Dogecoin (DOGE) Analysis: $0.18 Support Snaps as Whales Offload

Analysts warn that sustained trading below $0.18 could lead to a drop toward $0.07, while defending this level might spark a recovery.

Updated Nov 3, 2025, 11:20 a.m. Published Nov 3, 2025, 11:19 a.m.

- Dogecoin fell below the key $0.18 level as whale distribution increased, diverging from the broader market’s strength.

- The meme coin’s decline was marked by high-volume spikes and failed recovery attempts, indicating institutional repositioning rather than panic selling.

- Analysts warn that sustained trading below $0.18 could lead to a drop toward $0.07, while defending this level might spark a recovery.

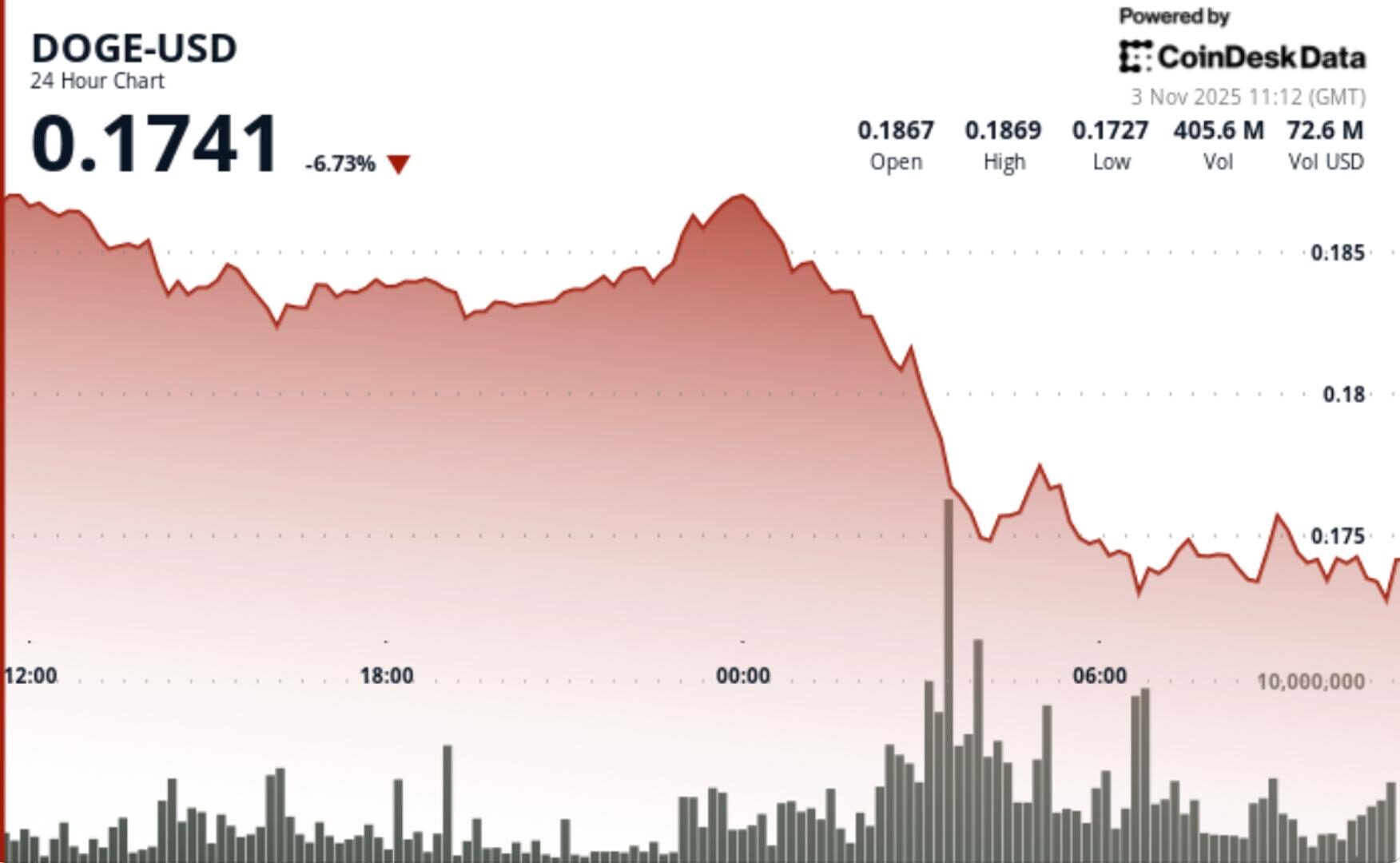

Dogecoin broke below the key $0.18 level Tuesday as whale distribution accelerated, diverging sharply from broader market strength. The meme coin slid 1.3% to $0.1740 while Bitcoin and major altcoins posted gains, confirming that institutional flows — not market sentiment — are dictating DOGE’s trajectory.

- DOGE fell from $0.1855 to $0.1740 across Tuesday’s 24-hour session, extending its underperformance against the CD5 index by more than 2%.

- The breakdown accelerated at 03:00 UTC as volume spiked to 1.10 billion tokens — 183% above the 24-hour average — triggering a clean breach of the $0.18 support zone.

- Resistance hardened near $0.1870, with three failed recovery attempts throughout the day.

- On-chain data from Santiment confirmed that wallets holding between 10 million and 100 million DOGE collectively dumped 440 million tokens over 72 hours, reducing their supply share from 15.51% to 15.15%.

- This represents one of the largest mid-tier whale liquidations in recent months.

- DOGE’s decline unfolded through consecutive distribution phases, each accompanied by high-volume spikes.

- The initial breakdown through $0.18 triggered a liquidation cascade toward session lows at $0.1755 before short-term buyers stabilized prices near $0.1740.

- The trading range of $0.0135 — roughly 7.3% intraday volatility — reflected institutional repositioning rather than panic selling.

- Analysts said the pattern suggests structural rotation rather than broad capitulation, but market breadth continues to deteriorate as the token detaches from the broader uptrend.

- Technically, DOGE sits at a binary inflection point. The $0.18 level represents both a structural pivot and the lower boundary of the prevailing ascending channel dating back to mid-August.

- Maintaining this support could open a recovery path toward $0.26–$0.33, but a confirmed failure risks acceleration toward the $0.07 accumulation cluster, where roughly 18.6% of total supply (28.3B DOGE) last transacted.

- Meanwhile, resistance at $0.1870-$0.1900 remains intact following repeated rejections.

- The steep volume surge on the breakdown, combined with declining open interest, reinforces the view that leveraged positions were flushed while spot sellers continued off-loading.

- Dogecoin’s near-term outlook hinges on whether bulls can defend the $0.18 channel base.

- Analyst Ali Martinez noted that “DOGE’s fate could hinge on this level—failure risks a drop toward $0.07, while defense could ignite a recovery to $0.26 or higher.”

- With whale activity easing into the close and distribution metrics plateauing, short-term stabilization remains possible.

- However, traders warn that sustained price action below $0.18 would confirm a structural breakdown, invalidating the medium-term bullish thesis that dominated October flows.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By Shaurya Malwa|Edited by Sheldon Reback

34 minutes ago

The pause allows developers to roll out an emergency hard fork aimed at isolating compromised contracts and recovering affected assets before resuming operations.

What to know:

- Berachain validators halted the network to address a vulnerability linked to the Balancer V2 exploit.

- The pause allows for an emergency hard fork to recover affected funds and isolate compromised contracts.

- Approximately $12 million in user funds are at risk, prompting swift action to protect assets.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language