The breakout attempt at $2.57 met resistance as profit-taking emerged, though buyers held firm above the $2.52-$2.53 zone to confirm short-term support.

By Shaurya Malwa, CD Analytics

Updated Nov 11, 2025, 4:38 a.m. Published Nov 11, 2025, 4:38 a.m.

- XRP outperformed the broader crypto market, rising 1.55% amid increased institutional flows and regulatory optimism.

- Trading volume surged 20.71% above the seven-day average, indicating strong institutional participation.

- XRP’s ability to maintain support above $2.50-$2.52 is crucial for sustaining its bullish momentum.

Institutional flows accelerated Tuesday as XRP broke from broader crypto weakness, posting steady gains amid improving regulatory clarity and controlled accumulation across key support zones.

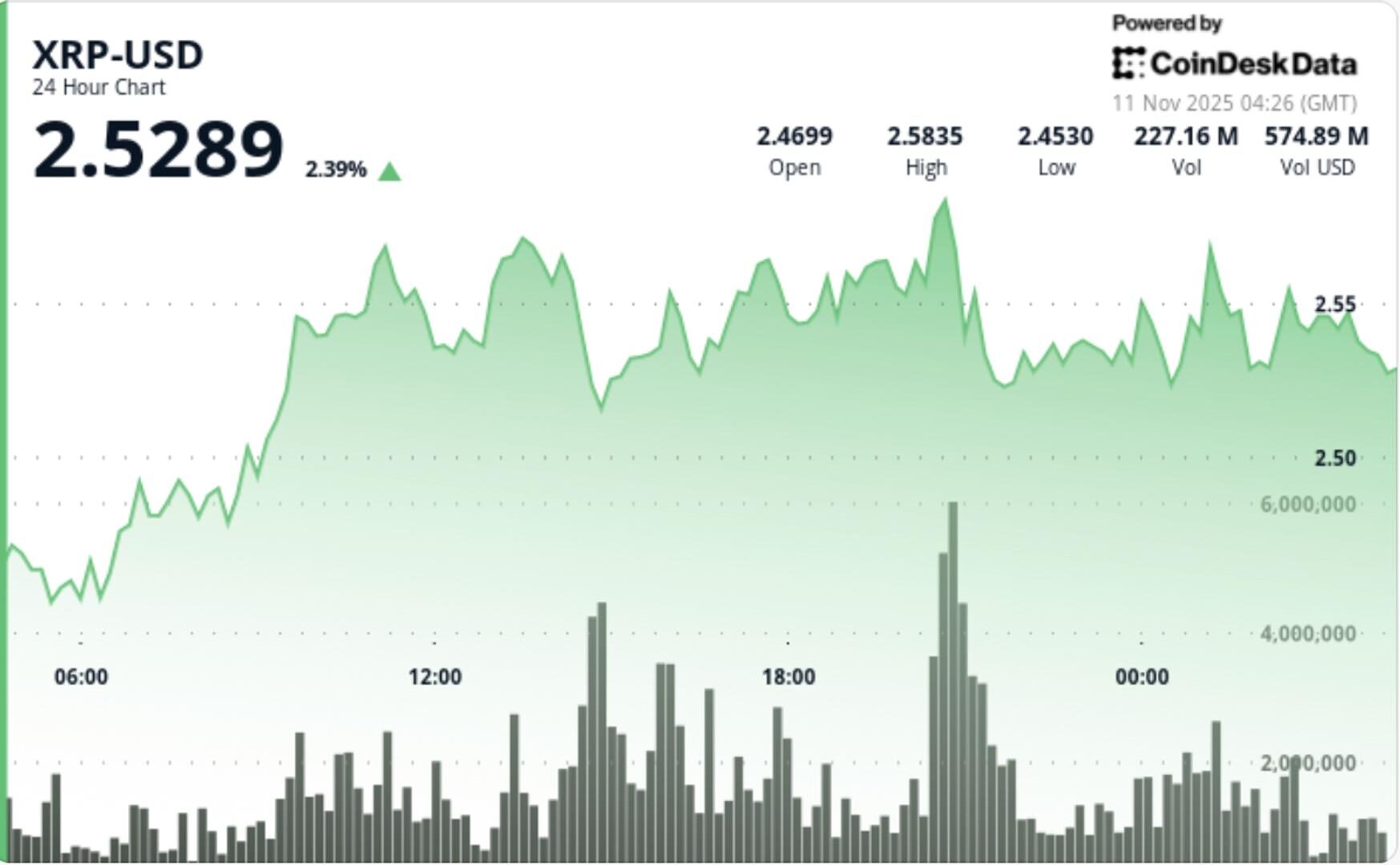

- XRP climbed 1.55% to $2.53 in Tuesday’s session, outperforming the broader crypto market by 2.33 percentage points. The advance came as investors continued building positions on renewed optimism around regulatory progress and ETF developments, while broader digital assets traded mixed.

- Canary Capital, Bitwise, Franklin Templeton, and 21Shares filed amended S-1 registration statements for spot XRP exchange-traded funds, introducing standardized listing language designed to streamline SEC review under existing 8(a) procedures.

- The five spot XRP ETFs have been listed on DTCC ahead of a potential US launch this month.

- Trading volume surged 20.71% above the seven-day average, confirming institutional participation. Market data showed 140.2 million tokens changing hands during the peak of the session—86% above the 24-hour moving average—underscoring sustained professional flows at higher price levels.

- XRP’s move contrasts with sector underperformance, highlighting the token’s decoupling as regulated exposure expands globally and on-chain data points to controlled accumulation among large holders.

- XRP traded within a $0.13 intraday range, advancing from $2.47 to $2.54 while forming higher lows at $2.45, $2.50, and $2.52.

- The breakout attempt at $2.57 met resistance as profit-taking emerged, though buyers held firm above the $2.52-$2.53 zone to confirm short-term support.

