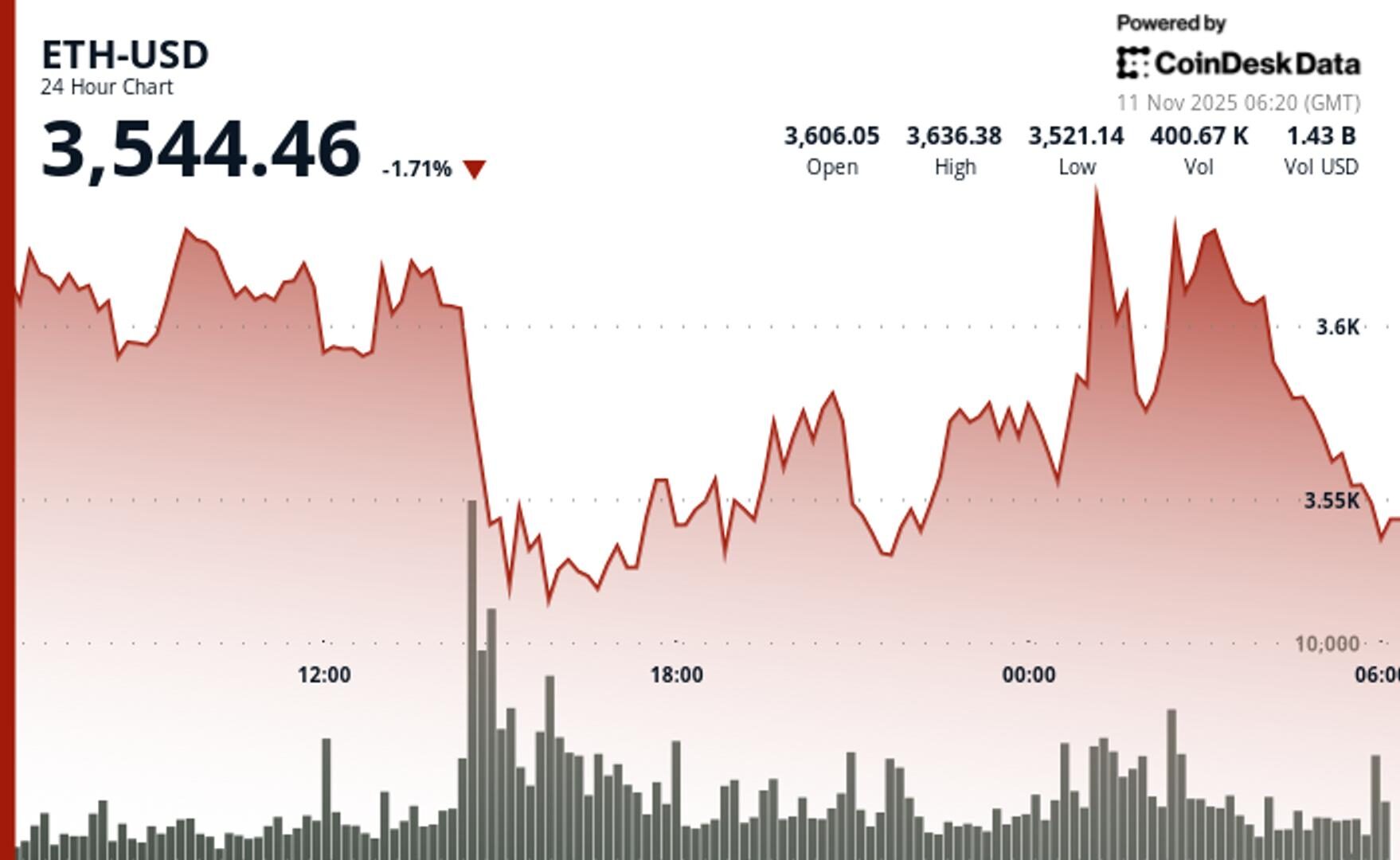

Ethereum Price Analysis: ETH Drops 1.5% Breaking $3,590 Support as Recovery Stalls

Bears regained control after early rally rejection, with exceptional selling volume confirming new lower trading range around $3,565-$3,589.

By CD Analytics, Siamak Masnavi

Nov 11, 2025, 6:39 a.m.

- ETH declined from $3,629 to $3,576 as volume surged 138% above average during breakdown.

- Critical support at $3,590 failed to hold, establishing bearish momentum with lower highs.

- Price consolidated near $3,565 after testing $3,532 lows, suggesting further weakness ahead.

According to CoinDesk Research’s technical analysis data model, Ether ETH$3,550.09 retreated 1.5% during Tuesday’s session as bears overwhelmed early bulls near critical resistance.

ETH plunged from $3,629 to $3,576 within a $136 trading range as selling volume spiked 138% above normal levels. The breakdown confirms bears now control the near-term direction after weeks of consolidation.

STORY CONTINUES BELOW

The selloff accelerated after ETH rejected the $3,646 resistance level during early morning trading. Exceptional volume of 338,852 contracts drove the decisive break below $3,590 support. This key level had previously provided reliable demand during recent volatility. ETH touched an intraday low of $3,532 before stabilizing near current levels.

Price action now shows lower highs despite multiple recovery attempts. The bearish structure emerged following the failed breakout attempt above $3,646. Volume normalized in final hours, suggesting the new $3,565-$3,589 trading range reflects genuine institutional selling rather than temporary liquidity gaps.

Technical factors dominated Tuesday’s session as momentum indicators flashed warning signals across multiple timeframes. The $3,646 rejection triggered cascading stops that overwhelmed recent institutional buying interest. Republic Technologies’ $100 million ETH allocation and BitMine’s 3.5 million token holdings provided insufficient support against the technical breakdown.

The $3,590 support failure marks a critical shift in market structure for ETH bulls. This level had served as a reliable demand zone during recent price swings. With momentum deteriorating and volume patterns confirming distribution, traders now eye further downside testing before any sustainable recovery emerges.

Support/Resistance: Primary support sits at $3,510-$3,530 cluster, with broken $3,590 level now acting as resistance

Volume Analysis: Breakdown volume of 338,852 exceeded 24-hour average by 138%, confirming institutional selling participation

Chart Patterns: Lower high formation at $3,646 followed by support breakdown establishes bearish continuation setup

Targets & Risk/Reward: Immediate downside target sits at $3,510 support, with further weakness toward $3,480-$3,500 zone likely

CD5 edged higher from $1,840 to $1,843 during volatile 24-hour trading that featured extreme price swings and distribution patterns across major crypto assets, with the index touching $1,869 highs before sellers emerged near resistance levels and drove prices back toward session averages.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 3, 2025

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

What to know:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

More For You

13 minutes ago

BTC drops after facing rejection at former support-turned-resistance.

What to know:

- BTC drops after facing rejection at former support-turned-resistance.

- The price action validates the impending death cross pattern.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language