The token defended its ascending channel structure despite distribution pressure at the upper boundary, keeping short-term bias neutral-to-bullish above $0.16.

By Shaurya Malwa, CD Analytics

Updated Nov 6, 2025, 5:25 a.m. Published Nov 6, 2025, 5:25 a.m.

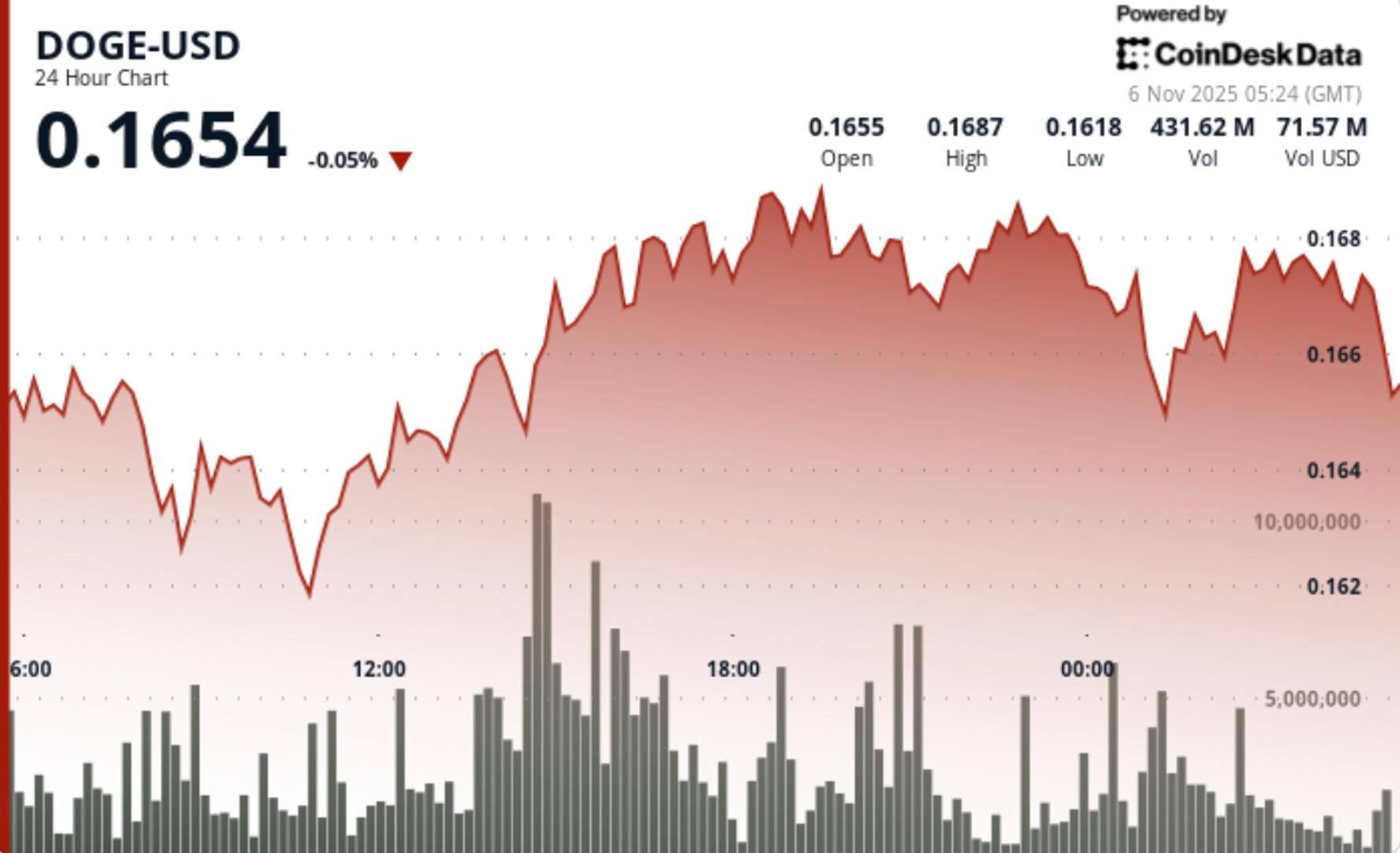

- Dogecoin’s price dipped 0.5% to $0.1657 amid institutional trading near resistance levels.

- Institutional investors accumulated Dogecoin early in the week and reduced holdings as prices approached $0.1670.

- Despite muted broader sentiment, Dogecoin’s structure remains intact with potential for a breakout above $0.16.

Dogecoin edged 0.5% lower to $0.1657 in Wednesday’s session as institutional flows rotated near resistance following a 104% volume spike above daily averages. The token defended its ascending channel structure despite distribution pressure at the upper boundary, keeping short-term bias neutral-to-bullish above $0.16.

- Institutional positioning continued to define DOGE’s intraday structure. Large-cap holders accumulated near $0.1620 early in the week, then trimmed exposure as bids thinned near $0.1670.

- The Tuesday breakout attempt on 774M volume marked the session’s pivot — confirming that smart-money participation, not retail noise, drove the move.

- Broader sentiment across the meme-coin complex remained muted, though derivative open interest in DOGE futures climbed modestly on Binance and Bybit, hinting at speculative hedging rather than outright risk-taking.

- Analysts said the pair’s resilience above $0.16 reflected disciplined profit rotation rather than trend exhaustion.

• DOGE advanced from $0.1646 to $0.1665 before mild pullback to $0.1657

• Support held at $0.1617–$0.1620 across four consecutive hourly tests

• Volume concentrated at $0.1665 highs (8.9M during 02:10–02:11) showing institutional distribution

• Channel structure remains constructive with higher lows, suggesting potential for renewed breakout attempts above $0.16.

STORY CONTINUES BELOW

• Trend: Sideways-to-bullish within ascending channel

• Support: $0.1620 primary; $0.1617 secondary buffer

• Resistance: $0.1665–$0.1670 zone repeatedly rejected on high volume

• Volume: 774M turnover (+104% vs SMA) confirms institutional participation

• Structure: Channel intact, volatility 4.2% — compression phase preceding next directional move.

• Ability of bulls to defend $0.1620 on declining volume — key for structure integrity

• Breakout confirmation above $0.1670 for continuation toward $0.17–$0.175

• Any intraday closes below $0.1615 signaling structural failure and downside expansion

• Cross-asset flow from BTC or SOL rotations as broader market gauges appetite for risk

More For You

Nov 3, 2025

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

What to know:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

More For You

By Shaurya Malwa, CD Analytics

11 minutes ago

The move marked the token’s strongest daily gain in a week and outperformance against a declining broader market, with traders now eyeing a clean push toward $2.50.

What to know:

- XRP surged 4.9% to $2.35, breaking key resistance on increased institutional volume.

- Ripple, Mastercard, and others launched a stablecoin settlement pilot using RLUSD on the XRP Ledger.

- Traders view the pilot as a validation of Ripple’s infrastructure beyond cross-border remittances.