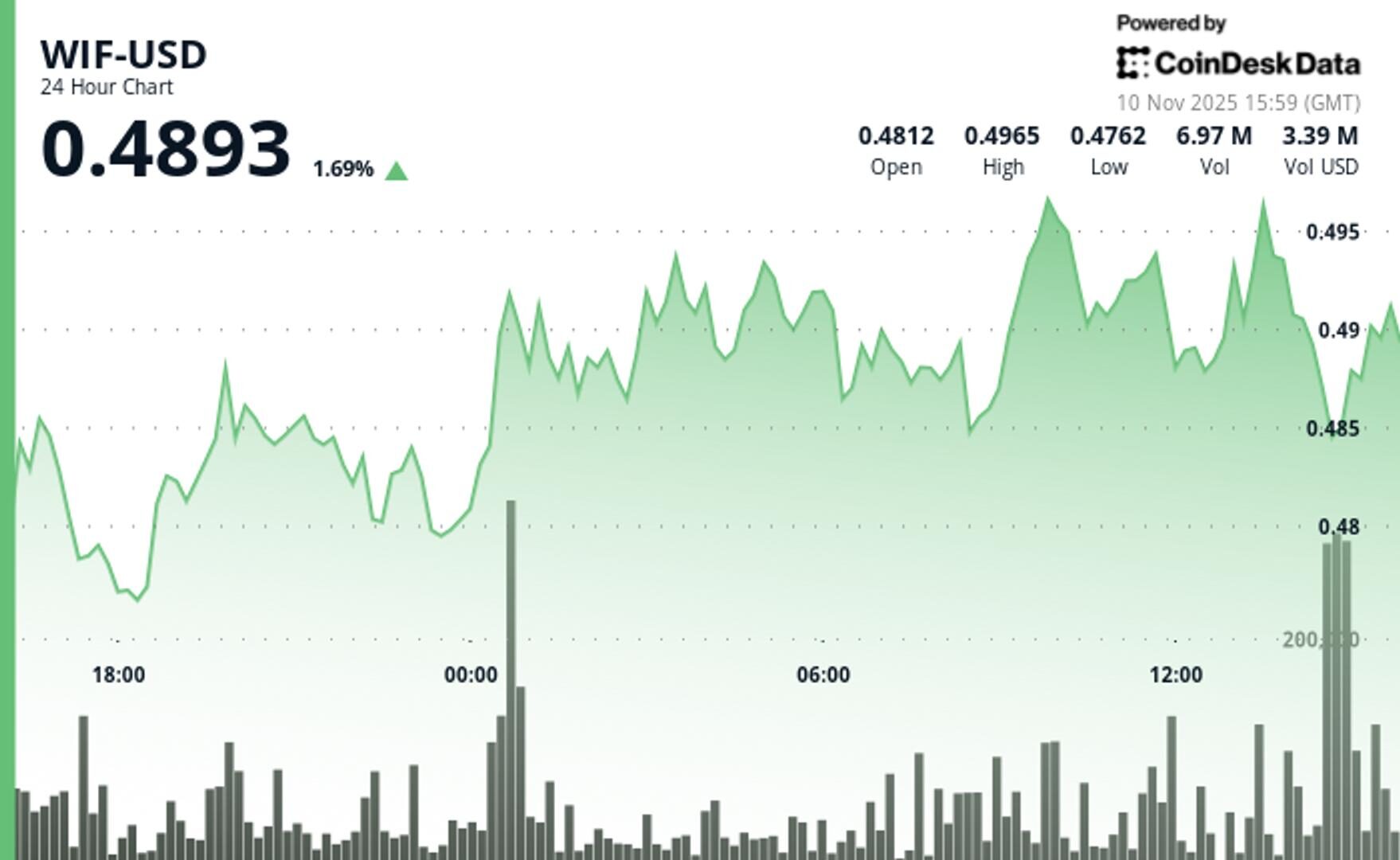

Memecoin News: Dogwifhat (WIF) Surged 5% to $0.497 Before Retreating as Profit-Taking Emerged

WIF broke above key resistance levels in volatile trading before institutional selling capped gains at session highs.

By CD Analytics, Siamak Masnavi

Nov 10, 2025, 4:23 p.m.

- WIF breached $0.4840 resistance with 98% volume surge hitting $0.497 peak.

- The memecoin consolidated in tight $0.4754-$0.4897 range before explosive breakout.

- Profit-taking emerged at $0.497 resistance forcing retreat to $0.491 close.

According to CoinDesk Research’s technical analysis data model, dogwifhat (WIF) staged a measured accumulation phase before explosive gains carried the memecoin to session highs near $0.497 during Tuesday trading. WIF spent most of the 24-hour period consolidating between $0.4754-$0.4897 before breaking out dramatically in overnight hours with institutional-level volume.

The breakout materialized at November 10 00:00 when trading volume exploded to 12.51M shares, marking a 98% surge above the session’s 5.62M average. WIF decisively cleared $0.4840 resistance while holding support at $0.4775, confirming three consecutive higher lows from the session base. The volume spike validated genuine buying interest as the token advanced through technical resistance levels.

STORY CONTINUES BELOW

Late-session action turned aggressive as WIF surged from $0.491 to $0.497 at 13:37 before profit-taking emerged. Volume spiked to 437K shares at 14:02 as selling pressure forced a retreat to $0.491 by session close. The sharp reversal at $0.497 suggests institutional players took profits at technical resistance.

With fundamental catalysts absent, technical levels dominated price action as WIF navigated between defined support and resistance zones. The overnight breakout on genuine volume confirms institutional participation while the $0.497 rejection establishes clear resistance for future tests.

The $0.490-$0.485 support zone becomes critical for bulls defending the breakout structure. Gap conditions through 14:13 indicate incomplete price discovery at highs, positioning WIF for either continuation above $0.497 or deeper pullback depending on volume follow-through.

Support/Resistance:

– Primary resistance established at $0.497 (session high with profit-taking)

– Secondary resistance at $0.4897 (consolidation range ceiling)

– Critical support zone: $0.490-$0.485 (breakout retest level)

– Base support confirmed at $0.4775 (validated during volume surge)

Volume Analysis:

– Breakout confirmation: 12.51M shares (98% above 24h average)

– Resistance test volume: 437K shares at $0.497 peak

– Volume contraction to 1.37M signals momentum pause at highs

Chart Patterns:

– Tight consolidation: $0.4754-$0.4897 range (5.0% spread)

– Three consecutive higher lows establishing bullish base structure

– Gap conditions near session highs indicate incomplete price discovery

Targets & Risk/Reward:

– Immediate focus: $0.490-$0.485 support retest for continuation setup

– Breakout target: Clear break above $0.497 opens extended upside

– Stop loss: Below $0.4775 invalidates bullish breakout structure

CD5 climbed from $1,783.62 to $1,848.07 for a $64.45 gain (3.61%) with momentum reaching $1,850.33 before sellers emerged at resistance.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Higit pang Para sa Iyo

Nob 3, 2025

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

Ano ang dapat malaman:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

Higit pang Para sa Iyo

Ni Jamie Crawley, CD Analytics|Edited by Stephen Alpher

2 minuto ang nakalipas

BONK climbed to $0.00001332 after breaking above key resistance, with volume up 82% above daily averages, signaling continued short-term strength.

Ano ang dapat malaman:

- BONK rose 1.7% to $0.00001332, sustaining momentum above resistance at $0.00001320.

- Trading volume surged 82% above the 24-hour average, confirming the breakout pattern.

- Consolidation is expected between $0.00001328 and $0.00001350 following rapid intraday moves.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language