By Shaurya Malwa, CD Analytics

Updated Nov 5, 2025, 3:19 a.m. Published Nov 5, 2025, 3:17 a.m.

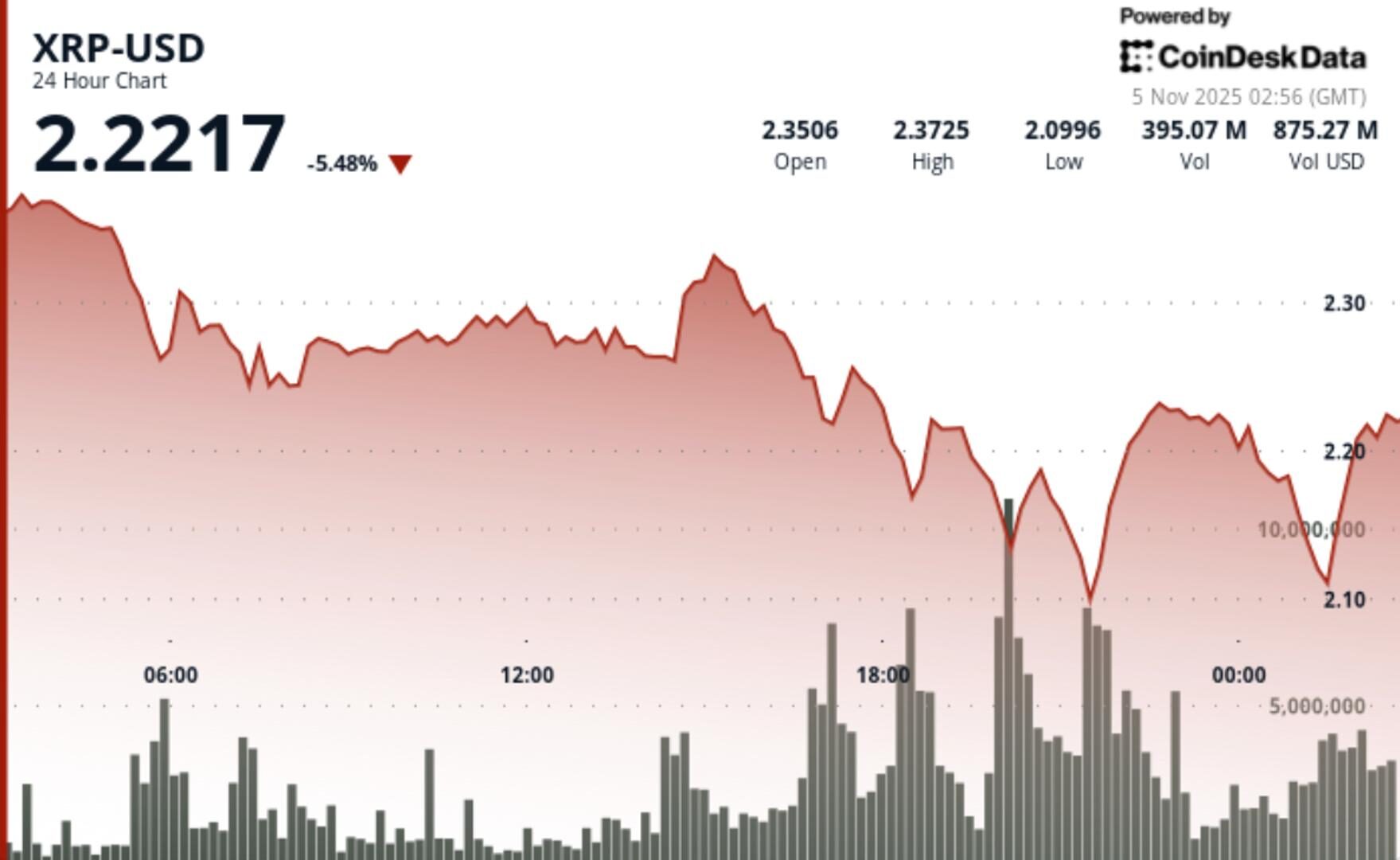

- XRP fell 6.4% to $2.20 amid heavy institutional selling, breaking key support levels.

- Trading volume surged 126% above average, indicating institutional participation in the selloff.

- Traders are monitoring the $2.08 support level to prevent further declines toward $2.00.

XRP plunged sharply during Tuesday’s session, breaking below key support levels on exceptional volume as bearish momentum strengthened and traders targeted the $2.00 psychological zone.

- XRP fell 6.4% to $2.20 over 24 hours, sliding from an intraday high of $2.35 amid heavy institutional selling pressure. The token traded across a wide 12.4% range as the broader crypto market stabilized, underscoring XRP’s isolated weakness.

- Trading volume spiked to 356.7 million, representing a 126% surge above the 24-hour average, confirming institutional participation in the breakdown sequence.

- Strong resistance persisted at $2.37, with rebound attempts to $2.33 and $2.23 repeatedly rejected.

- The failure to sustain gains above prior support marked a structural shift from accumulation to active distribution.

- Price action turned sharply bearish after the $2.17 breakdown, driving XRP to a session low of $2.08 before stabilizing around $2.20.

- Intraday data revealed a brief recovery from the $2.11 base, with price climbing 4.5% to $2.209 on a short-term volume burst of 5.8M tokens, though the rally stalled at $2.216 as liquidity faded.

- The late-session bounce coincided with news that Ripple’s RLUSD stablecoin crossed $1 billion in market capitalization, but technical dynamics remained the primary driver.

- Momentum loss above $2.22 signaled limited conviction behind the recovery, leaving XRP trapped below prior breakdown levels.

- The session confirmed a decisive bearish bias as XRP formed consecutive lower highs and lower lows from the $2.37 resistance peak.

- The pattern validates a short-term downtrend reinforced by volume expansion during selloffs and contraction during rebounds — a classic signature of institutional distribution.

- Momentum indicators turned negative, with the relative strength index trending near neutral after falling from overbought territory earlier in the month.

- The failure to reclaim the $2.17 line suggests further weakness unless renewed demand emerges around the $2.08-$2.11 consolidation base.

- While XRP’s structure hints at a possible oversold recovery, volume divergence and failed retests imply rallies may continue to face heavy resistance until broader market sentiment improves.

- Traders are watching whether XRP can hold above the $2.08 support to avoid accelerating losses toward the $2.00 psychological level.

- A sustained recovery above $2.22 would be required to re-establish bullish footing, while failure to maintain current levels risks another wave of liquidation.

- Institutional volume spikes during declines confirm active repositioning rather than retail-driven volatility.

- For tactical traders, the $2.17–$2.22 zone represents the key inflection range that could define short-term direction.

More For You

Nov 3, 2025

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

What to know:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

More For You

By Shaurya Malwa|Edited by Aoyon Ashraf

43 minutes ago

Traders can also keep track of where liquidation levels are concentrated, helping identify zones of forced activity that can act as near-term support or resistance.

What to know:

- Bitcoin’s price dropped to just above $100,000 amid forced liquidations and macroeconomic concerns.

- Over $2 billion in futures contracts were liquidated, with long traders suffering the majority of losses.

- Despite the volatility, analysts maintain a positive long-term outlook for Bitcoin.