SUI Plunges 9% as $116M DeFi Exploit Rattles Crypto Markets

By CD Analytics, Helene Braun|Edited by Sheldon Reback

Nov 4, 2025, 3:18 p.m.

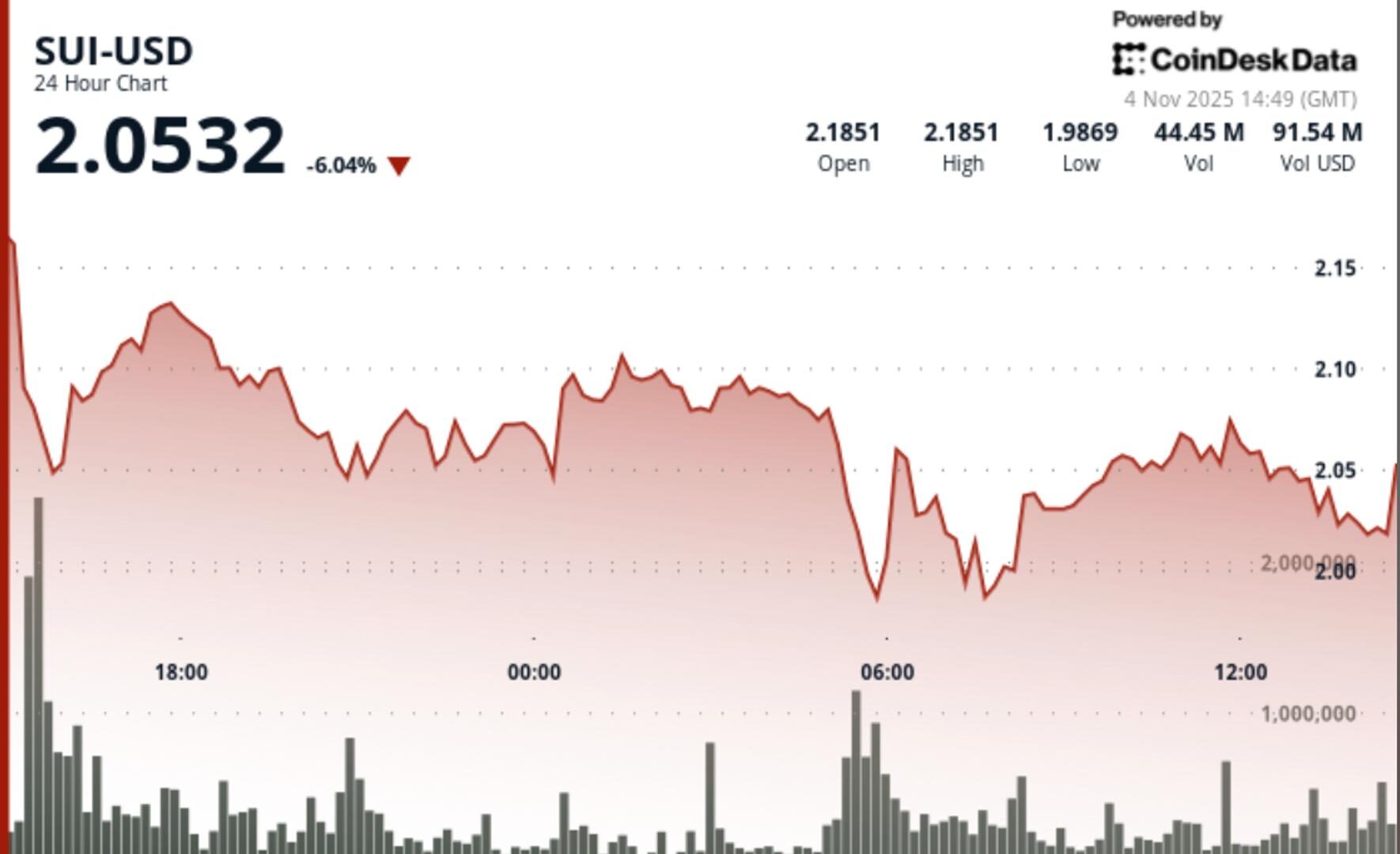

- SUI dropped over 9% Tuesday, breaking through key support as a broader DeFi exploit rattled investor confidence.

- The sell-off followed Monday’s $116M hack on Balancer, sparking heavy trading and signs of institutional exits.

- Analysts warned of further downside unless bulls reclaim $2.07, with technical targets now near $1.95.

SUI, the native token of the Sui blockchain, fell Tuesday after breaching critical support levels and triggering a wave of technical selling. The token dropped 9.2% to as low as $2.02 as trading volume spiked and recovery attempts repeatedly failed.

The sell-off followed Monday’s news of a $116 million exploit involving decentralized finance (DeFi) protocol Balancer, which has rattled sentiment across the industry.

STORY CONTINUES BELOW

As security concerns mounted, investors appeared to unwind exposure to riskier layer-1 tokens, with SUI showing signs of institutional liquidation, according to CoinDesk Research’s technical analysis model. Nearly 42.6 million tokens changed hands during the breakdown, 68% more than the daily average, according to on-chain data.

The $2.08 level — once a support zone — flipped into resistance during the rout, with multiple failed bounces reinforcing the bearish trend. During U.S. morning hours, SUI hovered around $2.02 in low-volume trading, suggesting traders were positioning ahead of the next major move.

Chart watchers noted classic capitulation behavior: a single-hour collapse, followed by lower highs and tight consolidation. If the token breaks below $2.014, technical targets point toward $1.98 or even $1.95. To regain momentum, bulls would need to reclaim $2.07 with conviction.

The CoinDesk 5 Index of the biggest cryptocurrencies dropped 1.15% on the day with all constituents lower.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

21 hours ago

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

What to know:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

More For You

By James Van Straten, AI Boost|Edited by Stephen Alpher

33 minutes ago

MPLX will supply natural gas from its Delaware Basin processing plants to MARA’s planned gas-fired power facilities.

What to know:

- MARA Holdings and MPLX (a spinoff of oil exploration giant Marathon Petroleum) signed a letter of intent to develop integrated power generation and data center campuses in West Texas, starting with 400 MW and scalable to 1.5 GW.

- The announcement came alongside MARA’s third quarter results, which showed net income of $123 million and adjusted EBITDA surging 1,671% to $395.6 million.

- MARA is lower by 2.3% in early action alongside a sizable sell-off in crypto and traditional markets.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language