- Volume distribution showed disciplined accumulation rather than speculative spikes, with buying concentrated around mid-range levels—consistent with institutional scaling behavior.

- Late-session trading printed sustained bid activity above $2.52 as volatility normalized from early-session highs.

- XRP maintains its ascending structure on the 4-hour chart, with RSI at 58 supporting further upside potential. MACD remains positive with a widening histogram, indicating strengthening short-term momentum.

- The token’s failure to break above $2.57 resistance highlights near-term consolidation risk, though the broader uptrend remains intact as long as price holds above $2.50.

- Volume patterns reinforce constructive positioning: the 21% increase above average coincided with stable volatility bands, suggesting controlled accumulation.

- Order book depth across major exchanges shows consistent buy-side layering between $2.48 and $2.52—an early signal of institutional defense ahead of macro catalysts.

- XRP’s ability to hold above $2.50-$2.52 remains key to sustaining bullish momentum.

- A daily close above $2.57 would confirm breakout continuation targeting $2.65-$2.70, while failure to defend support could trigger a corrective move toward $2.45-$2.47.

- Analysts note that ETF progress and Ripple’s increasing institutional partnerships continue to underpin long-term confidence, though short-term overextension risks warrant caution ahead of major data releases later in the week.

More For You

Nov 3, 2025

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

What to know:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

More For You

By Sam Reynolds|Edited by Aoyon Ashraf

1 hour ago

Once the future of digital money, central bank digital currencies barely featured this year as Hong Kong’s focus shifted to stablecoins and Brazil’s Drex pause showed how even early adopters are rethinking the model.

What to know:

- Central bank digital currencies are losing momentum as stablecoins gain prominence, highlighted at Hong Kong’s FinTech Week.

- Brazil’s pause on its CBDC project, Drex, exemplifies the global shift towards market-driven digital currencies.

- Despite widespread CBDC efforts, only three countries have launched them, while private sectors advance digital money infrastructure.