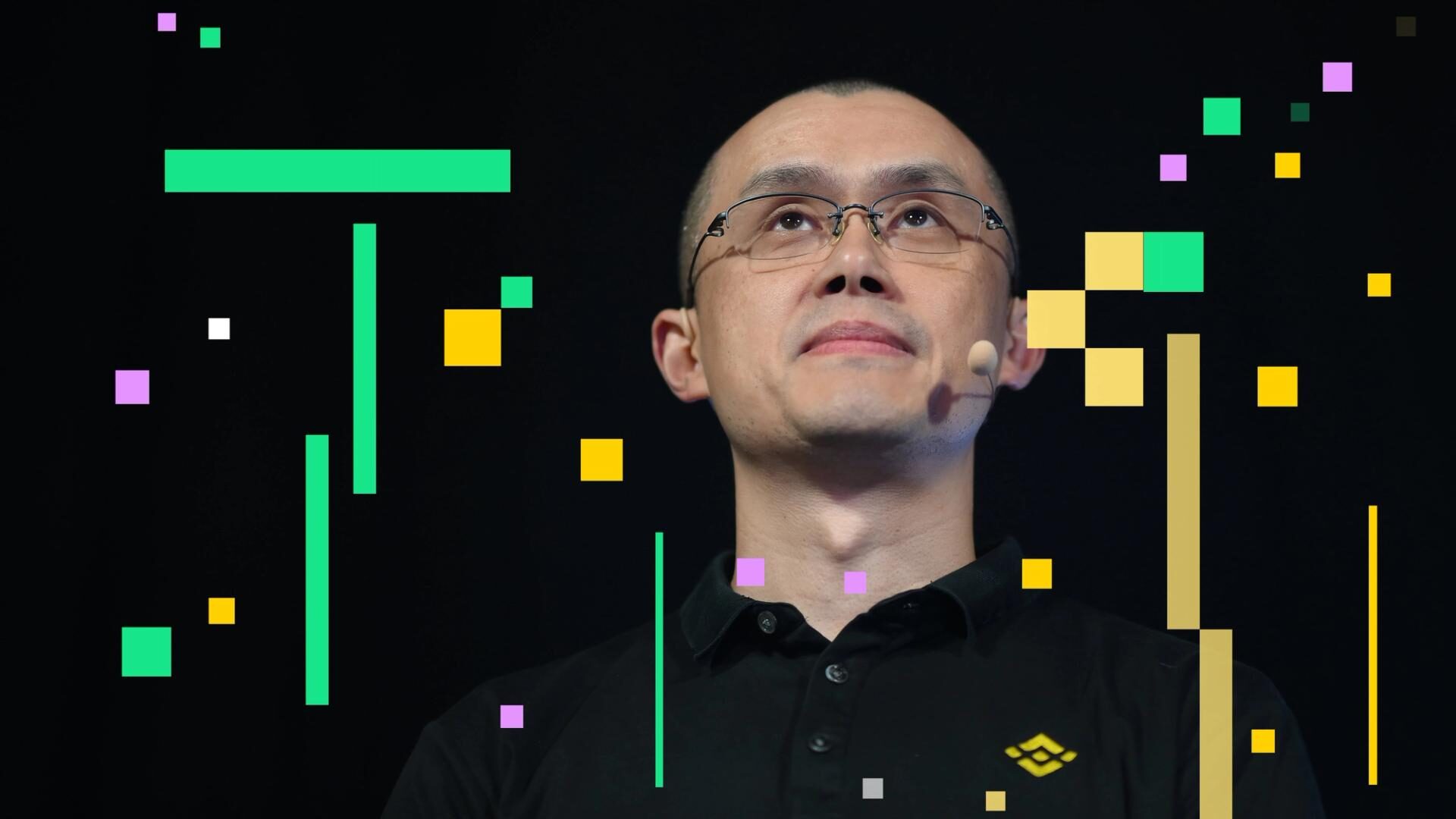

DEX token ASTER surged as Binance founder Changpeng Zhao (CZ) purchased approximately 2 million of them, sending a wave of speculative demand across the market.

Investors interpreted the purchase as a signal of confidence from one of crypto’s most influential figures, and ASTER climbed nearly 20% in response.

STORY CONTINUES BELOW

The underlying project behind ASTER is a rebranded derivative platform that merged from older tokens (including APX) and relaunched with a token-generation event in September 2025. ASTER’s max supply is 8 billion tokens, with over half allocated to community incentives such as airdrops and strategic distribution.

The platform packages itself as a hybrid decentralized exchange offering perpetuals and spot trading across multiple chains, with features like hidden orders and high leverage.

CZ’s public endorsement — where he described ASTER’s launch as a “strong start” — added fuel to the rally. On-chain data cited by analysts show ASTER’s wallet amassed large sums of USDT and became one of the largest on BNB Chain outside of Binance itself.

Although the jump is real, the risk of retreat is equally tangible. High token supply, intense competition (especially from rivals like HYPE), and a narrative-heavy boost rather than clear, sustained fundamental breakthroughs mean traders should remain vigilant of price spikes.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

39 minutes ago

Wildly successful ETFs, accelerating institutional adoption and friendly regulatory policy, yet bitcoin watches from the sidelines as other assets surge. What gives?

What to know:

- While bitcoin didn’t have an actual IPO, its recent acceptance in tradfi circles is similar and resulting in similar price action to that seen in stock IPOs, wrote Jordi Visser.

- It can take many months or years for the stocks of even generational companies to recover from the process of early investors cashing out their stakes, and bitcoin is proving no different.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language