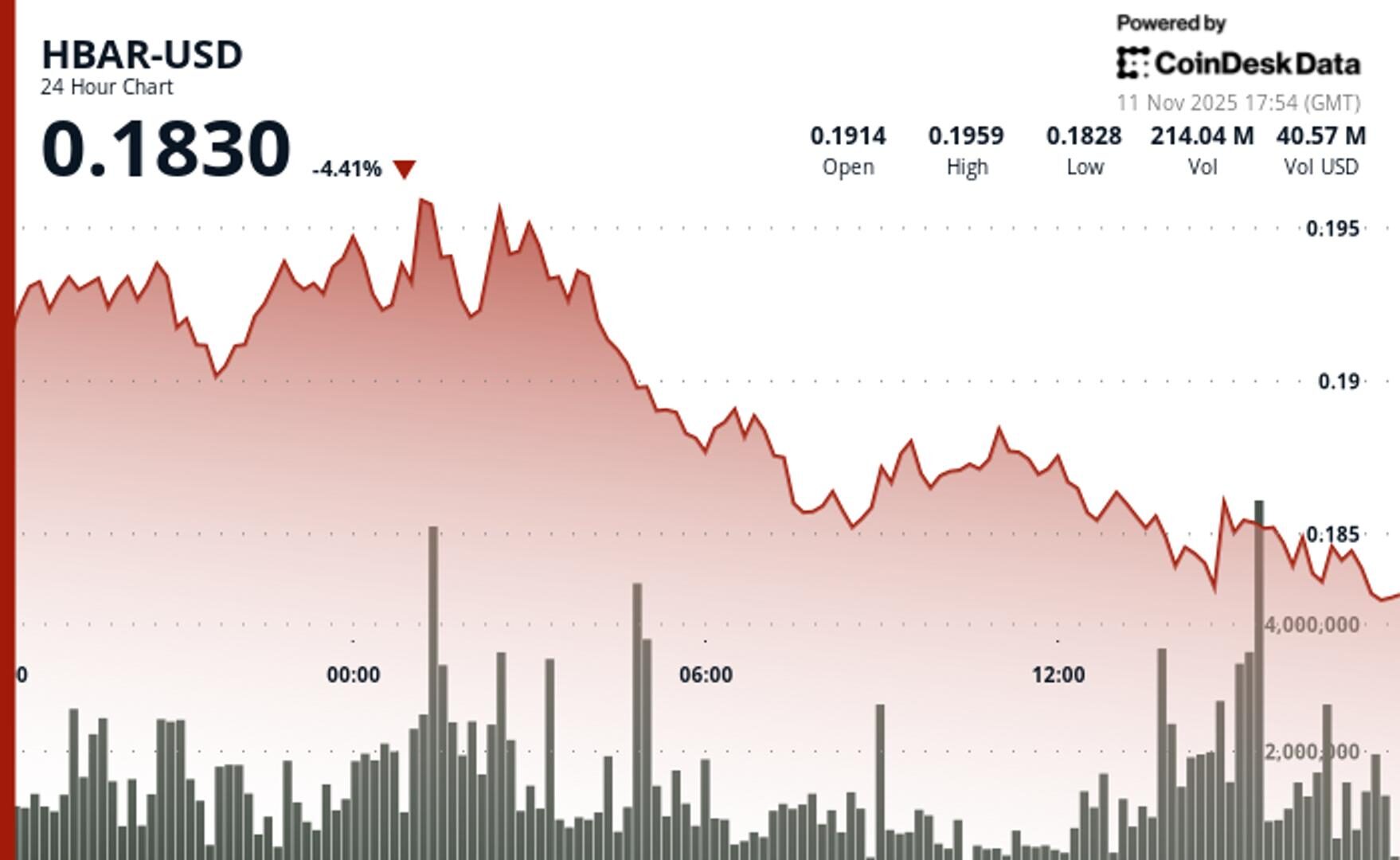

HBAR Declines 2.1% to $0.1837 as Volume Spike Signals Technical Breakdown

By CD Analytics, Oliver Knight

Updated Nov 11, 2025, 6:33 p.m. Published Nov 11, 2025, 6:33 p.m.

- HBAR dropped from $0.1885 to $0.1837, erasing earlier gains in final trading hour.

- Volume surged 95% above average to 142.7M during breakdown from consolidation zone.

HBAR declined 2.1% to $0.1837 during Tuesday’s session as the cryptocurrency faced rejection at key resistance levels near $0.1940.

The token initially posted modest gains of 1.09% to $0.1842, trading on volume 8.23% above its weekly average, before sellers emerged in the final hours.

STORY CONTINUES BELOW

The reversal pattern developed as HBAR tested resistance around $0.1885 early in the session, then broke lower through consolidation support between $0.1840-$0.1870.

Volume spiked to 142.7 million tokens during the breakdown, marking a 95% increase above the 24-hour average of 73.2 million and confirming institutional selling pressure.

With HBAR having failed at resistance and broken through consolidation zones, technical levels dominated price action as volume patterns confirmed selling pressure. The 95% volume surge during the breakdown from $0.1885 signaled institutional distribution rather than retail profit-taking.

- Support/Resistance: Critical support holds at $0.1831 after multiple successful tests; broken support at $0.1842 now acts as immediate resistance with major resistance remaining at $0.1940 rejection level

- Volume Analysis: Breakdown volume of 142.7M shares exceeded 24-hour SMA by 95%, confirming institutional selling; elevated activity at $0.1885 resistance marked distribution zone

- Chart Patterns: Lower highs pattern from $0.1967 peak intact; breakdown from $0.1840-$0.1870 consolidation zone validates bearish structure with momentum accelerating lower

- Targets & Risk/Reward: Next downside target at $0.1820 if $0.1831 support fails; recovery requires reclaim of $0.1842 broken support and sustained move above $0.1870 consolidation high

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 3, 2025

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

What to know:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

More For You

By Krisztian Sandor, James Van Straten|Edited by Sheldon Reback

1 hour ago

Crypto traders are taking profits on the bounce in prices, a Wintermute strategist said in a note.

What to know:

- Bitcoin erased the overnight rally, falling back below $104,000 by Tuesday U.S. morning hours.

- Crypto miners WULF, HUT, BTDR, CLSK tumbled as the red-hot AI infrastructure theme is cooling off amid weak earnings and development bottlenecks.

- The ADP reported soft jobs data, with the private sector cutting an average 11,250 jobs per week through October.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language