Dormant BTC Comes Back to Life as 4.65 Million BTC Reenters Circulation in 2025

Data shows long-term holders have driven an unprecedented wave of distribution across 2024 and 2025.

By James Van Straten|Edited by Oliver Knight

Updated Nov 6, 2025, 2:20 p.m. Published Nov 6, 2025, 2:20 p.m.

- More than 470,000 BTC held for over five years, worth $50 billion, changed hands in 2025 alone, the second-largest amount on record.

- Combined, 2024 and 2025 saw $104 billion in long-dormant bitcoin spent, accounting for 78% of all 5+ year old BTC ever moved in dollar terms.

For every buyer there’s a seller, and in 2025 those sellers have been especially active.

Bitcoin has mostly traded sideways, fluctuating within roughly a 20% range around $100,000 since the start of 2025.

STORY CONTINUES BELOW

The prevailing narrative is that “OGs” or long-term holders have been offloading coins. That’s true, but how much bitcoin has actually changed hands?

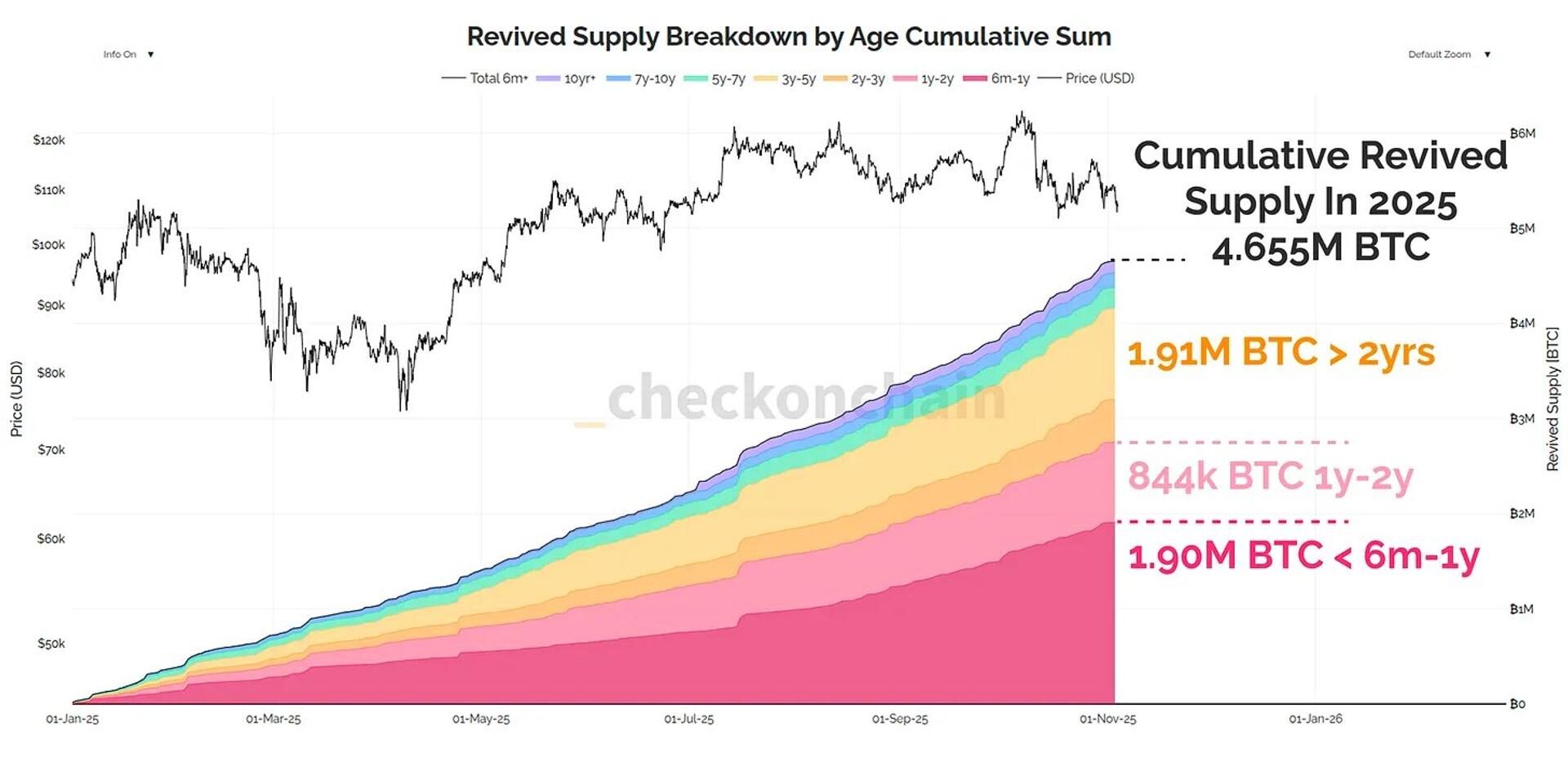

According to analyst James Check, also known as Checkmate, the cumulative revived supply the total amount of coins returning to circulation after being dormant for more than six months has reached 4.655 million BTC in 2025. This breaks down as follows:

- 1.91 million BTC from holders dormant for two years or longer.

- 844,000 BTC from 1–2 year holders.

- 1.9 million BTC from 6–12 month holders.

In dollar terms, Checkmate estimates the revived supply has reached $500 billion in 2025, slightly above $470 billion in 2024. However, in BTC terms, 2024 saw nearly 7 million BTC revived, compared to 4.655 million BTC this year.

There are several factors driving this selling activity. The $100,000 price level represents a significant psychological and profit-taking milestone.

Some long-term holders have sought diversification into Gold or AI equities.

Some are wary of emerging threats like quantum computing, while others are responding to the four-year cycle narrative. Bitcoin is now roughly 18 months post-halving a period that often aligns with market peaks and increased profit-taking by long-term holders.

Galaxy Research reached a similar conclusion. According to Alex Thorn, Head of Research at Galaxy, more than 470,000 BTC held for over five years worth about $50 billion has changed hands in 2025, the second-largest notional amount on record after 2024.

When combining 2024 and 2025, nearly half of all 5+ year old bitcoin ever spent was moved during these two years, accounting for 78% of all such BTC spent in dollar terms.

In total, the two years have seen more than $104 billion in long-dormant coins redistributed from old hands to new, according to the note.

More For You

Nov 3, 2025

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

What to know:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

More For You

By Francisco Rodrigues, AI Boost|Edited by Oliver Knight

50 minutes ago

The proceeds from the sale will fund new research projects at ITER, including exploring fields like quantum technology.

What to know:

- The council of Tenerife bought 97 bitcoin in 2012 for €10,000 as part of a research project, and is now selling them for nearly €10 million, a massive increase in value.

- The cryptocurrency was purchased by ITER to study blockchain technology, not to make a profit, and selling the coins requires working with a regulated Spanish financial entity.

- The proceeds from the sale will fund new research projects at ITER, including exploring fields like quantum technology.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language