Cantor Fitzgerald’s Brett Knoblauch Thinks IREN Could Be a $384 Stock in Three Years

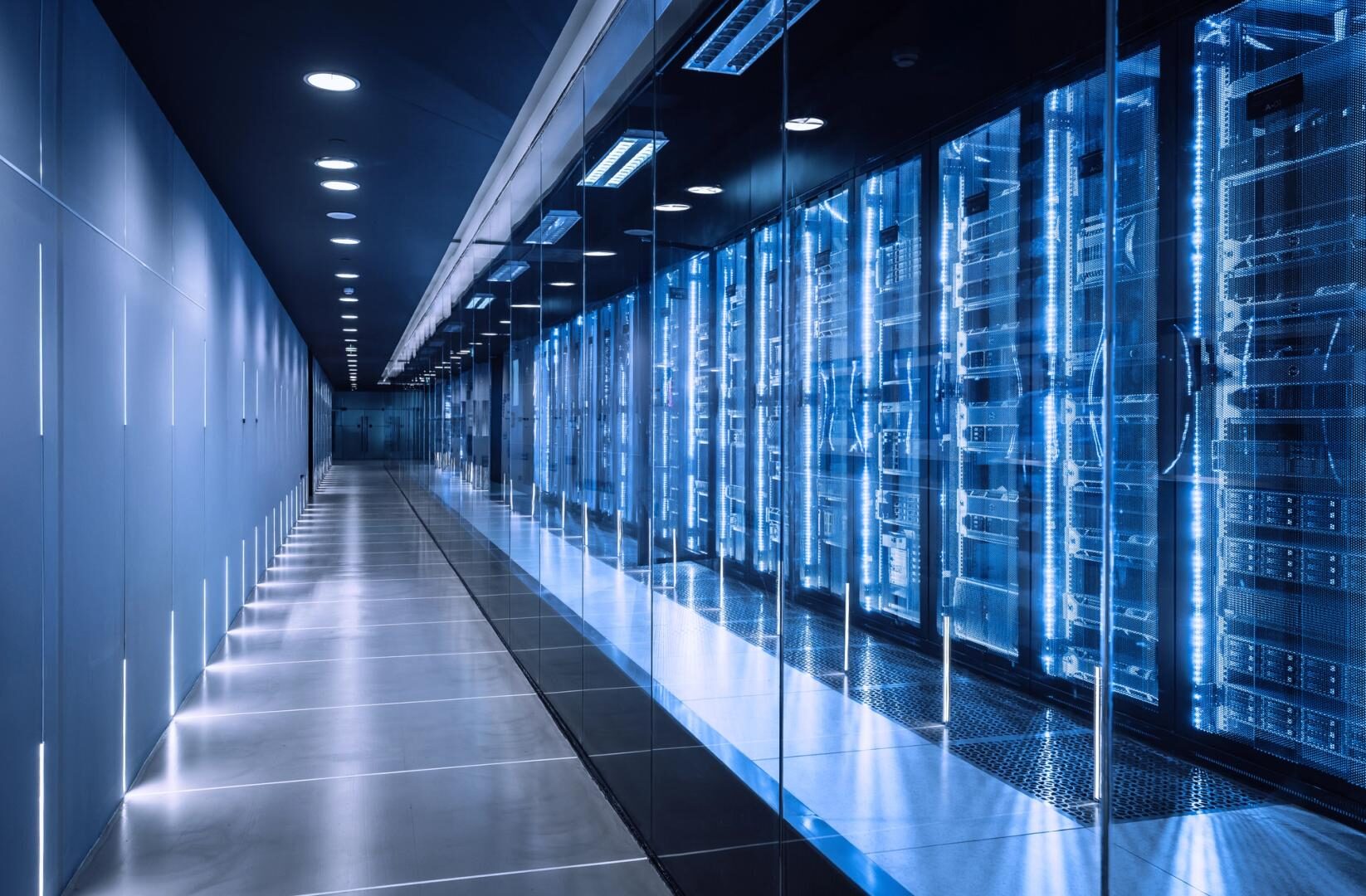

IREN has joined the ranks of large-scale “neocloud” providers, said analyst Brett Knoblach, adding credibility to the company’s ambitions to scale to $18.6 billion in annual revenue across its Texas and Canadian sites.

By Helene Braun, AI Boost|Edited by Stephen Alpher

Nov 10, 2025, 2:49 p.m.

- Cantor Fitzgerald projects that IREN shares could rise to $384 by 2028, up from their current price of $62.38.

- The firm believes IREN’s $9.7 billion deal with Microsoft positions it as a major player in the growing AI data center market.

- IREN raised its 2026 annual recurring revenue guidance to $3.4 billion, driven by expanding GPU capacity and cloud demand.

Shares of IREN, the bitcoin mining firm turned AI infrastructure player, are higher by more than 500% year-to-date, but that might just be a start, according to one Wall Street bull.

Following the company’s third-quarter earnings report last week and its $9.7 billion, five-year deal with Microsoft to deliver 200 megawatts of AI compute at its Childress, Texas site, Cantor Fitzgerald’s Brett Knoblach left his already bullish 2025 targets mostly in place, but said IREN could hit $384 by 2028 from the current $67.

STORY CONTINUES BELOW

With that deal, wrote Knoblach in a Friday note, IREN joins the ranks of large-scale “neocloud” providers, adding credibility to the company’s ambitions to scale to $18.6 billion in annual revenue across its Texas and Canadian sites. The firm’s updated 2026 annual recurring revenue guidance jumped from $500 million to $3.4 billion following the announcement.

On the recent earnings call, noted Knoblach, IREN highlighted its preference for cloud over colocation, noting stronger returns, upfront capital support from Microsoft, and long-term asset value. Even if the GPUs lose their usefulness after five years — a scenario he views as unlikely — the data centers themselves could still generate hundreds of millions per year under colocation contracts.

Knoblach sees Microsoft’s involvement as a key vote of confidence in IREN’s infrastructure. He also believes the architecture being built is “future-proofed” for upcoming GPU generations, with rack densities that could support NVIDIA’s Rubin chips or their successors.

While Knoblach trimmed his near-term price target to $136 from $142 due to weaker bitcoin mining revenues, he reiterated an “overweight” rating and called IREN a top pick.

Shares are 7.6% higher to $67.12 Monday alongside a general rally in stocks and crypto.

AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 3, 2025

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

What to know:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

More For You

11 minutes ago

Charts point to underlying bullish framework in the benchmark bond yield.

What to know:

- The 10-year yield remains sticky at around 4% despite persistent bearish momentum signals for nearly two years.

- The divergence could resolve with a fresh move higher toward 6%, mimicking a similar pattern in BTC in 2024.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language