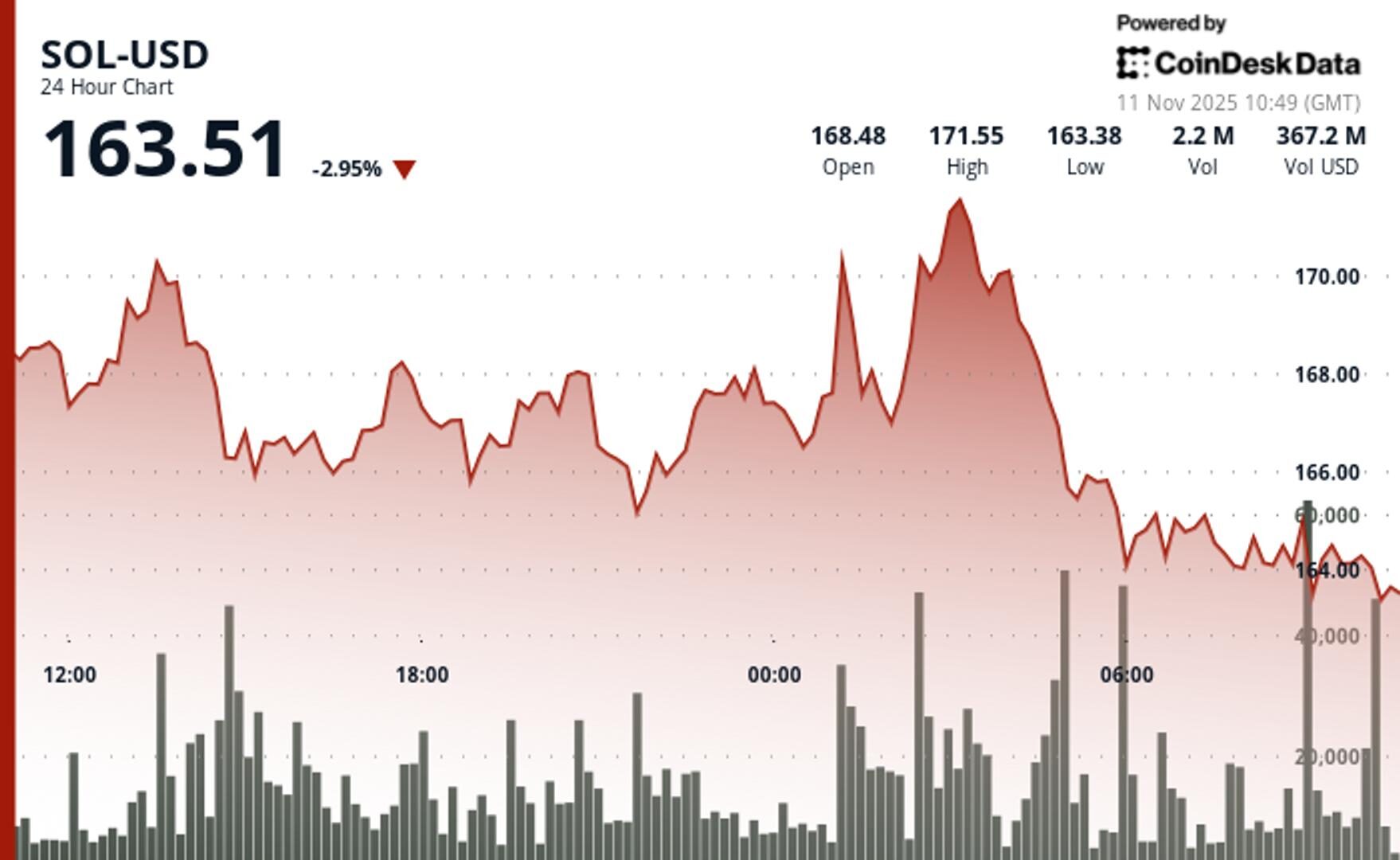

Solana Price Analysis: SOL Drops Below Key $165 Level as Technical Support Cracks

SOL breaks below key $165 level amid selling pressure while broader crypto markets show mixed signals during elevated volume session.

By CD Analytics, Siamak Masnavi

Nov 11, 2025, 11:02 a.m.

- SOL declined from $169.54 to $164.26 over the past 24-hour period with clear downtrend structure.

- Trading volume surged 58% above average during critical support test near $163.85.

- Strong resistance formed at $170.50 with multiple failed breakout attempts.

According to CoinDesk Research’s technical analysis data model, solana SOL$163.76 dropped 3.1% to $164.30 during Tuesday’s session as the token broke through critical technical support levels.

SOL declined from $169.54 to $164.26 over the 24-hour period ending November 11 at 09:00 UTC, establishing a clear downtrend structure with multiple rejection points above $170.

STORY CONTINUES BELOW

The selloff accelerated during Asian trading hours with significant volume accumulation. Trading activity surged 58% above the daily average as SOL tested the crucial $163.85 support zone. The session’s $8.06 range represented 4.9% volatility, with the most significant volume spike occurring at 06:00 UTC with 1.47 million shares traded.

SOL underperformed the broader crypto market by 1.42% relative to the CoinDesk 5 Index (CD5), signaling targeted selling pressure on the token. Recent 60-minute analysis showed an aggressive upside reversal that quickly collapsed, with SOL spiking from $164.07 to $164.97 before surrendering gains in a sharp selloff to $163.46. This whipsaw action highlighted the fragility of any bullish momentum within the established downtrend.

The technical breakdown occurred without clear fundamental catalysts, suggesting profit-taking and momentum-driven selling dominated price action. Institutional flows remained mixed as overnight accumulation patterns conflicted with daytime distribution activity.

With SOL having breached the $165 psychological level while volume patterns showed elevated selling interest, near-term price action centers on whether the $163.50 zone can hold as demand emerges. The downtrend structure remains intact with lower highs at $170.48 and $171.92 providing overhead resistance.

Momentum indicators deteriorated through the session as each rally attempt weakened. Volume analysis revealed selling pressure intensified on retests of highs while bounces attracted minimal buying interest, confirming the bearish bias in the near term.

Support/Resistance: Critical support now tests at $163.50 after the break of $165, while strong resistance remains at $170.50 with multiple failed breakout attempts.

Volume Analysis: Significant volume spike occurred with 1.47 million shares (58% above 24-hour average) during the support breakdown, with selling pressure peaking at 66,399 shares during the 09:16 UTC decline.

Chart Patterns: Established downtrend structure with lower highs at $170.48 and $171.92, followed by technical support failure and momentum deterioration.

Risk/Reward: The $163.50 level represents the next critical test for bulls, with technical indicators suggesting continued downside pressure toward the $160 psychological support zone.

CD5 dropped 1.63% from $1851.31 to $1821.19 during the 24-hour period, experiencing elevated volatility with a $52.78 intraday range between $1868.63 and $1816.85, while institutional buying emerged during overnight sessions supporting recovery from $1817 technical support.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Higit pang Para sa Iyo

Nob 3, 2025

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

Ano ang dapat malaman:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

Higit pang Para sa Iyo

Ni CD Analytics, Will Canny|Edited by Sheldon Reback

1 oras ang nakalipas

FIL faced heavy selling pressure as volume surged 137% above average during the technical breakdown.

Ano ang dapat malaman:

- FIL slid to $2.34 from $2.61 over 24 hours, establishing a clear downtrend

- The breakdown occurred on exceptional volume of 21 million tokens after the cryptocurrency broke support at the $2.50 and $2.40 levels.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language