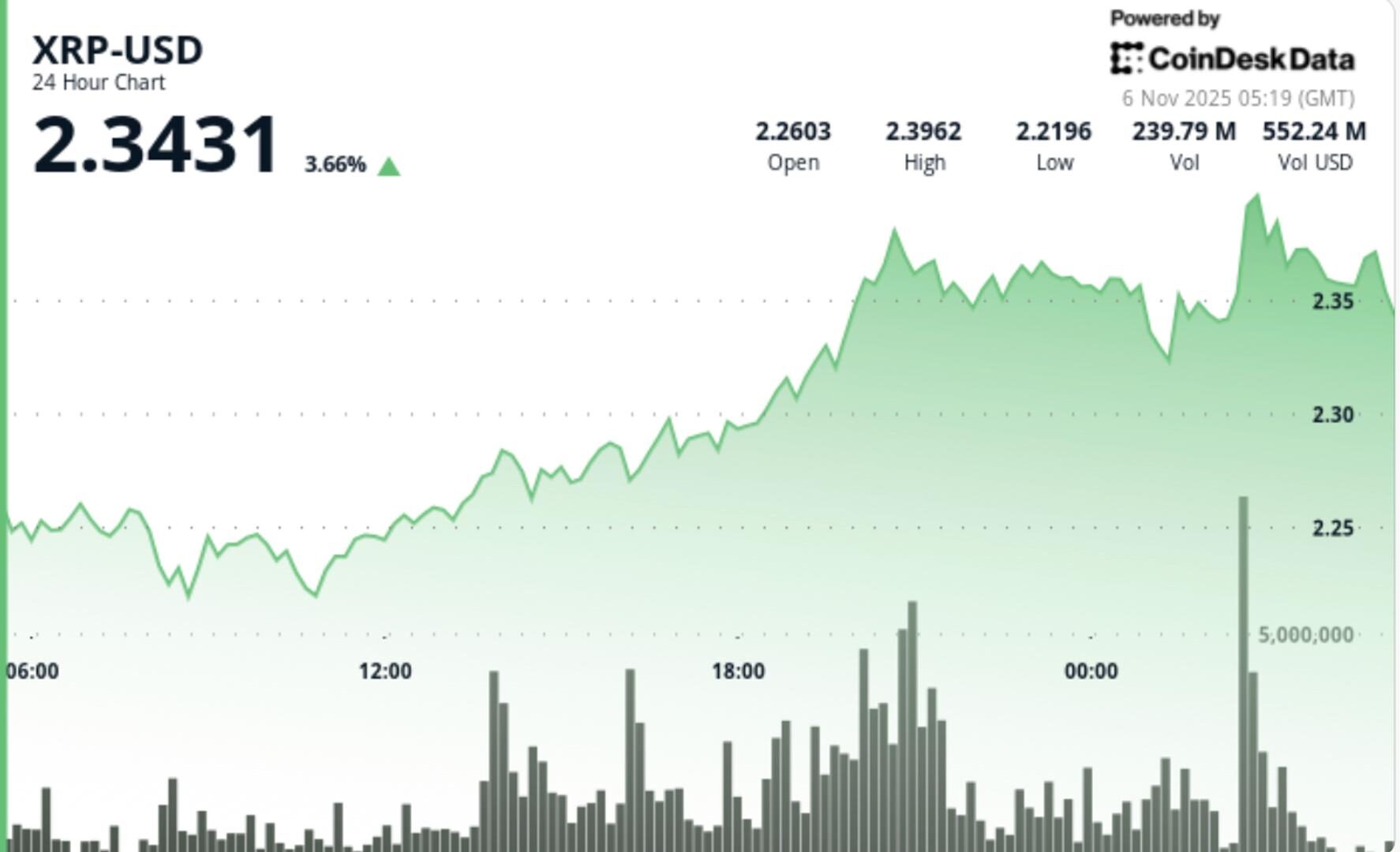

The move marked the token’s strongest daily gain in a week and outperformance against a declining broader market, with traders now eyeing a clean push toward $2.50.

By Shaurya Malwa, CD Analytics

Updated Nov 6, 2025, 5:20 a.m. Published Nov 6, 2025, 5:20 a.m.

- XRP surged 4.9% to $2.35, breaking key resistance on increased institutional volume.

- Ripple, Mastercard, and others launched a stablecoin settlement pilot using RLUSD on the XRP Ledger.

- Traders view the pilot as a validation of Ripple’s infrastructure beyond cross-border remittances.

XRP rallied 4.9% to $2.35 in Tuesday’s session, breaking through key $2.30 resistance on near-doubled institutional volume. The move marked the token’s strongest daily gain in a week and outperformance against a declining broader market, with traders now eyeing a clean push toward $2.50.

- Institutional flows rotated back into XRP as risk assets corrected elsewhere, with large holders accumulating near $2.30 following a week of compression. Three consecutive hourly candles broke through resistance on rising volume, signaling conviction-driven breakout behavior.

- Adding to sentiment, Ripple, Mastercard, WebBank, and Gemini jointly launched a stablecoin-based settlement pilot using RLUSD on the XRP Ledger to process fiat credit card payments.

- The initiative marks one of the first tests by a regulated U.S. bank to settle real-world card transactions directly over a public blockchain. RLUSD, which recently surpassed $1 billion in circulation, operates under New York’s Trust Charter, providing a regulated framework for stablecoin-backed payment rails.

- Traders interpreted the pilot as a potential validation of Ripple’s infrastructure beyond cross-border remittances — broadening enterprise use cases at a time when stablecoin settlements are becoming the preferred on-chain banking mechanism.

• Breakout sequence triggered after $2.30 reclaim on 164M volume

• Session high hit $2.39 before light profit-taking

• Support now anchored at $2.32; prior resistance turned base

• Momentum held through final hour consolidation between $2.34–$2.35

• XRP registered higher highs and maintained a clean breakout channel

STORY CONTINUES BELOW

• Trend: Bullish reversal confirmed by higher low formation

• Support: $2.32 (new base), $2.21 (secondary)

• Resistance: $2.38–$2.39 immediate barrier; upside target $2.50–$2.60

• Volume: 95% surge vs 24-hour average confirms institutional conviction

• Momentum: RSI rising, no exhaustion signals yet

• Structure: Clean breakout above prior consolidation; intraday volatility 7.4%

• Whether XRP can sustain closes above $2.35 and flip $2.38–$2.39 into support

• Continuation of RLUSD-led institutional narrative as Mastercard tests on-chain settlements

• Volume consistency post-breakout — key for confirming fund-driven follow-through

• Pullback risk toward $2.30 if momentum fades

• ETF and regulatory updates through mid-November that could reinforce bullish flows

More For You

Nov 3, 2025

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

What to know:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

More For You

3 hours ago

BTC recently fell below $100,000 as macro uncertainties weighed over spot ETF inflows.

What to know:

- Traders are increasingly cautious in the bitcoin options market, with a notable rise in demand for lower strike put options on Deribit.

- Bitcoin’s price has fallen over 18% from its peak, influenced by macroeconomic pressures and reduced demand for spot ETFs.

- Open interest in $80,000 and $90,000 put options is high, indicating hedging against further price declines.