BNB Price Analysis: Slips Below $1,000. Will It Breach $970 Support?

The token’s decline continues a downward trend, with resistance at $1,000-$1,008 and support at $972.85.

By CD Analytics, Francisco Rodrigues|Edited by Aoyon Ashraf

Nov 11, 2025, 3:11 p.m.

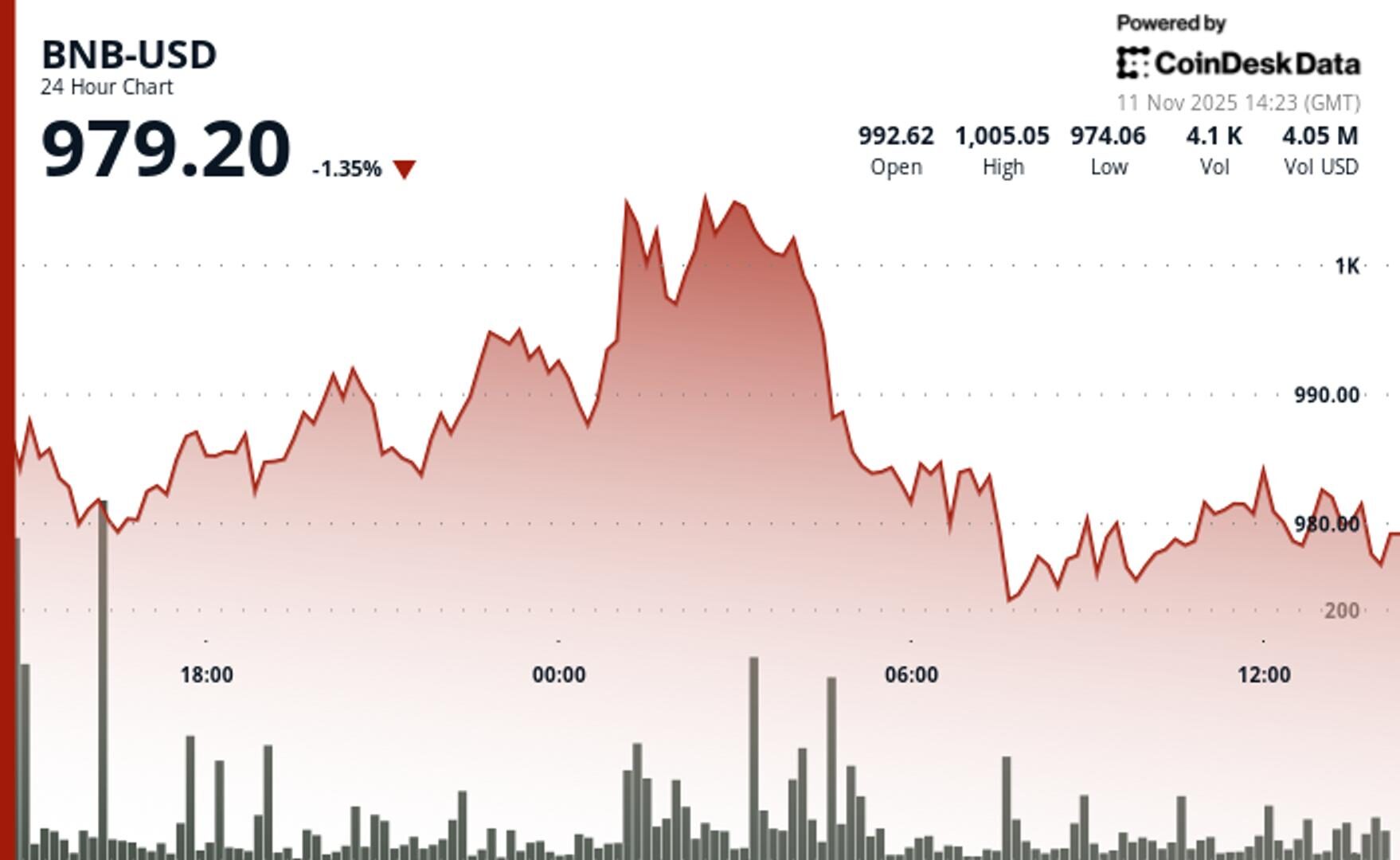

- BNB fell below $1,000 to a low of $974, with a surge in trading volume suggesting large-scale selling.

- The token’s decline continues a downward trend, with resistance at $1,000-$1,008 and support at $972.85.

- Despite short-term volatility, some analysts see a stable long-term picture, citing BNB’s infrastructure and on-chain utility.

BNB Chain’s native asset, BNB, fell below the closely watched $1,000 level over the last 24-hour period, hitting a $974 low in a move that marked a shift into bearish territory.

The decline came with a surge in trading volume, nearly 88% above its 24-hour average, suggesting large-scale selling according to CoinDesk Research’s technical analysis data model.

STORY CONTINUES BELOW

The token has been establishing a consistent downward trend after it hit a high of around $1,300 earlier this year. Attempts to rebound failed to push the price back above $1,000, and technical patterns, such as lower highs and a failed double bottom near $975, indicate more potential downside ahead.

Still, some see the long-term picture as more stable. “Short-term volatility doesn’t shape the foundation of BNB’s innovation,” Jake A., an analyst at BNB-linked project AIC, told CoinDesk. “While market sentiment weighs on price action in the near-term, what matters is infrastructure, including the new generation of token launchpads that drive on-chain utility.”

BNB now faces immediate resistance in the $1,000–$1,008 range, while support sits around $972.85, with a psychological floor at $970. If that breaks, analysts are watching $959 as the next potential target.

The decline over the past 24-hour period came amid a broader crypto market drop, with the CoinDesk 20 (CD20) index losing 2.16% of its value over the period.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 3, 2025

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

What to know:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

More For You

By CD Analytics, Francisco Rodrigues|Edited by Sheldon Reback

28 minutes ago

The token briefly rose to $2.16 before reversing, with high trading volume indicating strong resistance at that level.

What to know:

- Toncoin fell 2% to $2.07, extending a week-long downtrend with lower highs and consistent selling.

- The token briefly rose as high as $2.16 before reversing, with high trading volume indicating strong resistance at that level.

- TON now faces a key support level at $2.05, and a recovery attempt would likely need to reclaim $2.1 to gain momentum, with $2.16 remaining a key resistance point.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language