SUI Token Drops 9% as Institutional Selling Hits Harder Than Broader Crypto Market

By CD Analytics, Helene Braun|Edited by Nikhilesh De

Nov 3, 2025, 7:08 p.m.

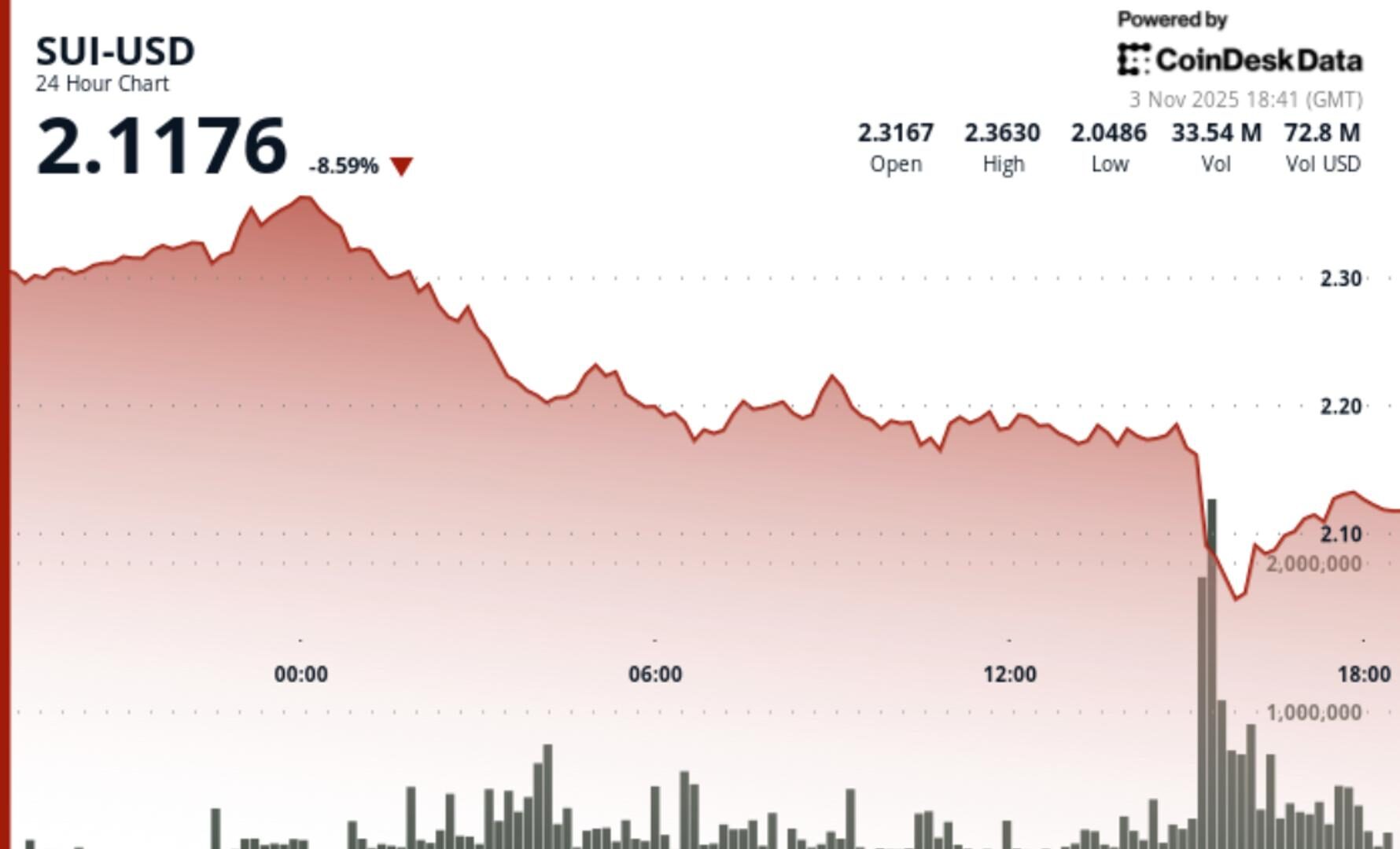

- SUI dropped 9% to $2.10 in 24 hours, falling nearly 5% more than the broader crypto market.

- Trading volume surged over 600% above average as SUI broke key support, pointing to institutional selling

- A sharp rebound from $2.04 stalled below $2.13, showing weak follow-through from buyers after the crash.

SUI, the native token of the Sui network, plunged 9% to $2.10 over the past 24 hours, sharply underperforming the broader crypto market during a sector-wide selloff.

STORY CONTINUES BELOW

The token’s 4.89% lag behind the crypto market suggests the move wasn’t just about market weakness but that it was SUI-specific.

The selloff carried the hallmarks of institutional liquidation. Prices dropped from $2.32 to test critical support, with trading volume surging 53% above the 7-day average. The spike in activity points to large-block repositioning, not a retail-driven panic.

At the core of the move was a decisive breakdown at $2.16. SUI dropped through that level on volume of 99.13 million tokens — 628% above its 24-hour average — confirming strong bearish pressure. That breakdown was followed by a sharp rebound from $2.04, forming a V-shaped bounce as institutions appeared to scoop up the token at lower levels.

Still, the recovery lost steam near $2.13, a psychological resistance zone. Volume declined into the close, suggesting buyers lacked conviction to push SUI meaningfully higher in the short term.

Elsewhere, the CoinDesk 5 Index (CD5) saw a 3.35% drop to $1,860.70, including a flash crash to $1,826.66 before bouncing back. The move also showed signs of institutional selling, overwhelming technical support in a high-volatility session.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By CD Analytics, Krisztian Sandor|Edited by Nikhilesh De

1 hour ago

The oracle network’s token hit its weakest price since the October 10 crash, breaking key support levels after multiple failed breakout last week.

What to know:

- LINK fell over 10% to $15 on Monday morning, hitting its lowest since October crash amid heavy trading.

- Downside risk to fall to $14.5 persists if token fails to reclaim $16, CoinDesk Research’s technical model says.

- Chainlink announced Rewards Season 1, offering token incentives to eligible LINK stakers starting next week.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language