Polkadot (DOT) Slides 12% as Bears Break Key Support at $2.87

By CD Analytics, Will Canny|Edited by Sheldon Reback

Nov 3, 2025, 3:57 p.m.

- DOT slumped 12% as a 5.49 million token sell-off overwhelmed support.

- Wider crypto markets also fell, with the broader market index, the CoinDesk 20, lower by 6%.

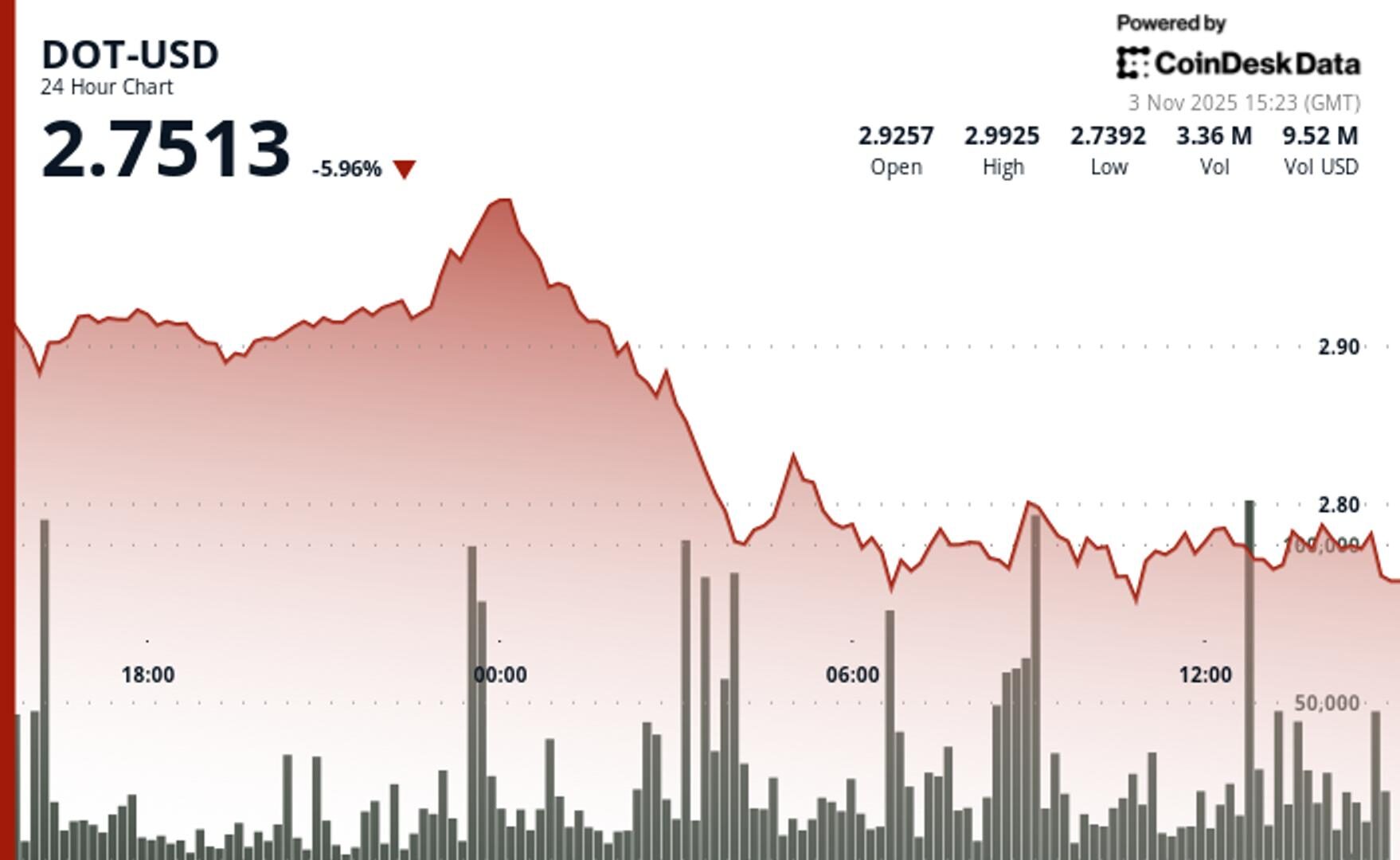

DOT$2,7740 cracked under intense selling pressure Monday, dropping 12% to $2.56 as institutional-sized orders broke critical support levels, according to CoinDesk Research’s technical analysis model.

The model showed that the token posted extreme volatility, swinging from session highs of $2.99 to $2.56 lows. Bears dominated price action during early morning hours when massive volume spikes overwhelmed technical defenses.

STORY CONTINUES BELOW

The session’s defining moment struck at 03:00 UTC as exceptional selling pressure reached 5.49 million tokens, more than double the 24-hour moving average, according to the model.

This institutional-sized distribution event coincided with a decisive break below the $2.87 support zone, according to the model.

Technical Analysis:

- Primary support broke at $2.76 following institutional selling cascade

- Critical resistance zone at $2.80-$2.82 represents next upside target

- Major resistance at $2.87 breakdown level remains key reclaim threshold

- Session high of $2.99 serves as ultimate resistance for bullish continuation

- Exceptional selling pressure of 5.49 million tokens marked 106% above average

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

Di più per voi

Di Krisztian Sandor, Helene Braun|Editor Stephen Alpher

2 minuti fa

The downturn in prices rippled across derivatives markets, liquidating over $1 billion in leveraged trading positions across all digital assets Monday, CoinGlass data showed.

Cosa sapere:

- A late weekend decline in cryptocurrencies sped up in U.S. morning trade Monday, with bitcoin dropping more than 4% to $105,500 and major altcoins like ether and solana falling 6%-10%.

- Over $1 billion in leveraged trading positions were liquidated across digital assets, reflecting the market’s volatility.

- Despite the downturn, some analysts, including Tom Lee, remain optimistic about Bitcoin’s potential to reach $200,000 and ether $7,000 by year-end — both would require about a doubling in price over the next eight weeks.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language